As the U.S. stock market flirts with new highs, driven by strong performances in sectors like airlines and technology, investor sentiment remains cautious amid ongoing trade uncertainties. In this dynamic environment, identifying small-cap stocks with strong fundamentals can offer unique opportunities for growth and diversification.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingWest Bancorporation169.96%-1.41%-8.52%★★★★★★FineMark Holdings122.25%2.34%-26.34%★★★★★★Metalpha Technology HoldingNA81.88%-4.97%★★★★★★Senstar TechnologiesNA-20.82%14.32%★★★★★★FRMO0.09%44.64%49.91%★★★★★☆Valhi43.01%1.55%-2.64%★★★★★☆Pure Cycle5.11%1.07%-4.05%★★★★★☆Solesence82.42%23.41%-1.04%★★★★☆☆Reitar Logtech Holdings31.39%231.46%41.38%★★★★☆☆Vantage6.72%-16.62%-15.47%★★★★☆☆

Click here to see the full list of 277 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Pioneer Bancorp, Inc. serves as a holding company for Pioneer Bank, National Association, offering a range of banking products and services in New York with a market cap of $314.66 million.

Operations: Pioneer Bancorp generates revenue primarily from its banking segment, amounting to $88.64 million. The company’s financial performance is influenced by its net profit margin trends, which can provide insights into its profitability over time.

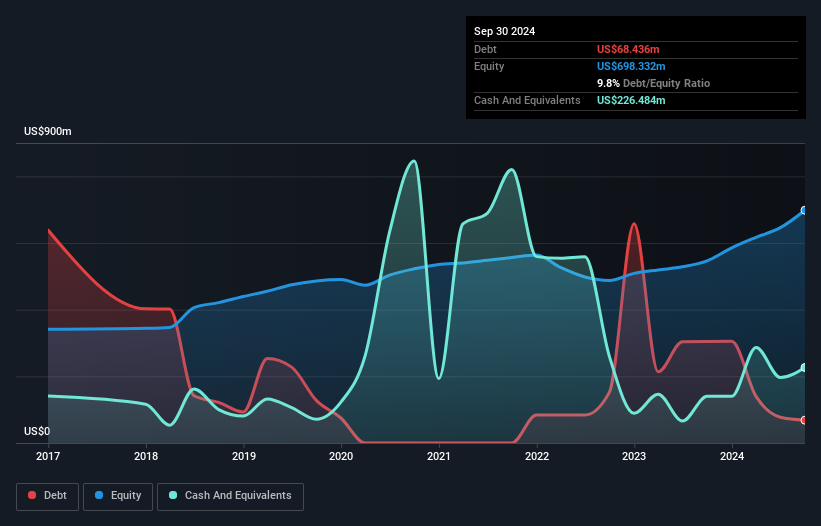

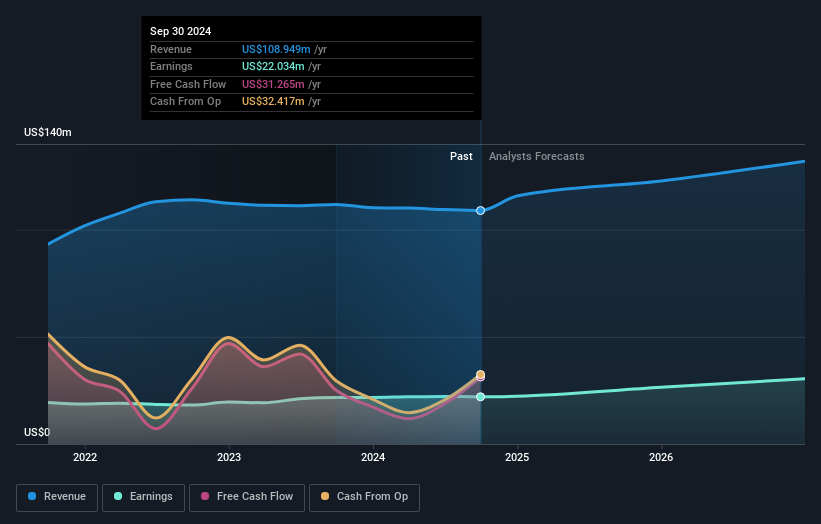

Pioneer Bancorp, with total assets of US$2.1 billion and equity of US$310.7 million, showcases a robust financial profile. Its earnings growth of 27.8% outpaces the industry average, reflecting strong performance in the banking sector. The company maintains a prudent approach to risk management with non-performing loans at just 0.7% and an allowance for bad loans at 213%. Total deposits stand at US$1.7 billion against total loans of US$1.5 billion, indicating solid liquidity management supported by low-risk funding sources primarily from customer deposits (98%). Despite being dropped from the Russell 2000 Dynamic Index recently, its P/E ratio remains attractive at 15.6x compared to the broader market’s 18.6x.

Simply Wall St Value Rating: ★★★★★★

Overview: Amalgamated Financial Corp. is the bank holding company for Amalgamated Bank, offering commercial and retail banking, investment management, and trust and custody services in the United States, with a market cap of $1.01 billion.

Operations: Amalgamated Financial generates revenue primarily through its banking segment, which accounts for $303.97 million. The company’s net profit margin reflects its profitability efficiency in managing expenses relative to its total revenue.

Amalgamated Financial, with assets totaling $8.3 billion and equity of $736 million, is making strategic moves to bolster its growth potential. The company has a solid foundation with total deposits of $7.4 billion and loans amounting to $4.6 billion, supported by a sufficient allowance for bad loans at 170%. Its liabilities are primarily low-risk customer deposits, comprising 98% of the total. Recent initiatives include share repurchases worth $2.09 million in early 2025 and investments in a new NYC headquarters to enhance operational efficiency and attract talent, aiming for long-term revenue expansion through diversified deposit growth and C-PACE originations.

Simply Wall St Value Rating: ★★★★★★

Overview: Colony Bankcorp, Inc. is a bank holding company for Colony Bank, offering a range of banking products and services to retail and commercial clients in the United States, with a market capitalization of approximately $311.02 million.

Operations: Colony Bankcorp generates revenue primarily through its Banking Division, which contributes $93.03 million, followed by the Small Business Specialty Lending Division at $14.11 million, and the Mortgage Banking Division at $6.62 million. The company’s market capitalization stands at approximately $311.02 million.

Colony Bankcorp, with assets totaling $3.2 billion and equity of $286.9 million, is making strategic moves to diversify its revenue streams. The acquisition of Ellerbee Agency and the launch of a credit card program are expected to enhance noninterest income significantly. It boasts a solid allowance for bad loans at 160% and maintains low-risk funding with 91% sourced from customer deposits. Despite challenges like seasonal revenue dips, earnings grew by 14.1% last year, outpacing the industry average of 5.5%. The company repurchased 209,788 shares recently for $2.88 million under its buyback program initiated in October 2022.

Where To Now?

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com