Market snapshot

Prices current 7:10am AEST

CBA exits Chinese investment

The CBA has completed its exit from its holding in the Chinese Bank of Hangzhou, an investment it originally made back in 2005.

CBA sold its remaining 5.45% stake in the bank to the Beijing-based New China Life Insurance.

CBA originally owned 10% of the bank but sold another tranche back in 2022 as it prepared to exit the Chinese market.

The deal sees CBA net $940 million which will increase its Tier1 capital ratio by approximately 17 basis points.

Rare earths focus of US-China trade talks

While most of the headlines since Donald Trump’s “liberation day” announcement in April have centred on tit-for-tat tariffs, the new round of talks between US and China in London appear to be focusing much more on export controls than import taxes.

For the US that means getting more of China’s rare earths needed for top-end electronic manufacturing, while China is after more semiconductors from the US.

The talks are being attended by heavy hitters from both countries.

The US team is headed by Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer.

The Chinese contingent is led by Vice-Premier He Lifeng and includes Commerce Minister Wang Wentao and the ministry’s chief trade negotiator, Li Chenggang.

Both sides made goodwill gestures ahead of the talks.

China issued extra rare earth export licences to three US car makers, while the US eased controls on semiconductors to China, although the top-end Nvidia chips are still off the table.

White House economic adviser Kevin Hassett said the US team wanted a handshake from China on rare earths.

“The purpose of the meeting today is to make sure that they’re serious, but to literally get handshakes,” Mr Hassett, told CNBC in an interview ahead of the talks.

He said the US would expect export controls to be eased and rare earths released in volume immediately afterwards.

Chinese trade data released yesterday showed exports of rare earths in May were down 48% over the year.

On figures released by the International Energy Agency last week, China holds the whip hand on critical mineral production for electronics components.

China is the dominant global player of 19 of the 20 critical minerals surveyed by the IEA, and across the board it averages around 70% share of the export market of the minerals.

US Commerce Secretary Howard Lutnick’s inclusion in the talks (he wasn’t present at the Geneva talks last month that centred on lowering the triple-digit tariff rates) is an indication of the importance of rare earths in the current conflict and that the US is now open to easing some export restrictions to China.

36m agoMon 9 Jun 2025 at 10:16pm

This week: Consumer and business surveys, US inflation

Australia:

Tue: Consumer confidence (June), Business survey (May)

Thu: Household spending (May)

Fri: Overseas arrivals & departures (Apr)

International

Tue: US – Small business confidence (May), wholesale inventories (May)

Wed: US – CPI (May), Federal budget balance (May)

Thu: US – Producer Price Index (May)

Fri: US – Consumer confidence (Jun)

After last week’s data deluge, including first quarter National Accounts, things are quieter in this truncated trading week.

The Westpac/Melbourne Institute consumer index for June drops at 10:30am AEST and will be interesting given it will capture the response to the RBA’s latest rate cut, as well as easing trade tensions.

Expect overall sentiment still to be pessimistic (below an index reading of 100 points), but an improvement from the slump recorded in April after US “liberation day” tariffs declared an economic war on virtually every nation except Russia and North Korea.

An hour later, NAB releases its Business Conditions in May.

The April survey interviewed businesses in the immediate aftermath of “liberation day” and was fairly glum.

Business conditions and confidence may have been buoyed by the recent easing in trade tensions.

The CBA’s economics team has been busy too and will release its signature Household Spending Indicator on Thursday.

Spending has been in CBA’s words “tepid”. The May survey may show a pick-up in spending after last month’s rate cut.

Internationally, the key figure will be US CPI for May (Wednesday).

CPI is expected to tick higher as higher taxes on imports kicks in, but most economists see the June figure as more meaningful.

US producer prices data comes on Thursday, and another measure of the increasingly important consumer confidence will be released on Friday

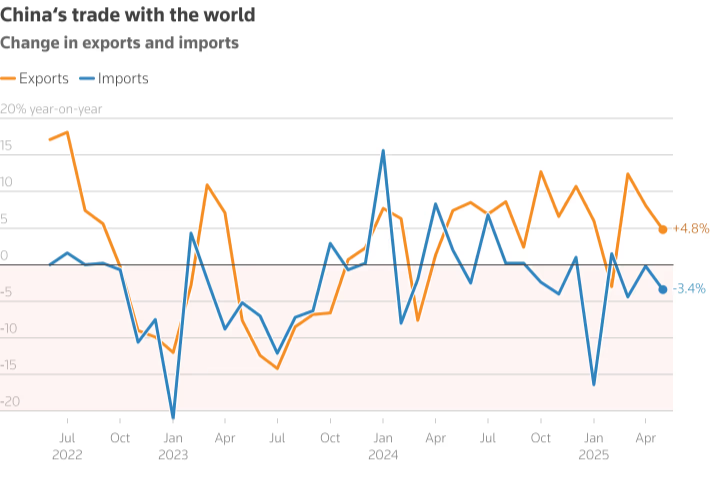

Chinese exports show resilience, but imports hit by weaker domestic economy

Ahead of the London trade talks, Chinese customs released its monthly trade balance data — and in light of the on-going hostility, they make for interesting reading.

Chinese exports continued to slow as US tariffs bit but were still surprisingly resilient.

More worryingly from an Australian perspective was the impact subdued Chinese domestic demand had on commodity imports.

China’s total exports expanded by 4.8% year-on-year in value terms in May, slowing from the 8.1% jump in April.

Underlying the theme that China has long been looking for alternative export markets to the US, Chinese exports to the US plunged 34.5% (YoY), the sharpest decline since the COVID-19 outbreak.

Imports dropped 3.4% (YoY), deepening from the 0.2% slip in April.

Iron ore imports are down 4% over the year, while coal imports are down 18%.

ANZ’s senior commodity strategist Daniel Hynes said the commodity import data for May reflected subdued domestic demand but on the other side of the ledger, exports were resilient.

“A temporary 90-day tariff truce between the US and China prompted front purchases, particularly in steel and aluminium exports,” Mr Hynes said.

“However, weaker industrial activity weighed on import volumes. We expect imports to remain volatile amid persistent internal and external headwinds over the coming months.”

Mr Hynes said iron ore imports slipped below the 100 million tonne mark amid growing pressure on domestic steel production by the government to reduce steel surplus.

However, he noted iron ore port inventories had continued to shrink.

China’s steel exports exceeded 10 million tonnes for the third consecutive month as exporters accelerated shipments in expectations of higher trade tariffs.

China’s May trade surplus came in at $US103.2 billion, up from the $US96.2 billion the previous month.

Trade talks put Wall Street on pause, ASX set to slip

Wall Street traders sat pretty much on the sidelines overnight waiting for meaningful news out of the latest round of talks between US and Chinese negotiators in London.

The S&P 500 edged up 0.1% while the Dow was flat. The tech centric Nasdaq gained 0.2%.

European markets were generally softer.

The ASX is poised for a cautious start to the shortened week with futures trading pricing in a 0.1% slide on opening.

The vibe of the talks has so far been positive.

US Commerce Secretary Howard Lutnick described the talks as “fruitful”.

Both sides came to the talks bearing gifts and a degree of goodwill.

For the US, that meant easing export controls on semiconductors (excluding the very-high-end Nvidia chips).

Ahead of the talks, China said it would release a greater volume of its rare earths stash with some new export licences approved.

The modest gain on the S&P 500 followed a 1% rise on Friday with the key index now back above 6,000 points and just 2.3% shy of a new record high.

There was not much in terms of new US data overnight except a modest improvement in consumer expectations for inflation.

Friday’s jobs figures came in line with expectations with 139,000 new jobs and unemployment holding at 4.2%, although very close to rounding up to 4.3%.

The US dollar was broadly weaker against most currencies, including the Australian dollar, which is back above 65 US cents.

Gold rose in response, up 0.5% to $US65.38/ounce.

The positive sentiment ahead of the London trade talks supported a rise in the oil price, the global benchmark Brent crude up 0.9% to $US67.09/barrel.

1h agoMon 9 Jun 2025 at 9:09pm

Good morning

Good morning and welcome to another (slightly delayed start to the) week on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, it looks like a marginally negative start to the week after Wall Street’s quiet opening to the week as traders sat on the sidelines pending news out a new round of US-China trade talks that commenced in London overnight.

Futures trading points to the ASX slipping 0.1% on opening.

We’ll get some important “soft data” releases later this morning with NAB’s May business conditions survey and the Westpac/Melbourne Institute consumer sentiment index for June being published.

As always, the game’s afoot, so let’s get blogging.

Loading