(Bloomberg) — Equity futures fell as growing speculation that the US will directly support Israel in its war against Iran fueled geopolitical uncertainty and concerns about the inflationary impact of higher crude prices.

Most Read from Bloomberg

Listen to the Stock Movers podcast on Apple, Spotify or anywhere you listen.

S&P 500 contracts retreated 0.8% on a day when cash trading in US stocks and Treasuries is closed for a public holiday. Europe’s Stoxx 600 gauge declined 0.4%, setting the index on course for a third day of losses. Asian shares dropped more than 1%.

Brent crude traded near $78 a barrel, extending gains in a week where market reaction to the Middle East conflict has been most concentrated in oil. The dollar was little changed.

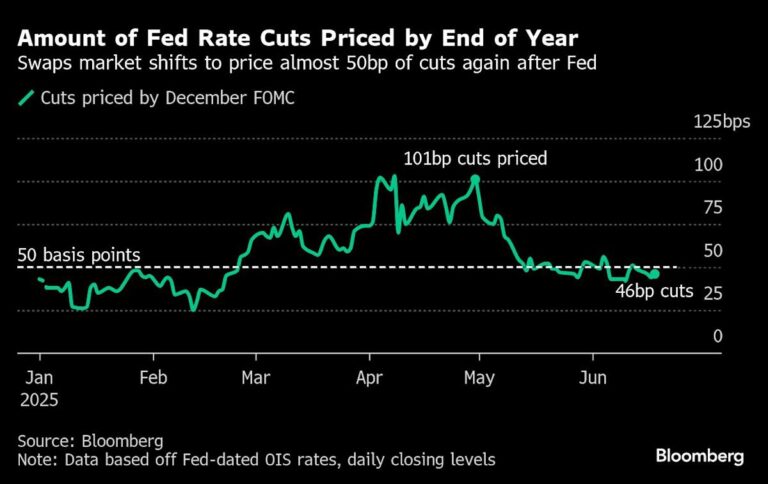

Traders’ sentiment turned more cautious following a Bloomberg report that senior US officials are preparing for a possible strike on Iran in the coming days. Markets were already on edge after the Federal Reserve downgraded its estimates for growth this year and projected higher inflation.

“If the US does strike, you’re going to see a big knee-jerk reaction,” said Neil Wilson, investor strategist at Saxo UK. “No one will be wanting to make big long bets.”

Trump has for days publicly mused about calling for a strike on Iran. He told reporters at the White House Wednesday that he prefers to make the “final decision one second before it’s due” because the situation is fluid.

The odds for the US to become involved are “quite high at this moment in time,” said Anna Rosenberg, head of geopolitics at Amundi Investment Institute.

“For the US, this is a moment to take out a big geopolitical headache, which is Iran potentially developing a nuclear weapon,” Rosenberg told Bloomberg TV. “Having said that, acting comes with a lot of consequences too. Trump will have to make a really difficult decision.”

Among a flurry of monetary policy decisions in Europe, the Bank of England kept its benchmark rate on hold at 4.25%. While the outcome was in line with economists’ expectations, more committee members than anticipated had voted for a cut. The pound fell before erasing the loss.

Earlier, the Swiss National Bank cut its interest rate to zero as policymakers sought to deter investors from pushing up the franc, which has gained almost 10% against the dollar this year. In Norway, officials surprised with the central bank’s first post-pandemic reduction of borrowing costs.

Leer más