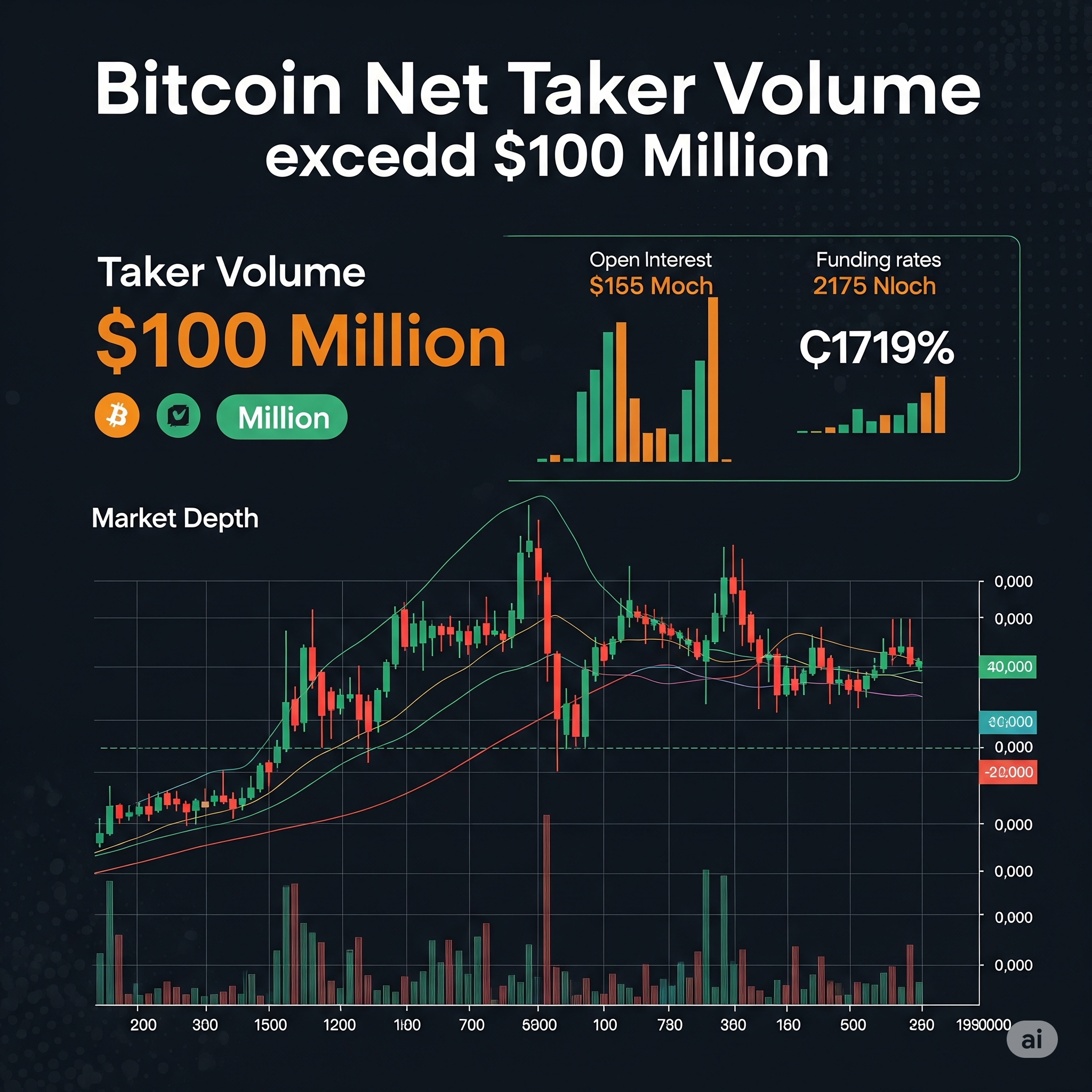

On June 24, Binance’s Net Taker Volume — a key measure of buying and selling pressure — surged past $100 million for the first time since June 9. While this spike might indicate bullish momentum, CryptoQuant warns that such sharp increases often result from aggressive retail trading or forced liquidations of leveraged shorts, rather than sustained investor demand.

Simultaneously, stablecoin net outflows from derivatives exchanges topped $1.25 billion, marking the largest withdrawal since mid-May. This trend signals weakening structural support for long positions and a broader pullback from risk-on assets.

These market moves coincide with growing speculation about a shift in U.S. monetary policy. Federal Reserve Chair Jerome Powell’s recent Congressional testimony hinted at the possibility of future interest rate cuts, signaling a potential easing stance. Supporting this view, the U.S. 2-year Treasury yield has trended downward, reflecting market expectations for rate reductions. Likewise, the Swiss Franc recently surged beyond 1.24 against the U.S. dollar, emphasizing increased demand for traditional safe havens and reinforcing a cautious risk-off sentiment.

While the spike in Net Taker Volume could drive short-term volatility, the outflow of stablecoins from derivatives platforms raises concerns about Bitcoin’s ability to maintain its upward trajectory. Heightened macroeconomic uncertainty and declining liquidity suggest the market may be nearing a correction.

Rising Volatility and Long-Term Holders Trimming Exposure

Additional internal signals from Binance add to the cautious outlook. The 24-hour Open Interest (OI) change recently exceeded 6% for the third time in two months. Previous spikes in OI during late May and early June were followed by price corrections or consolidation phases, hinting that increased leveraged positions may precede short-term profit-taking.

Moreover, the Long-Term Holder (LTH) Net Position Realized Cap has dropped sharply from over $57 billion to $3.5 billion, indicating that long-term holders are reducing their BTC exposure — likely locking in gains amid evolving macro conditions.

Although these trends don’t guarantee an immediate bearish reversal, CryptoQuant emphasizes that the market’s sensitivity is increasing. Bitcoin now faces a critical crossroads, where profit-taking and potential pullbacks may become more frequent as speculative enthusiasm grows and long-term confidence softens.