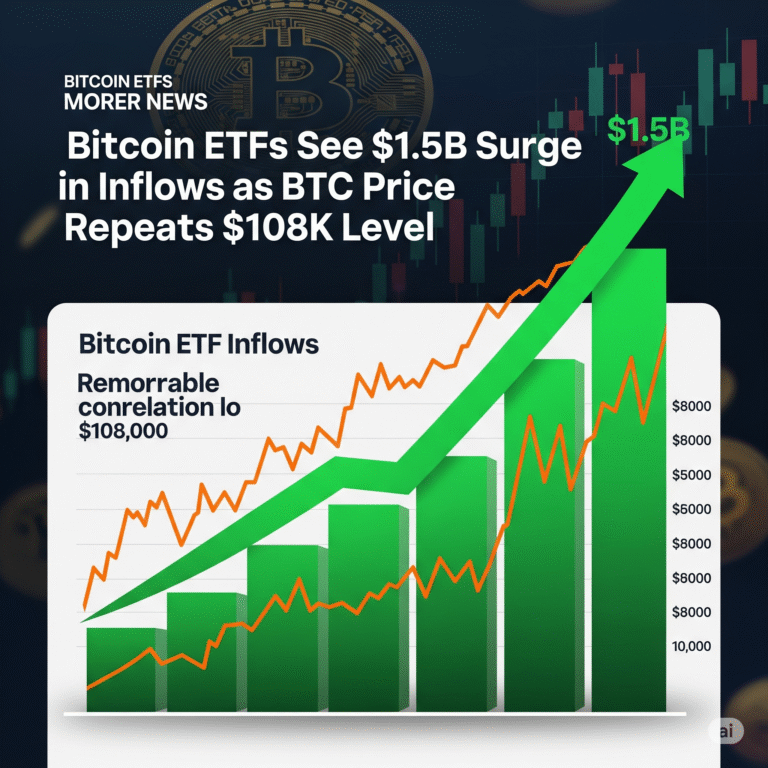

Spot Bitcoin ETFs have attracted nearly $1.5 billion in inflows this week alone, signaling a renewed wave of institutional demand as BTC revisits the $108,000 price level.

According to data from Farside Investors, U.S. spot Bitcoin ETFs pulled in $1.48 billion over just three trading days, with no daily outflows recorded since June 6 — nearly three weeks of uninterrupted net gains.

“It’s absolutely ridiculous,” said Nate Geraci, President of ETF Store, who noted that total inflows across all Bitcoin ETFs since their launch 18 months ago are now approaching $50 billion, including nearly $4 billion in fresh capital this month alone.

BlackRock and Fidelity Lead the ETF Pack

BlackRock’s iShares Bitcoin Trust (IBIT) remains the dominant force, accumulating over 9,400 BTC this week. The fund saw $340 million in new inflows on Wednesday and has now surpassed $52 billion in total inflows since its inception.

Fidelity’s Bitcoin ETF follows in second place, with $115 million in daily inflows on June 25 and a total of $11.7 billion in assets gathered. The remaining nine U.S. spot Bitcoin ETFs pale in comparison, holding only a fraction of these inflows.

ETF Expansion: Solana and NFTs in Focus

In parallel with the Bitcoin ETF boom, Invesco and Galaxy Digital filed for a Solana ETF on Wednesday, becoming the ninth issuer to seek SEC approval for such a product, according to Bloomberg ETF analyst James Seyffart.

Also notable is Canary Capital’s 19b-4 filing with CBOE for a PENGU ETF, which would cover Pudgy Penguins NFTs and token exposure, further signaling institutional interest in emerging digital asset classes.

Bitcoin’s Price Action and Dominance

Bitcoin has gained almost 10% since briefly dipping below the $100,000 mark earlier this week. It has since double-tapped $108,100 within 24 hours before a slight pullback to $107,800 during Thursday’s Asian session.

The rally has pushed Bitcoin dominance to a four-year high of 65.7%, as Ethereum and other altcoins continue to stagnate. According to analyst Rekt Crypto, this resurgence mirrors historical dominance cycles, though this cycle appears to be unfolding at a slower pace.

“Many are hoping for a quick spike to 70% dominance, but markets rarely deliver exactly what people expect,” Rekt noted.

Adding to the bullish sentiment, Bitcoin has now been formally recognized as a reserve asset by the U.S. housing system, a move hailed by Michael Saylor as a “defining moment for institutional BTC adoption and collateral recognition.”