(Bloomberg) — The global copper market is reeling from its biggest shock yet in a year of policy surprises, violent price swings and unprecedented trade dislocation.

Most Read from Bloomberg

US President Donald Trump went ahead with 50% tariffs on copper imports but exempted refined metals, which are the mainstay of international trading. The move triggered a record plunge for US prices after a period of fat profits for traders who hurried metal to America before the levies kicked in. A large premium for New York futures over London evaporated.

“The blow-out in the CME-LME spread has been touted as one of the most profitable commodity trades in modern history,” Daniel Ghali of TD Securities Inc. wrote in a note. “In a single session, the White House’s proclamation on copper tariffs annihilated the spread and catalyzed CME copper’s largest intraday fall on record.”

Copper futures on Comex in New York fell by 22% as traders recalibrated the value of metal in the US versus the rest of the world. With prices on the London Metal Exchange falling by a much smaller margin, Comex front-month futures swung to a discount against the LME benchmark from a premium of more than 30% a week ago.

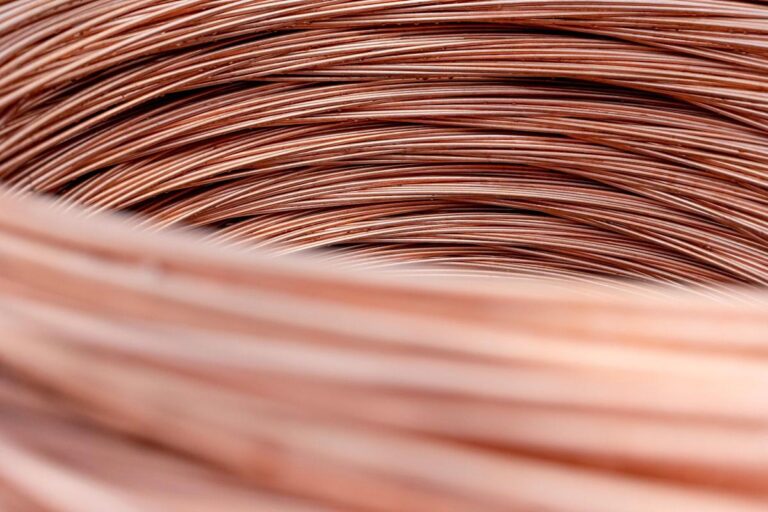

The decision to exempt refined copper will roil global trade of the metal, which plays a crucial role in the world economy thanks to its use in electrical wiring. Massive volumes now sit in US warehouses, and there’s already speculation about potential re-exports.

Copper Rush

When Trump first flagged the likelihood of tariffs early this year, US prices soared relative to the rest of the world, and major traders scurried to get metal to American ports in a trade that some industry veterans said was the biggest of their lifetimes.

Early in July, Trump said the tariff would be a higher-than-expected 50%, ratcheting up the potential rewards. That spurred a last-minute rush, with at least one copper-laden ship heading for Hawaii before the end of this month.

“This has badly deviated from market expectations,” said Li Xuezhi, head of research at Chaos Ternary Futures Co., a unit of a commodities hedge fund in Shanghai. Those betting on higher US prices have “wasted all their efforts,” and global copper flows will return to normal, he said.

Analysts at Goldman Sachs Group Inc. said they were “surprised” by the exemptions but added that they don’t see it changing market fundamentals and don’t expect large-scale re-exports from the US. Comex prices should stay at least on a par with LME prices, they said.

Story Continues