Market snapshot at lunchtime

Prices current around 12.35pm AEST.

Live updates on the major ASX indices:

1m agoWed 23 Jul 2025 at 4:00am

Genea IVF patient health information leaked on dark web

IVF giant Genea has written to patients to inform them their sensitive medical information has been posted on the dark web.

The move came five months after the company confirmed it had been targeted by cyber criminals.

Emails obtained by the ABC state the data includes patients’ full names, addresses, dates of birth, and “clinical information related to the services that you received from Genea or other health service providers and/or medical treatment”.

You can read more on this story by Rhiana Whitson here:

17m agoWed 23 Jul 2025 at 3:44am

NAB CEO responds to investor complaints

National Australia Bank’s chief executive Andrew Irvine says he has to ‘get through’ complaints about his management style and drinking at customer events.

Media reports last week claimed major investors had questioned whether Mr Irvine should strengthen his leadership skills and curtail drinking.

According to the reports, NAB’s board has stood by its CEO, but increased mentoring and leadership development.

Speaking at a banking conference, Mr Irvine said public figures should expect scrutiny.

“I’m not going to beat around the bush, especially when media is quite personal and public; it was hard for me and my family,’ he said.

“I’ve just got to get through it and I plan on doing that.”

-with Reuters

33m agoWed 23 Jul 2025 at 3:28am

What’s happening with Telix Pharmaceuticals?

Shares in biopharma company Telix Pharmaceuticals have fallen as much as 16.4 per cent, leading the worst performing stock on the ASX 200 today.

It’s all because the US Securities and Exchange Commission has subpoenaed Telix seeking documents and information relating to the company’s disclosures regarding its prostate cancer therapies.

The company is head quartered in Melbourne, but has international operations in the US.

In an announcement to the ASX yesterday, Telix says it is fully cooperating with the SEC and is in the process of responding to the information request.

“At this stage, this matter is a fact-finding request,” the statement reads.

“The information request from the SEC does not mean that Telix or anyone else has violated United States federal securities laws or that the SEC has a negative opinion of any person, entity or security.”

The company will continue with its clinical development programs in the ordinary course of business.

Bureau of Statistics to change how it measures inflation

The Australian Bureau of Statistics will introduce a more comprehensive monthly consumer price index, to bring it in line with global peers and allow for more timely decisions by policy makers.

The primary measure of headline inflation will change from the quarterly CPI to monthly CPI.

The new series will start on November 26.

“Since its introduction in 2022, the Monthly CPI Indicator has provided a helpful earlier read on inflation,” said statistician Dr David Gruen AO.

“The transition to a complete, internationally comparable Monthly CPI as Australia’s primary measure of headline inflation will provide better information for monetary and fiscal policy decisions that have a direct impact on all Australians.”

The new monthly CPI will include comprehensive coverage of price changes each month. Currently, monthly CPI only includes up-to-date prices for around two thirds of goods and services and tends to be volatile.

The complete CPI will bring Australia in line with all other G20 countries and make it easier to compare inflation trends.

Quarterly CPI figures have made it difficult for the Reserve Bank to make real time policy decisions. It kept interest rates on hold this month, in large part to wait the CPI for the second quarter.

1h agoWed 23 Jul 2025 at 2:50am

First Nations Australians being failed by super system

Indigenous Australians face discriminatory policies when it comes to accessing their super say consumer groups.

A report by Super Consumers Australia and Mob Strong Debt Help found First Nations Australians, particularly those who live in rural and remote areas, are frequently locked out of their super accounts.

Some of the biggest barriers are rigid requirements for verifying identities and the reliance on digital platforms to access funds.

Almost 40 per cent of respondents did not have internet access and only a quarter had access to MyGov or email.

You can read more on this story here:

1h agoWed 23 Jul 2025 at 2:31am

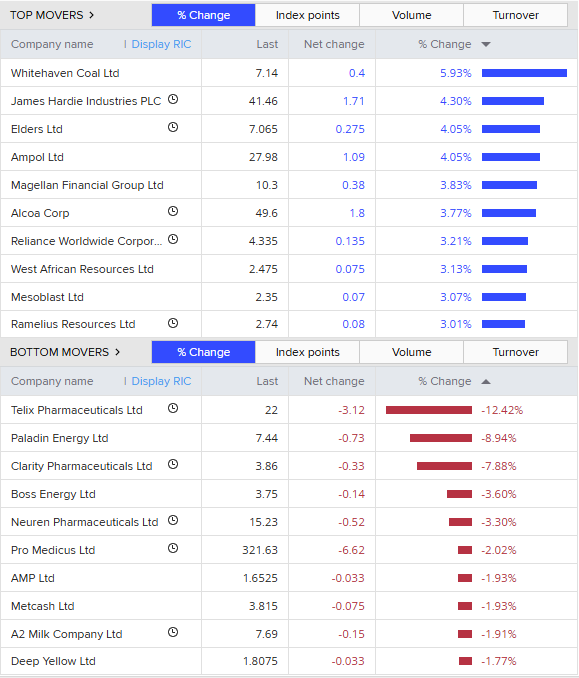

Local markets are still up at midday trading

Australian shares have extended early gains.

The ASX200 is up almost 0.6 per cent to 8,727 points at 12:25pm (AEST).

The broader All Ordinaries index is also up about 0.55 per cent to 8,990 points.

The best performing sectors are basic materials (up 1.7%), academic and educational services (up 1.4%) and energy (up 1.2 %).

When it comes to individual stocks, Whitehaven Coal is up 6%, James Hardie is up 4.3% and Ampol up 4%.

The bottom movers are led by Telix Pharmaceuticals, down more than -12% on news the company will face a regulatory inquiry over cancer therapy.

Meanwhile, Japan’s Nikkei is up 2.8 per cent on news of a US-Japan trade deal.

1h agoWed 23 Jul 2025 at 2:18am

AI causing gridlock in the jobs market, says recruitment firm

Recruiters and employers are being inundated with generic or embellished CVs created by artificial intelligence, making it harder to find the right talent, says recruitment firm Hays.

While AI is useful, it’s not without risk, says Matthew Dickason, Hays APAC chief executive officer.

“When job seekers rely too heavily on AI to generate applications, quality and legitimacy suffer. Candidates need to carefully review and personalise AI-generated content to ensure it’s accurate, relevant and highlights the human skills employers value most.”

Hays Salary Guide, a report into salaries and workforce trends, found almost a third of Australians changed jobs in the past year and more than 60 per cent expect to leave their jobs in the next year, despite economic uncertainty.

This was primarily due to low salary and lack of career progression.

“This should tell employers that despite the cost of living, salary is not longer enough – benefits, progression and purpose matter more than ever,” said Mr Dickason.

The report is based on a survey of 12,000 respondents across more than 25 industries and 1000 roles.

1h agoWed 23 Jul 2025 at 2:03am

US real estate giant CoStar reports results ahead of Domain buyout

US real estate listings firm CoStar has reported its quarterly earnings, which came in ahead of expectations. Revenue was also up 15 per cent from a year ago.

CoStar struck a deal with Domain earlier this year, to take over the Australian listings giant for $3 billion (including debt).

E&P Capital analyst Entcho Raykovski noted some interesting commentary from the CoStar earnings call this morning regarding Domain and local rival REA Group.

“CoStar have also pointed to the ACCC investigation of REA as creating ‘an excellent opportunity for Domain to position itself as the more reasonable and stable service provider’,” he wrote.

The competition watchdog has an ongoing probe into REA, over price gouging concerns.

CoStar also commented on press speculation over who the next REA boss will be, with current chief executive Owen Wilson retiring this year.

Damian Eales, the current boss of US property listings platform Move has been reported among the front runners to lead REA — which Mr Raykovski says CoStar framed as a beneficial for it in both the US and Australia, “stating that ‘if that were to occur, it would mean two disruptive leadership changes in our favour in one move’,.”

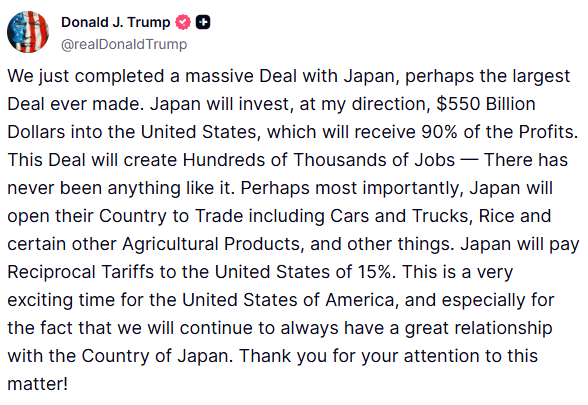

Japanese shares rally on trade deal

The Japanese market has rallied, but bonds slid, following the news US President Donald Trump has reached a trade deal with Tokyo.

The Nikkei is up 2.5 per cent, with car making giant Toyota up almost 11 per cent.

Benchmark 10-year Japanese government bonds futures tumbled to 137,59 yen, their lowest levels since March.

Japanese media are reporting specific duties on Japanese auto imports will be 15 per cent instead of 25 per cent.

The yen has been on a bit of a rollercoaster since the news, last up just 0.1 per cent to 146.48 US dollars.

2h agoWed 23 Jul 2025 at 1:29am

When will student debts be reduced?

Hello,

Emily Stewart here, taking over the blog for the afternoon.

I want to talk about student debts, often known as HECS or HELP debt.

Three million Aussies are likely to see an automatic reduction to their student loans later this year.

That’s because parliament is back and Labor is keen to get on with its election promise to reduce loans by 20 per cent.

The Coalition and Green appear likely to support it.

If it’s passed, the ATO will apply the reduction automatically, based on the value of your loan on June 1 2025.

If you happen to have repaid the last of your loan after that date, you may get a refund.

On the other hand, if you had already paid off your loan by June 1, there will be no refund and these changes do not benefit you.

For more on this, take a look at this article by Tom Crowley.

Japanese media cite sources saying autos will face 15 per cent tariff

Here’s the latest from financial news service Reuters, which explains why the share prices of Japanese car makers are going ballistic this morning.

Trump’s post made no mention of easing tariffs on Japanese motor vehicles, which account for more than a quarter of all the country’s exports to the United States and are subject to a 25% tariff. But NHK reported that the deal lowers the auto tariff to 15%, citing a Japanese government official.

“This is a very exciting time for the United States of America, and especially for the fact that we will continue to always have a great relationship with the Country of Japan,” Trump said on the social media platform.

Japan is the most significant of the clutch of deals Trump has struck so far, with two-way trade in goods between the two superpowers totaling nearly $US230 billion in 2024, and Japan running a trade surplus of nearly $US70 billion. Japan is the fifth-largest US trading partner in goods, US Census Bureau data show.

Autos are a huge part of U.S.-Japan trade, but is almost all one way to the U.S. from Japan, a fact that has long irked Trump. In 2024, the U.S. imported more than $US55 billion of vehicles and automotive parts while just over $US2 billion were sold into the Japanese market from the US.

Reuters could not immediately confirm the elements of the deal announced by Trump, and details were scant. The White House did not immediately respond to a request for additional details.

Speaking early on Wednesday in Tokyo, Japanese Prime Minister Shigeru Ishiba said he had received an initial report from his trade negotiator in Washington but declined to comment on the specifics of the negotiation.

A 15% tariff would be a lot better for them than 25%, and a potential competitive advantage if autos from other countries where still subject to the higher rate.

2h agoWed 23 Jul 2025 at 1:07am

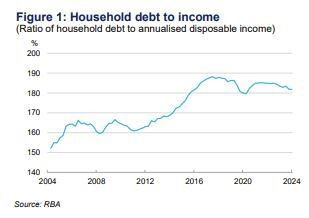

APRA points out ‘structural vulnerability’ in Australia’s economy

Hi team,

Just jumping in with some new insight from prudential regulator APRA.

I used the Freedom of Information (FOI) process to ask government agencies for their “incoming government brief” — the kind of “lay of the land” document presented to new ministers.

They’re generally heavily redacted, but provide insight into the challenges different sectors are facing.

Treasury’s brief for Jim Chalmers left in chapter headings it had meant to stay hidden, giving advice about the need to raise tax, cut spending and how the government’s housing target would “not be met”.

But I’m still receiving them.

Here’s some highlights from APRA, focused on our housing market:

“Australia’s households are highly indebted relative to most of their OECD peers, presenting the Australian economy with a structural vulnerability.

“A highly indebted household sector is more vulnerable to future shocks with implications for banks and wider system stability, particularly considering that over 60 per cent of Australian banks’ loan books are comprised of housing loans.

“Australia has the third-highest level of household debt among OECD countries at 180 per cent of incomes, with only Norway and Switzerland having higher levels of debt. Mortgage debt typically makes up the biggest portion of average household debt in Australia, with other contributors being car loans, credit cards and student loans.”

“While higher interest rates over the past three years have created stress for segments of borrowers, banks’ lending standards — supported by APRA’s serviceability assessment buffer — have cushioned against widespread defaults to date.

“The level of banks’ non-performing housing loans is similar to immediately prior to the pandemic, and well below arrears rates experienced domestically during the GFC.

“Total non-performing loans picked up slightly over 2024 from a low base alongside high debt servicing costs and cost of living pressures.

“However, with continued uncertainty in the economic outlook, high levels of household indebtedness, and the large proportion of housing loans on banks’ loan books, it is important that lending practices remain prudent.

“Weaker lending standards would amplify the impact of any future shocks, for borrowers and the wider economy. While these are not areas APRA is currently concerned about, they are being closely monitored, next to broader financial conditions, and the macroprudential settings will be adjusted if necessary.”

I’ve written a lot about the Treasury brief. Here’s my summation of the “others” and what they tell us.

3h agoWed 23 Jul 2025 at 12:59am

Japanese tariff deal a ‘mild upside surprise’

Financial news service Reuters has been gathering initial reactions to the apparent trade deal between the US and Japan from analysts around the region.

CHARU CHANANA, CHIEF INVESTMENT STRATEGIST, SAXO, SINGAPORE:

“Expectations for a breakthrough were low, so Trump’s announcement delivers a mild upside surprise — providing near-term relief for Japanese equities.

“The reduced 15% tariff, down from the previously flagged 25%, is meaningful and should lift sentiment in export-driven sectors, even if the fine print, especially on autos, remains critical. Markets will largely discount the $550 billion FDI headline as political theatre rather than a tradable catalyst.

“Strategically, the deal allows Japan to sidestep immediate tariff escalation, while Trump’s attention shifts elsewhere.”

HIROFUMI SUZUKI, CHIEF CURRENCY STRATEGIST, SMBC, TOKYO:

“This is good news for the Japanese economy.

“There are reports that automobiles will also be subject to a 15% tariff, which is clearly good news. I don’t think this alone will lead to a Bank of Japan rate hike next week, but the possibility of a rate hike between September and October has increased. This will create pressure to buy the yen.”

3h agoWed 23 Jul 2025 at 12:50am

Hyundai shares up 4.5pc

It seems optimism is contagious.

Even though we’ve seen no official confirmation yet that Japanese automakers will be excluded in any way from the existing 25% US tariffs on the sector, the share prices of Toyota, Honda and Nissan have been surging.

Not to be left out, Hyundai’s share price is also 4.5% higher in early trade.

Korea hasn’t even struck a trade deal with the US.

For that matter, I still haven’t seen anything from the Japanese government confirming Donald Trump’s Truth Social post about the apparent trade deal with that nation.

Seems like traders are keen to buy on the rumour, and deal with any potentially inconvenient facts later.

3h agoWed 23 Jul 2025 at 12:30am

Japanese auto stocks rally on tariff deal

In early trade, some of the biggest winners on the Japanes market have been automakers.

Toyota shares are up around 10%, while Honda shares are up 8.6% and Nissan shares are 7.6% higher.

Donald Trump’s social media post outlines a 15% ‘reciprocal’ tariff rate on Japan, but makes no mention specifically about auto tariffs.

The US currently has a 25% tariff in place on automotive imports, which overnight saw US-owned General Motors take a $US1.1 billion hit in earnings as it absorbs most of the tax rather than passing it on through higher prices.

The Wall Street Journal also reports that it has been unable to confirm whether Japanese automakers would be excepted from the 25% sector tariff, nor whether steel and aluminium producers would be carved out from the 50% tariff on those goods.

Then again, access to the Trump administration for the WSJ is probably not great at the moment!

3h agoWed 23 Jul 2025 at 12:24am

Market snapshot

Prices current around 10:20am AEST.

Live updates on the major ASX indices:

ASX 200 up a third of a per cent

The ASX 200 index is up around a third of a per cent in early trade as markets react to Donald Trump’s social media announcement of a trade deal with Japan.

Japan is one of Australia’s leading export destinations, particularly for raw materials and energy, so a deal that minimises damage to that nation’s large manufacturing sector is good news for Australia.

Big miners led the market higher early on, with BHP up 2%, Rio Tinto 2.7% higher and South32 up 2.5%.

Woodside Energy was up 1.2%, while Whitehaven and Yancoal jumped 3.9 and 1.9% respectively.

Aside from the flagged 15% general tariff rate on Japan, US Treasury secretary Scott Bessent last night made positive noises about the progress of trade discussions with Australia’s largest export destination, China.

Overall, by 10:15am AEST, the ASX 200 index was up 0.4% to 8,711 points.

Japanese shares jump 1.2 per cent on open after US trade deal announcement

Tokyo’s Nikkei jumped 1.2% at the opening of trade, which came just minutes after Donald Trump announced on Truth Social that he had struck a trade deal with the nation.

Automakers are posting particularly strong gains, in the hope of a better deal for the sector than the 25% tariffs currently in place.

However, details of the trade deal are scant and consist mainly of a Truth Social post and unattributed White House sources talking off the record to news agencies.

We’ll bring you more detail as we can confirm it.

4h agoTue 22 Jul 2025 at 11:56pm

Trump announces trade deal with Japan on Truth Social

As is the president’s wont, he announced the apparent trade deal with Japan on his Truth Social platform.

Aside from the 15% tariff rate, Trump is very excited about $US550 billion of investment into the US, apparently at his direction.