Market snapshot

Prices current around 4:15pm AEST

Live updates from major ASX indices:

3h agoMon 14 Jul 2025 at 7:43am

Goodbye

That’s it for another day on the blog, thanks for company.

Looking ahead, Wall Street’s reversal looks likely to continue with all the key futures indices down around 0.6%.

Don’t forget The Business with Kirstin Aikin is on ABC News at 8:45pm AEST and after the Late News on ABC-TV if you haven’t quite had you fill of business and finance news today.

The most dapper reporter on the finance desk, “Downtown” Dan Ziffer, will be fired up (by several cups of highly concentrated coffee) to greet you in the early hours of tomorrow with everything has happened overnight.

Joyeux quatorze juillet. À toute à l’heure.

Loading

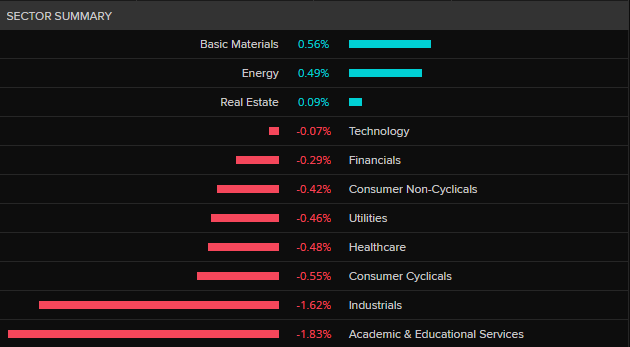

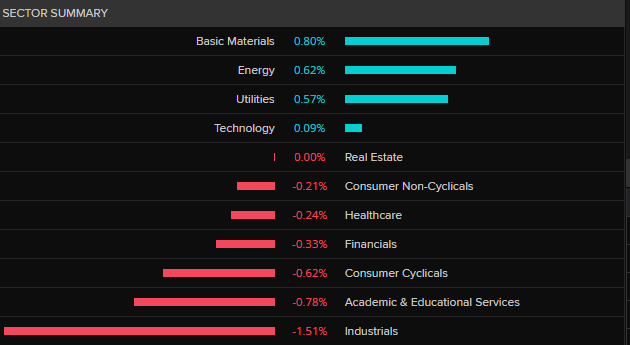

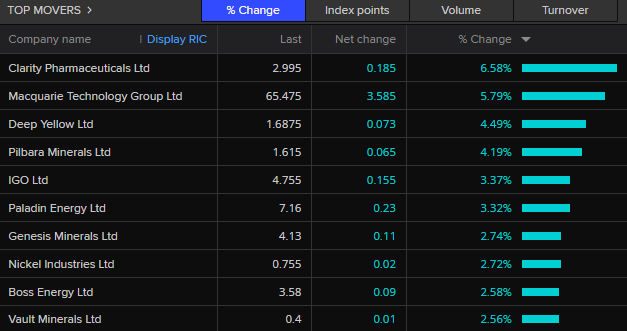

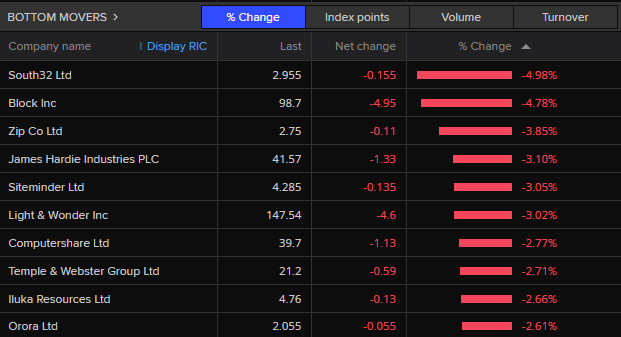

ASX fades to close 0.1% lower, dragged down by banks

The ASX 200 wobbled around over the course of the day, before wilting in closing trades, to end 0.1% lower at 8,570 points.

Mining and energy stocks were generally stronger, acting as a counterweight to weaker banking, healthcare and industrial stocks.

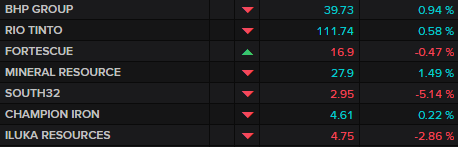

The big miners BHP (+0.9%), Rio Tinto (+0.6%) were supported by higher iron ore prices, although Fortescue (-0.5%) was lower

While Woodside (+0.2%) and Santos (+0.5%) benefited from stronger oil prices and the IEA’s view that supply is tight, the big winners in the energy sector today were the uranium miners.

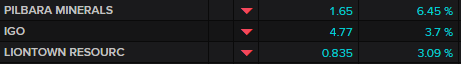

Lithium miners also enjoyed their day.

The retail banks, bar NAB (+0.1%,) were not in favour with ANZ down 0.8%.

Investment bank Macquarie gained 0.2%.

Macquarie Technology (+9.6%) made the biggest gain on the ASX 200 after announcing it planned to expand its data centre footprint.

Clarity Pharmaceuticals, which has struggled this year with its value almost halving, had a better day gaining almost 9%.

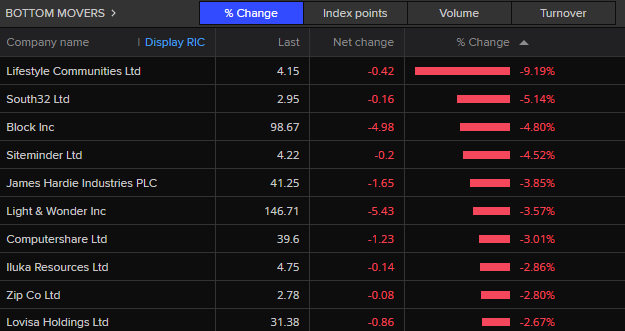

The troubled retirement village builder, Lifestyle Communities (-9.2%) was the biggest loser, dropping sharply in late trade.

South 32 was also hit hard after flagging problems at its Mozambique aluminium smelter could hurt it its bottom line.

4h agoMon 14 Jul 2025 at 5:58am

Macquarie Technology shares surge on expansion plans

Data centre firm Macquarie Technology Group has announced it has entered a deal to develop a new data centre campus in Sydney.

That sent its shares surging today, currently up 9.2 per cent.

The process won’t be a quick one, with development and board approvals needed, land that needs to be subdivided, and construction that will occur in stages.

If the subdivision goes ahead and the company exercises its option to buy the “large parcel of land”, the purchase price will be $240 million.

Existing cash reserves and debt will be used for the land purchase, and the new data centres are expected to take a few years, so Macquarie will secure additional finance for the centres themselves in this time.

It says the planned development will deliver more than 150 megawatts of IT load.

The company also gave an update on another campus project, the IC3 SuperWest data centre development at Macquarie Park in Sydney’s north, which it says remains on track to complete the first of stage of construction in September 2026.

“Together with the new campus announced today, the company will be strategically placed to provide a continuous pipeline of available capacity for its customers over the next 7-10 years,” it said in an ASX statement.

Chinese iron ore imports and rare earth exports pick up

Buried beneath the overburden of the headline trade balance data out of China’s customs bureau this afternoon are some quite interesting nuggets.

Chinese steelmakers’ appetite for iron ore jumped 8% in June.

As well, China’s rare earths exports — a bone of contention for US trade negotiators — rose 32% in June from the month before.

Iron ore: June imports at 105.95 mmt, up 8.5% y/yRare earths: June exports at 7,742.2 mt, up 32% m/mCrude oil: June imports at 49.89 mmt, up 7.4% y/ySoybeans: June imports at 12.26 mmt, up 10.35% y/yUnwrought copper: June imports at 464,000 mt, up 8.7% m/mCoal: June imports at 33.04 mmt, down 26% y/y

The spurt in iron ore imports was largely attributed to Australian miners ramping up shipments to meet quarterly targets after cyclones hit first quarter imports and as lower ore prices and healthy steel margins spurred demand.

“Handsome profits incentivised steelmakers to initiate a wave of iron ore stockpiling especially when the hot metal output still stayed at a relatively high level, contributing to higher imports last month,” Cao Ying, a Beijing-based analyst at broker SDIC Futures, told Reuters.

On the other end of the steel production, China’s steel exports in June slid by 8.5% from May to a four-month low of 9.7 million tons.

But total outbound shipments in the first half rose 9.2% year-on-year to an all-time high of 58.15 million tons as steelmakers boosted exports ahead of an expected drop in demand due to U.S. tariff hikes.

China’s crude oil imports rebounded in June and reached the highest daily rate since August in 2023 as refiners took advantage of cheaper fuel to boost stockpiles.

Imports of other energy sources, such as coal (-26%) and LNG (-8%), fell.

While in more promising news on the trade war front, it seems the increased flow of rare earths to foreign electronics and technology manufactures show negotiations between the US and China have been succeeded in taking some of the heat out of the issue.

The spike in soybean imports may not be great news for US growers, as the bulk of it was sourced from a bumper (and thus cheaper) crop from China’s BRICS ally, Brazil.

5h agoMon 14 Jul 2025 at 5:15am

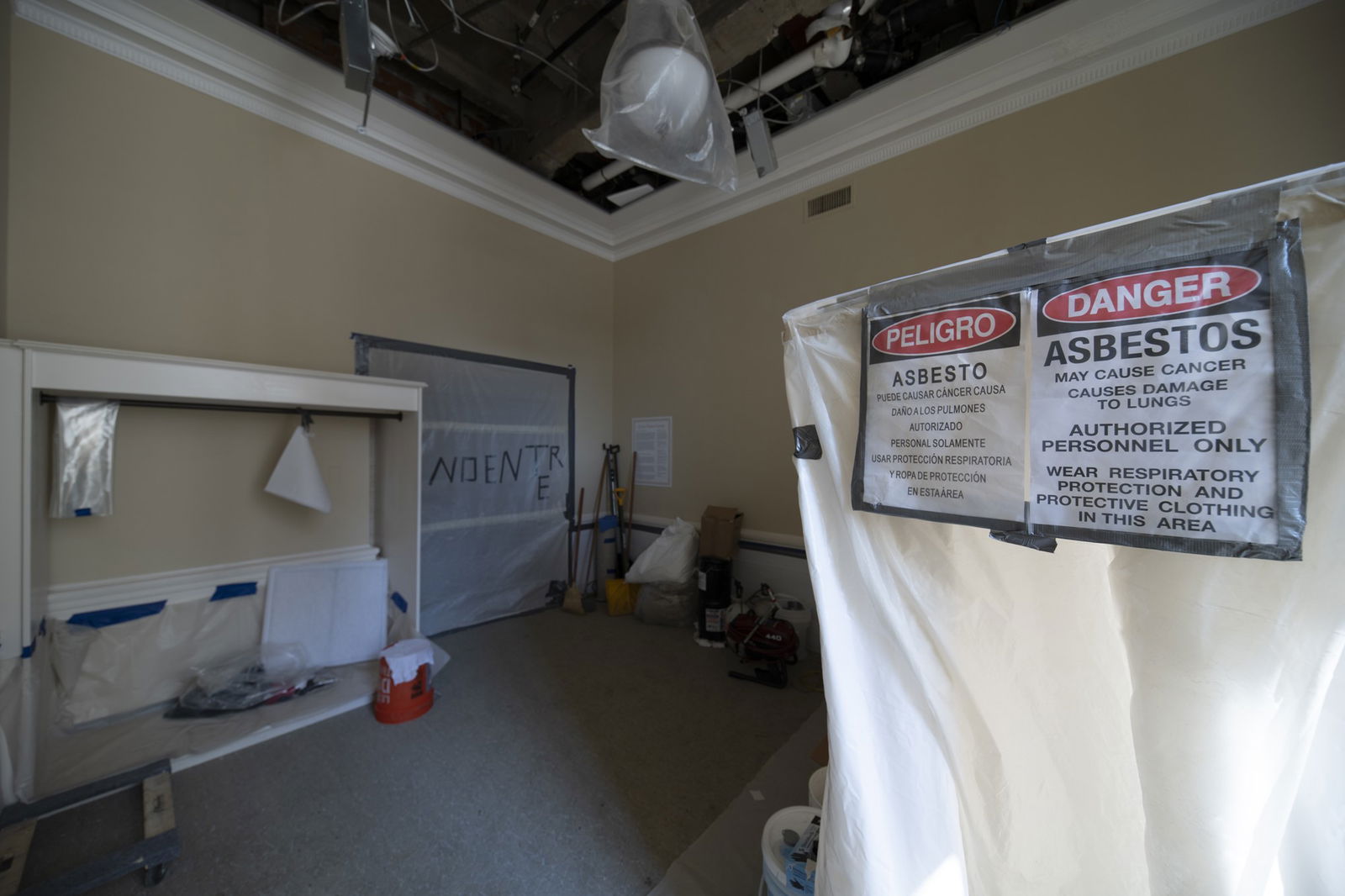

Federal Reserve says renovation cost blow-out due to asbestos, not VIP areas

How does an office renovation cost more than US$2.5 billion?!

– Alex

Thanks for the comment Alex and good question — according to the Federal Reserve, it’s far from a simple project.

The Trump administration has raised the cost blow-out of the renovation as a potential reason Fed chair Jerome Powell could be fired “for cause”, but the central bank has said it was more asbestos removal, less water features and VIP areas that led to the overrun.

Here’s a wrap of their response from Reuters:

The Fed on Friday appeared to rebut some of Vought’s claims in a ‘Frequently Asked Questions’ posting about the project, describing it as the first complete renovation of the buildings since their construction in the 1930s, including removing lead contamination and more asbestos than initially anticipated.

It shows pictures of leaky pipes and roofs and notes that costs have risen due to increased material, equipment and labour costs.

It denied assertions that there were VIP dining rooms or elevators being installed. The project will have a “green roof” using plants to help manage water runoff and aid with heating and cooling, as many other federal buildings have used for decades but no terrace access.

“There are no new water features, there’s no beehives, and there’s no roof terrace gardens,” Mr Powell told US senators in testimony in June, denying excessive spending on the project.

Powell said the almost 90-year-old headquarters “was not really safe, and it was not waterproof” while acknowledging cost overruns.

The Fed has said that the project, which includes upgrades to an adjacent building, will consolidate staff into a single campus and reduce off-site lease costs. As of February, a Fed Inspector General report estimated that costs had risen to $US2.4 billion ($3.7 billion) from an estimate of $US1.9 billion two years earlier, a $US500 million increase.

6h agoMon 14 Jul 2025 at 4:48am

Bitcoin record

Bitcoin and crypto hitting record heights over past 2 months. Maybe worth a mention ABC?

– Matt

Thanks Matt, we managed to address your issue at 14.17.29 pm AEST, two minutes before your comment. As with comedy, timing is everything in blogging. Come to think of it, blogging is weird and largely unfunny subset of comedy.

6h agoMon 14 Jul 2025 at 4:41am

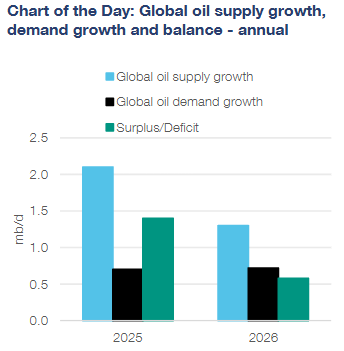

Oil market ‘tight’, but not for long

News that the authoritative and independent International Energy Agency described the oil market as “tight” saw the global benchmark Brent crude index jump by 2.5% above $US70, a level it has held to today.

However, that “tight” description needs a more nuanced look, given the IEA’s broader forecast for weak demand growth and an upgrade in supply forecasts.

The IEA forecasts global oil consumption to increase by only 0.70million barrels/day (mb/d) this year which would mark the lowest increase since 2009, excluding the 2020 COVID impacted year.

On the supply side, the IEA forecasts production to increase by 2.1mb/d in 2025 and 1.3mb/d in 2026.

The current tightness could soon be replaced by price crushing over supply in a matter of months.

“Refinery activity, which picks up from May to August as seasonal demand typically rises in the Northern Hemisphere summer period, helps explain the current tightness in the market,” CBA’s mining and energy commodities analyst Vivek Dhar said.

“But if the IEA’s projections hold true, then oversupply conditions may emerge as early as September, as a drop off in refinery activity coincides with another potential strong increase in OPEC+ supply.

“The IEA’s projections suggest a substantial increase in stockpiles in Q4 2025 (+2mb/d) and Q1 2026 (+3mb/d).”

Mr Dhar said these increases are consistent with Brent oil futures falling to $US63/bbl in Q4 2025.

“For now, oil markets are waiting to see whether US President Trump’s threats against Russia will amount to stricter US sanctions on Russia’s exports of oil (~4.5% of global demand) and oil products (~2.5% of global oil demand), Mr Dhar said.

“The stricter sanctions reflect US President Trump’s growing frustrations with Russia’s President Putin over the Ukraine war.

“(They) could potentially include a 500% increase in US tariffs for any buyers of Russian energy.”

India and China have typically accounted for 55 65% and 35% 45% of Russia’s oil seaborne exports over the last year respectively.

“It’s worth noting that US efforts to reduce Russian oil shipments have failed in the past, with the most recent attempt taking place in January 2025 by the Biden Administration, suggesting that Russia’s ability to sidestep sanctions can’t be underestimated,” Mr Dhar said.

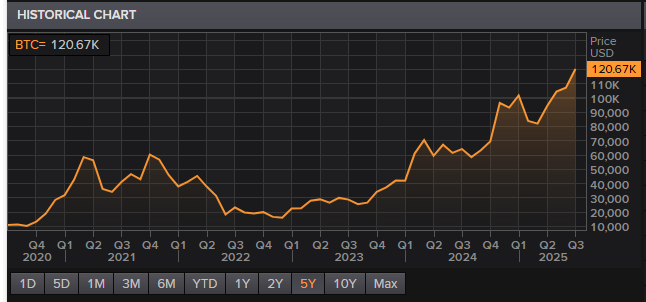

Bitcoin crashes through $120,000 to a new record

Bitcoin’s recent rampage continues unabated with the world’s largest cryptocurrency, pushing through the $US120,000 mark for the first time in history on Monday.

The digital currency, which has gained more than 29% for the year thus far, traded 1.4% higher at $120,670 at 2:10pm AEST.

It has bounced 20% in just a couple of weeks since it dipped below $US100,000 on June 22.

China trade surplus jumps as exports boom

China’s exports have accelerated again ahead of yet another tariff deadline from the US.

Outbound shipments rose by 5.8% year-on-year in June, up from the 4.8% growth in May.

Imports also rebounded, up 1.1% (yoy), having declined by more than 3% in May.

Overall, China’s 12-month surplus with the rest of the world hit $US115 billion — a new record high.

Much of the surge is attributed to exporters pushing goods onto ships to beat looming, but constantly delayed tariff deadlines.

The most recent deadline for China to reach a trade agreement with the US has now been pushed out to August 12.

However, fears that third party countries such as Vietnam, which handles Chinese shipments could face 40% tariffs, remains a concern for exporters and US consumers alike.

Additionally, China’s alliance with the BRICs nations — a group particularly disliked by Mr Trump — could see it hit with another 10% on top of everything else.

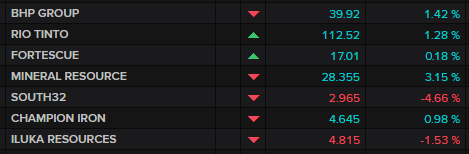

ASX flat, propped up by miners

The ASX 200 is flat — well, marginally lower, down just 0.1 point to be exact— heading into the afternoon session (12:40pm AEST).

Mining and energy stocks are generally stronger, acting as a counterweight to weaker banking, healthcare and industrial stocks.

The big miners BHP (+1.4%) , Rio Tinto (+1.3%) and Fortescue (+0.2%) have all been supported by higher iron ore prices

While Woodside (+0.2%) and Santos (+0.5%) have benefited from stronger oil prices and the IEA’s view that supply is tight, the big winners in the energy sector today are the uranium miners.

The retail banks, bar NAB (+0.2%) have not been in favour with ANZ down 0.7%.

Investment bank Macquarie has gained 0.4%.

Clarity Pharmaceuticals, which has struggled this year with its value almost halving, is having a better day and is the ASX 200’s biggest winner today.

Macquarie Technology is also in demand after announcing it planned to expand its data centre footprint.

South 32 is the biggest loser after flagging problems at its Mozambique aluminium smelter could hurt it its bottom line.

8h agoMon 14 Jul 2025 at 2:30am

ASX flat but wobbling around

The ASX 200 clawed back earlier losses to eke out a small gain at midday.

It’s now basically flat (just 2 points below its opening level), with winners and losers evenly spread across the 200 stocks on the index.

Chalmers endorses Treasury’s modelling of ‘worst-case’ scenarios for US economic fallout

The subject heads in the incoming government brief, accidentally released to the ABC in response to a Freedom of Information (FOI) request, show that Treasury has modelled four different “trade, uncertainty and financial market disruption” scenarios.

These range from “escalating tariff”, through “uncertainty”, to “financial disruption” and ultimately “worst case”.

We know from the subheadings that the “financial disruption scenario” includes some discussion of a potential 200 basis point increase in US sovereign risk and “Fed loss of independence”.

Treasurer Jim Chalmers says his department is just doing its job well by modelling such scenarios, even if they are unlikely.

“I welcome and I encourage the Treasury to think about best and worst-case scenarios,” he tells reporters.

“I believe if you consider worst-case scenarios, it gives you a better chance to work through them if they eventuate. So the approach we took in the global financial crisis, it’s the approach we take now.

“We’ve got to recognise this is the fourth big economic shock in less than two decades. It would be strange if Treasury wasn’t advising me on the worst-case scenarios, whether it’s about bond markets in the US, currency exchanges, or other challenges to the global system.

“As I made clear at the very beginning, you know, this global economic uncertainty is really the primary influence on the government’s second term. It’s the thing that is most likely to constrain our choices and guide our and shape our choices.

“And so I think what you’re seeing in those headings released under the FOI is really the Treasury’s best attempt at working out a whole range of scenarios. I appreciate that. I’m grateful for that work that they do because it helps me think through various scenarios, even if we think that the chances of that happening are remote.”

Plan for the worst, hope for the best.

8h agoMon 14 Jul 2025 at 2:20am

Market snapshot

Prices current around 12:20pm AEST

Live updates from major ASX indices:

8h agoMon 14 Jul 2025 at 1:58am

Politics blog covers fallout from Treasury FOI release and PM’s China visit

Political reporter Courtney Gould and other colleagues in the press gallery are on top of all of today’s political developments.

And there are a lot. From the treasurer’s response to his department’s accidental release of information from the incoming government brief that it had intended to keep confidential, to the prime minister’s visit to China.

You can stay across it all on the politics live blog.

9h agoMon 14 Jul 2025 at 1:52am

Treasurer pushes back on prospect of GST increase

Asked about the prospect of broadening, increasing or otherwise changing the GST as part of efforts to raise revenue to sustainably repair the budget, Treasurer Jim Chalmers says he will welcome all ideas at the upcoming “reform roundtable”.

However, he also points out that both he and the prime minister have repeatedly said in the past that they don’t support a GST increase.

Mr Chalmers says he does want to see a broad range of suggestions about tax at the roundtable.

“We are interested in ways to simplify the tax system,” he says.

“When we speak with tax experts and people that have a view about tax reform, they’re interested in efficiency and equity and simplicity, and other design principles like that. So ideally people will come with views about how we simplify the tax system.”

Chalmers ‘relaxed’ about Treasury’s accidental FOI disclosure

Asked about the accidental release of subject headings in a Freedom of Information request for the incoming government brief, which Treasury had intended to redact, Treasurer Jim Chalmers tells reporters he isn’t too worried.

“I’m pretty relaxed about it, to be honest, because, of course, Treasury provides advice for incoming governments and no government typically goes into the detail of that,” he responds.

“The other reason I’m pretty relaxed about it is we have already made it really clear that we will need to do more to meet our housing targets. We have already made it really clear that we will do more to make our economy more productive and more resilient. We have made it clear that we need to build on the progress we have made in repairing the budget so that we can make the budget even more sustainable.

“So the priorities which are being reported today … those are the sorts of things that I have mentioned before including at the national Press Club.”

Nothing new to see here, says the treasurer.

9h agoMon 14 Jul 2025 at 1:39am

Treasurer heading to G20 in South Africa later this week

The treasurer has told a media briefing that he’ll hold a series of bilateral meetings when he travels to the G20 finance ministers meeting later this week.

“I’ll be heading to Durban this week, later in the week, for meetings on Thursday and Friday,” he said.

“I’ll be participating in G20 discussions, but also meeting directly with my counterparts from Indonesia, Japan, Canada, the UK, and Germany.

“And my focus at the G20 will be on strengthening economic ties, but also with the particular focus on capital flows, on supply chains, on critical minerals, and also dealing with the structural issues in our own economies.”

9h agoMon 14 Jul 2025 at 12:58am

Fearless and free Treasury isn’t holding back

Treasury briefing notes for the re-elected Labor government, accidently included in a Freedom of Information (FOI) release to the ABC, show the Albanese government was advised the budget cannot be fixed without raising taxes and cutting spending, and that its housing target is unachievable.

Business reporter Daniel Ziffer lodged the FOI request for the incoming government brief, which initially appeared to be not much. But when Dan received requests to urgently delete the document, the ABC took a closer look.

Read Dan’s analysis about what the documents revealed and why the brief should give Australians confidence that Treasury is having fearless and tough conversations with government decision-makers:

10h agoMon 14 Jul 2025 at 12:41am

Market snapshot

Prices current around 10:40am AEST

Live updates from major ASX indices: