Here are five key things investors need to know to start the trading day:

1. Talking it out

The major stock indexes saw modest moves Monday in light of trade talks between the world’s two largest economies. The talks in London between the United States and China were set to continue Tuesday, raising hopes for an agreement. The S&P 500 gained a modest 0.09%, while the Nasdaq Composite rose 0.31% for the day. The Dow Jones Industrial Average, meanwhile, lost 1.11 points. Follow live market updates.

2. Apple’s not far from the tree

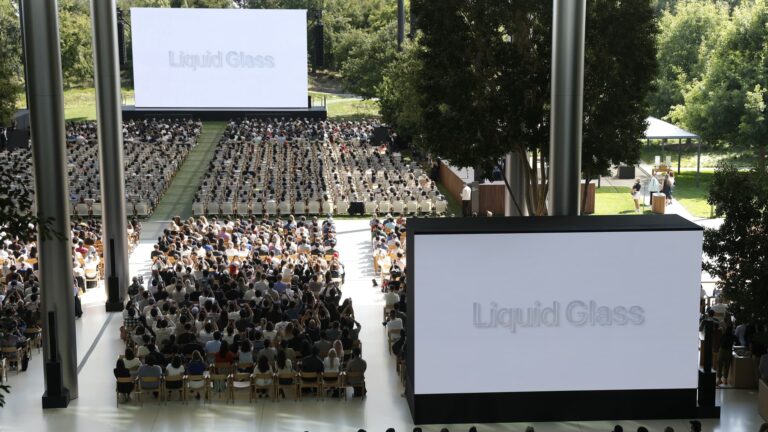

Apple announces liquid glass during the Apple Worldwide Developers Conference (WWDC) on June 09, 2025 in Cupertino, California.

Justin Sullivan | Getty Images News | Getty Images

Apple unveiled a slew of software updates for consumers at the company’s annual Worldwide Developers Conference, but had relatively few splashy announcements. The tech giant’s biggest update was a new operating system called “Liquid Glass” that will change the way Apple devices, from iPhones to Macs, will look and is the first major change since 2013. The new OS will be available to all consumers in the fall after testing. Apple also doubled down on games, added new features, including lyric translation to Apple Music, and introduced new options for its Vision Pro headset, among other things.

3. Less inflated

Carol Flood, left, and her sister, Judy Naper, load grocery items after shopping at an Amazon Fresh on Dempster Street on May 2, 2025, in Morton Grove, Illinois.

Chicago Tribune | Getty Images

Americans’ inflation fears eased in May, according to the latest New York Federal Reserve survey. The one-year inflation outlook saw a significant dip, falling to 3.2%. That was a 0.4 percentage point drop from April, the survey showed. And the outlook for the three-year horizon dropped 0.2 percentage point to 3%, while the five-year forecast slipped to 2.6% from 2.7%. Those are still higher than the Federal Reserve’s goal of 2% inflation, but show improvement after President Donald Trump backed off his most severe tariff proposals.

4. A shot in the dark

U.S. Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. and Secretary of Education Linda McMahon attend a Make America Healthy Again (MAHA) Commission event, in the East Room of the White House in Washington, D.C., U.S., May 22, 2025.

Evelyn Hockstein | Reuters

Health and Human Services Secretary Robert F. Kennedy Jr. said he is removing all 17 vaccine advisors on a crucial government panel. The Advisory Committee on Immunization Practices, or ACIP, is made up of independent medical and public experts who make recommendations on vaccines to the Centers for Disease Control and Prevention based on rigorous scientific review and evidence. Kennedy, a prominent vaccine skeptic, has made several other moves to change and potentially undermine vaccinations in the U.S. since taking over the HHS role. He has said the panel is “plagued with persistent conflicts of interest and has become little more than a rubber stamp for any vaccine,” but there haven’t been any related issues for years.

5. Defense disruptors

The Anduril Industries headquarters in Costa Mesa, California, US, on Thursday, Dec. 14, 2023.

Kyle Grillot | Bloomberg | Getty Images

For the first time in 13 years, CNBC’s Disruptor 50 list — which showcases 50 tech companies that are challenging the status quo — is topped by a defense tech company. Anduril, which has been working closely with the tech sector to create the military of the future, is the No. 1 company on the list this year, underscoring a rising trend in technology and venture capital, as well as in politics and society. Three other defense technology companies made the list along with Anduril: Flock Safety, Saronic Technologies, and Shield AI. Together, the four firms have a combined value of more than $45 billion and have raised almost $10 billion from investors. Aside from the defense sector, artificial intelligence remained key to chosen startups.

— CNBC’s Pia Singh, Jesse Pound, Kif Leswing, Jordan Novet, Samantha Subin, Annika Kim Constantino, Kate Rooney, Julia Boorstin and Ian Thomas contributed to this report.