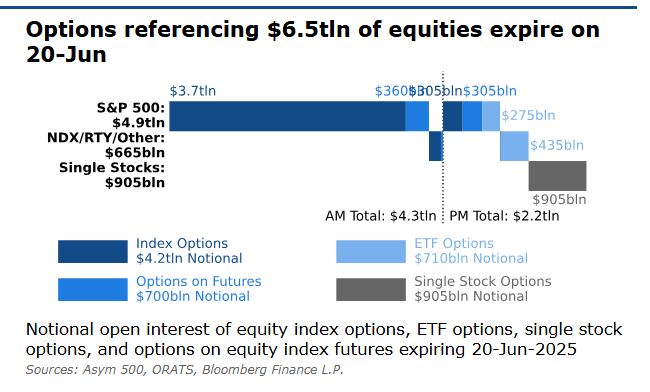

(Bloomberg) — Investors are bracing for $6.5 trillion of notional US options expiring on Friday, in a move that could free stocks to swing more wildly than the subdued changes seen in recent weeks.

Most Read from Bloomberg

Every quarter, a cluster of different exchange-traded derivatives contracts all terminate on the same day, leading to what is sometimes dubbed a “triple witching” event by market watchers. The event isn’t expected to add additional volatility on Friday itself, but could open a path to more sudden stock market moves next week.

Daily gyrations in US stocks have been relatively restrained since early May, a situation helped by the pinning effect of a swath of bearish options trades placed earlier in the year — when the chances of the S&P 500 (^GSPC) making a recovery to near-record highs seemed remote, according to Rocky Fishman, the founder of research firm Asym 500 LLC. “Pinning” refers to the tendency of a stock price to close near the strike of heavily-traded options as the expiration date nears.

During the height of tariff-driven volatility in early April, many pessimistic investors bought insurance against a further drop in stocks, funding those positions by capping upside a little beyond the S&P 500’s current level of 5,981.

“People might have seen a 6,000 level as something that’s really hard to get to as we were dealing with a lot of the tariff drama over the last few months, and therefore sold calls in the 6,000 range as a way of funding protection at various points,” said Fishman, who called Friday’s expiry “one of the largest ever” in a recent note.

The way market makers and broker-dealers have to hedge their own books can have major implications and echo back into equity markets.

Fishman says dealer hedging could be a contributing factor to the fairly placid state of equity markets since early May, despite turmoil in the Middle East and continued tariff talks. To Fishman, the market is in a state known as positive gamma, which means players can be incentivized to sell into rallies and buy dips.

It was different during early April’s tariff turmoil, when many intermediaries found themselves having to dump stock into falling markets, and then buy it back as markets rose, exacerbating swings, according to Matthew Thompson, co-portfolio manager at Little Harbor Advisors.

Story Continues