Market snapshot

Live updates on the major ASX indices:

ASX closed down

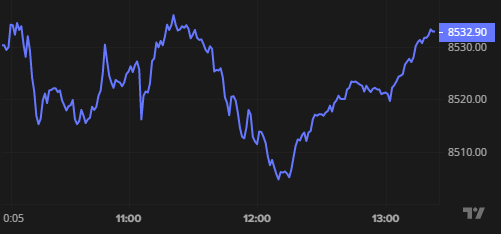

The Australian share market has ended the session in the red, dragged down by mining, health and tech sectors.

The ASX 200 finished the day 8 points or 0.1% lower to 8,523.

Six out of the 11 sectors were lower, with miners (-1.5pc) leading the losses.

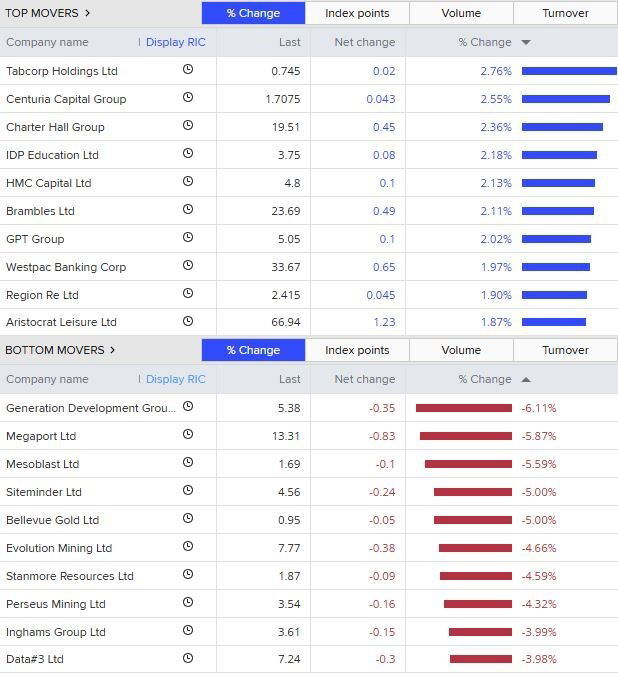

Here are the top and bottom movers of the day.

18h agoThu 19 Jun 2025 at 5:49am

Scammers impersonating ACCC

The consumer regulator ACCC runs the National Anti-Scam Centre but has now been impersonated by scammers.

In a statement, the regulator warned that publicly available ACCC phone numbers had been “spoofed” or impersonated by scammers, in an attempt to steal personal information.

“Spoofing is when scammers disguise their phone number to make it look like they’re calling from a trusted organisation — including government agencies like the ACCC — to deceive people into answering and sharing personal information,” ACCC deputy chair Catriona Lowe said.

Scammers have been claiming to be ACCC representatives and requesting “sensitive information over the phone” in some cases.

“In others, they misused the ACCC acronym to impersonate an unrelated organisation and spoke in a language other than English,” according to the ACCC’s statement.

The ACCC and the National Anti-Scam Centre say they will never cold call or email consumers and ask for personal information, and reminded people that it doesn’t charge for its services.

Unfortunately, it’s not an uncommon tactic by scammers, as anyone who’s received texts claiming to be from their bank might be able to attest to.

The best thing to do? Hang up. Or if it’s a text, delete and ignore.

Then, report it at ScamWatch.

This previous story from reporter Dannielle Maguire has more on the “spoofing” and what to look out for:

Gold stocks hit a month low as bullion falls

Australian gold miners have taken a hit as bullion prices fall after the US Federal Reserve kept interest rates on hold and signalled towards slower future cuts.

The sub-index lost 2% in afternoon trade, reaching its lowest levels since May 22.

Bellevue Gold (-5.7pc), Perseus Mining (-4.7pc) and Evolution Mining (-4.7pc) were among the worst performers on the benchmark index.

19h agoThu 19 Jun 2025 at 4:50am

Markets betting a July rate cut is very likely

The next Reserve Bank board meeting ends on Tuesday, July 8.

After today’s ABS jobs data showed 2,500 fewer employed Australians but a steady unemployment rate at 4.1%, bets on a rate cut next month have remained fairly steady.

According to Bloomberg, market pricing implies a 78% chance of rates falling next month.

TD Securities strategists Prashant Newnaha and Alex Loo have examined how market pricing correlates with the RBA’s decisions.

“The key takeaway from our analysis is that as long as market pricing for a RBA cut >19bps between now and the RBA Board meeting, then the odds of the RBA easing in July strengthen significantly.

“Every time the market has priced in 19bps or more of easing the day before the RBA meeting, the RBA has always delivered a cut.”

The market has currently priced in just over 19 basis points of rate reduction by July 8 (that’s where that 78% chance figure is derived from).

So if, and it’s a big if, that market pricing holds constant until July 7, then that would make a rate cut look all but certain for the next day, according to historical patterns.

19h agoThu 19 Jun 2025 at 4:33am

Iron ore extends declines

The price of iron ore futures has eased for a sixth session as a protracted crisis in China’s property market continues to weigh on demand prospects for the steelmaking material.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) traded 0.4% lower at 692.5 yuan ($148) a metric tonne.

The benchmark July iron ore on the Singapore Exchange was trading flat at $US92.35 a tonne.

Downstream demand in China has entered the off-season, and inventories continue to accumulate, said broker Hexun Futures in a note.

Total iron ore stockpiles across ports in China climbed about 1.06% week-on-week to 133.4 million tons, as of June 13, according to Steelhome data.

Moreover, real estate sales weakened and market sentiment has turned cautious, added Hexun.

With Reuters

19h agoThu 19 Jun 2025 at 4:20am

Market snapshot

Prices current around 2:17pm AEST.

Live updates on the major ASX indices:

19h agoThu 19 Jun 2025 at 4:13am

We live in interesting times

These are confusing times – we have half hourly updates on the potential for war, markets routinely stated as over priced, US bond yields behaving at odds with other safe havens and yet the global markets are all performing amazingly. I’ve never been so certain of how uncertain I am about anything.

– Brian

Hi Brian.

I have been covering business, finance and economics at the ABC for more than 17 years, including the global financial crisis in 2008-09, the European debt crisis, Trump Mk1, COVID, Ukraine and the inflation breakout that followed.

Those were all big events but, in many ways, far more predictable and less confusing than what is happening now.

Stay with us on the blog, and we’ll all muddle through together!

Loading

Nikkei retreats from 4-month high

Japan’s Nikkei share average retreated from a four-month high on Thursday as the threat of war between the United States and Iran dampened demand for higher-yielding assets.

The Nikkei 225 Index slid 0.8%, snapping a three-day rise that lifted the gauge to the highest since February 20. The broader Topix lost 0.6%.

The Israel-Iran conflict entered its seventh day, and US President Donald Trump was ambiguous about whether the US would join in bombardment of Iran’s nuclear sites.

“Heightened tensions in the Middle East continue to cool investor sentiment, with the downside appearing to widen,” said Nomura strategist Fumika Shimizu.

With Reuters

20h agoThu 19 Jun 2025 at 3:37am

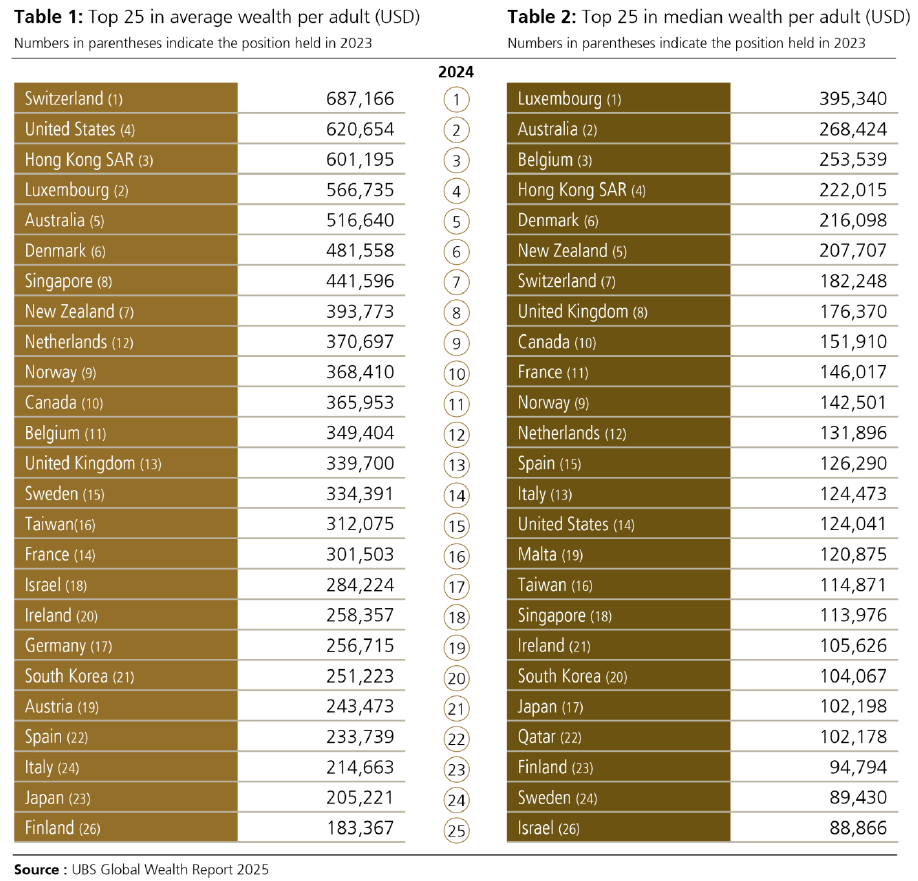

Australia’s wealth distribution among the world’s most equal, UBS report finds

The UBS Global Wealth Report shows the wealth of the median Australian household grew more over the past year than average wealth did, and the middle Australian is now 19% richer than they were in 2020, versus a 15% rise in the average.

This means that wealth inequality has decreased slightly, according to the UBS data.

This is reflected in a slight decline in Australia’s Gini coefficient for wealth to 0.55.

The Gini coefficient is a measure of inequality, where a reading of 1 would mean the richest person has all the wealth while a reading of zero would mean that wealth is completely evenly shared amongst all people.

Australia’s reading of 0.55 puts us in 27th place out of the 32 countries studied in terms of wealth inequality.

Brazil was most unequal, with a Gini coefficient of 0.82, with Russia also at that level, followed by South Africa and the UAE on 0.81.

Slovakia ranked as most equal, with a very low coefficient of just 0.38, while Belgium, Qatar, Japan and Luxemburg also ranked as slightly more equal than Australia in wealth distribution.

20h agoThu 19 Jun 2025 at 3:24am

ASX claws back some ground at lunchtime

The local share market has clawed back some ground and is again hovering around the flatline in the early afternoon.

The ASX 200 is a point higher at the moment, while the All Ords is slightly down.

Energy, mining and health stocks are dragging, while financials and real estate are on the rise.

Australian wealth rises with house prices, but our debts are also large

The latest UBS Global Wealth Report, its 16th edition, finds Australians are getting richer, with the middle class doing relatively well.

UBS finds real wealth per adult rose 4% in Australia last year, when measured in the local currency.

Since 2020, average wealth has grown 15% and median wealth is up 19%, suggesting the middle class did comparatively better than the top end of town.

However, close to 70% of Australians’ wealth is tied up in non-financial assets, predominantly our homes and the land they sit on.

So, it’s perhaps not surprising that median wealth has performed better recently, as lower value property markets in the smaller capitals and regions have generally seen stronger price growth since COVID than the bigger, traditionally expensive markets of Sydney and Melbourne.

The concentration of wealth in property also means net wealth is lower, with debts equal to about 17% of our gross household wealth — a level beaten by only Switzerland and Sweden out of the 25 countries studied.

In US dollars, Australia ranks fifth for average wealth ($US516,640) and second for median wealth ($US268,424).

Switzerland ($US687,166), the United States ($US620,654), Hong Kong ($US601,195) and Luxembourg ($US566,735) rank ahead of Australia for average wealth.

Only Luxembourg ($US395,340) ranks ahead of Australia for median wealth out of 25 countries studied.

“Australia now has approximately 1.9 million USD millionaires which ranks us eighth globally,” said UBS GWM Australia chief of investments Andrew McAuley.

“Our average wealth per adult at USD516k sees us fifth overall out of the 56 markets analysed.

“In terms of median wealth, which is a more relevant comparison of wealth across a full population, Australia ranks second, ahead of New Zealand, the UK and Canada.

“This shows that we have a more equal spread of wealth than comparable nations.”

21h agoThu 19 Jun 2025 at 2:30am

How has the unemployment rate been tracking?

According to the latest ABS data, the unemployment rate held steady at 4.1 per cent in May.

That’s now eight out of the last 12 months that Australia’s jobless rate has been at 4.1 per cent, seasonally adjusted, including the last three months.

This chart (courtesy of Gareth Hutchens) gives you the longer-term view:

21h agoThu 19 Jun 2025 at 2:26am

Market snapshot

Prices current around 12:25pm AEST.

Live updates on the major ASX indices:

21h agoThu 19 Jun 2025 at 2:19am

Strong jobs run to slowly fade: Oxford Economics

The unemployment rate held steady in May, as workforce participation eased off very slightly.

Employment decreased by 2,500 people and the number of officially unemployed people declined by 2,600.

Since employment and unemployment both declined in May, the labour force shrank a little — by 5,100 people.

That saw the participation rate decline by 0.1 percentage points, to 67 per cent, down from 67.1 per cent in April.

Oxford Economics Australia economist Kar Chong Low described it as the labour market “stumbling” after the strong jobs growth in April.

“We’re not concerned by May’s weakness.

“The drop in jobs does not reflect a sudden reversal of the labour market’s fortunes. Instead, part of the fall reflects normalisation following exceptionally strong growth in April.

“Similarly, the rebound in hours worked, the tick down in underemployment, and the jump in full-time work show firms are still demanding workers’ time.

“Looking ahead, the labour market’s strong run over the past 12 months will slowly fade.

“Global uncertainty is clouding business decisions and prompting many firms to temper hiring plans. To be clear, we don’t expect a sharp uptick in layoffs.

“Instead, slower hiring will see employment growth fall behind the number of people looking for work — pushing the unemployment rate to 4.5% by the end of the year.”

22h agoThu 19 Jun 2025 at 2:00am

CBA extends sponsorship deal with Football Australia

The Commonwealth Bank has signed a six-year sponsorship deal with Football Australia (FA), soccer’s national governing body.

The deal extends the bank’s existing sponsorship of the sport, notably its naming rights deal for the national women’s team, the Matildas.

The new deal will see CBA sponsor all levels of Australia’s national teams, from the Matildas and Socceroos, the male and female national youth teams, the Pararoos and ParaMatildas, as well as support for grassroots programs such as Miniroos.

“With the Socceroos facing the upcoming FIFA World Cup 2026, and the Matildas preparing for the Australian-hosted AFC Women’s Asia Cup, there has never been a more exciting time to be a fan of football in Australia,” CBA’s CEO Matt Comyn said in a joint statement with Football Australia.

The statement doesn’t reveal the bank’s financial commitment to FA in return for these naming rights.

Employment falls in May

According to the ABS, the number of people employed fell by 2,500 last month.

Sean Crick, ABS head of labour statistics, says “this fall in employment, combined with a drop in unemployment of 3,000 people, meant that the unemployment rate remained steady at 4.1 per cent for May”.

The participation rate fell 0.1 percentage points to 67.0 per cent.

Mr Crick says despite the slight fall in the employment-to-population ratio in May, the female employment-to-population ratio rose 0.1 percentage points to a record high of 60.9 per cent.

Hours worked increased 1.3 per cent in May, following lower levels in the previous two months coinciding with the Easter holiday period and severe weather disruptions.

BREAKING: unemployment rate steady at 4.1pc in May

The seasonally adjusted unemployment rate remained at 4.1 per cent in May, according to data released today by the Australian Bureau of Statistics (ABS).

23h agoThu 19 Jun 2025 at 12:58am

CEOs earn 55x average earnings, but that’s an improvement from a decade ago

At Australia’s largest listed companies, in the ASX 100, leaders’ salaries come in at 55 times the average earnings of an Australian worker, despite flattening over the past decade.

That’s according to the latest CEO pay report card from the Australian Council of Superannuation Investors.

That is up from 50 times the average earnings in the 2023 financial year, but down significantly from 2014, when CEO salaries were 71 times the average worker’s.

“Australia is actually doing well relative to other markets where there’s been a significant breakout in CEO pay,” said ACSI’s Ed John.

“There’s been recent studies that show CEO pay is a multiple of about 106 times median salaries in the UK and in the US, that’s actually more than 300 times in the largest companies.”

Read the story from business reporter Emily Stewart:

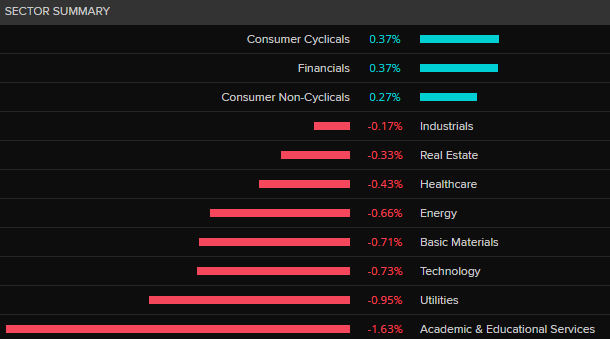

Most sectors in the red as ASX picks a direction

After trading close to flat after the open, the ASX 200 is now modestly lower, down about 0.2 per cent at the moment.

Here’s how the sectors are stacking up:

Looking at some of the biggest players, the Big Four banks, the major supermarkets and Wesfarmers and gaming group Aristocrat are all higher, but losses for Goodman Group, BHP, Rio Tinto, Woodside and CSL are weighing.

The best performing stocks so far:

HMC Capital +3%EVT +1.9%Cleanaway Waste Management +1.9%Eagers Automotive +1.8%Mineral Resources +1.5%

And the worst:

Bellevue Gold -4.8%Perseus Mining -4.6%Lifestyle Communities -4.4%Evolution Mining -3.7%Siteminder -3.5%