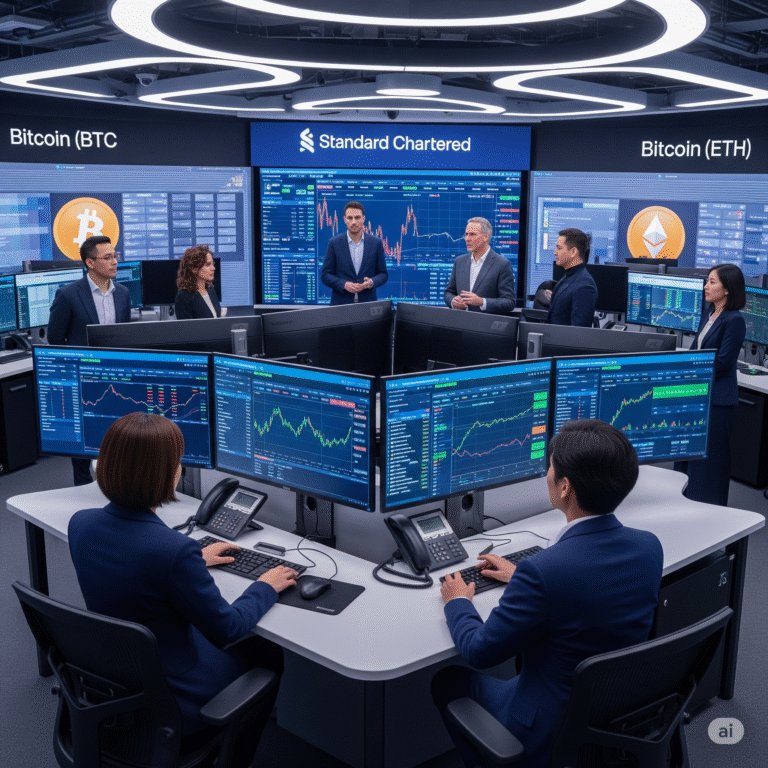

Standard Chartered has become the first major global bank to launch institutional spot trading services for Bitcoin (BTC) and Ethereum (ETH), signaling a bold step forward in bridging traditional finance with the crypto economy.

Direct Crypto Trading Now Available for Institutions

The newly launched offering allows institutional clients—including asset managers, corporations, and large investors—to trade BTC and ETH directly through the bank’s existing FX trading infrastructure. Unlike derivatives-based exposure, these are deliverable trades, meaning clients will receive actual crypto assets upon settlement.

Clients may also select their preferred custody provider, including Standard Chartered’s in-house custody solution.

Initially, trading will be available during Asian and European market hours, with 24/5 access under consideration depending on future demand.

Upcoming Derivatives and Risk Management Tools

In addition to spot trading, Standard Chartered plans to introduce non-deliverable forwards (NDFs) for BTC and ETH. This will offer institutional investors enhanced tools for risk management as demand for secure, regulated crypto exposure continues to rise.

Leading the Charge in Institutional Crypto Adoption

This launch is part of a broader digital asset strategy by Standard Chartered, which also includes a Luxembourg-based crypto custody entity and stablecoin development partnerships in Asia. The bank’s proactive embrace of blockchain-based finance contrasts with competitors like JPMorgan and Goldman Sachs, which remain more cautious in rolling out direct spot crypto services.

Industry voices like Nate Geraci, co-founder of The ETF Institute, have criticized such conservative stances, warning that legacy financial players may lose relevance if they continue to sideline crypto offerings.

A Long-Term Commitment to Digital Assets

Standard Chartered Group CEO Bill Winters has repeatedly affirmed the bank’s conviction in the future of crypto, stating, “Digital assets are here to stay.” By launching institutional spot BTC and ETH trading services, Standard Chartered positions itself as a first-mover in the regulated digital asset space—an area increasingly attractive to institutional investors seeking trusted, compliant market access.