In this installment of the ‘Agronometrics In Charts’ series, we take a look at the U.S. berry market. Each week, the series looks at a different horticultural commodity, focusing on a specific origin or topic, visualizing the market factors that are driving change.

As the 2025 domestic berry season pushes through its summer peak, the U.S. market is seeing a mixed performance from strawberries, blueberries, and raspberries. The newly published Fruit and Tree Nuts Outlook from the USDA paints a nuanced picture of how the season is unfolding.

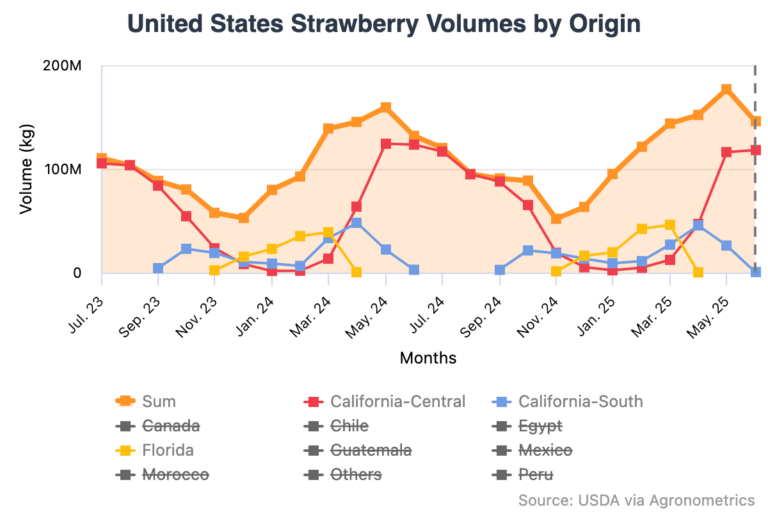

Strawberries: There’s still hope in California

Domestically grown strawberries are available year-round, with Florida supplying the winter market and California dominating the summer peak. In 2025, early-season shipments from Florida were higher than a year ago, giving the market a strong initial boost. However, by mid-July, total domestic strawberry shipments had fallen below 2024 levels, though they remained above those recorded in 2023.

Central and Southern California, which typically account for roughly half the annual strawberry volume by early July, have seen lower shipments year-to-date. Still, industry reports from Santa Maria and the Watsonville/Salinas areas suggest excellent fruit quality, thanks to favorable weather conditions. This could help balance the slower shipment pace with strong retail appeal.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

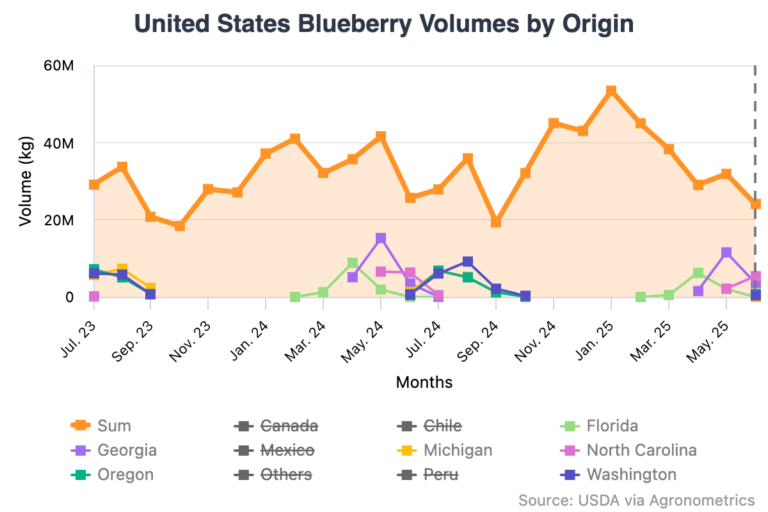

Blueberries: Delayed harvests due to cool weather

The U.S. blueberry season, which runs from April through August, also faces shipment slowdowns this year. Domestic blueberry volumes through mid-July were below 2024 levels, driven largely by setbacks in the Southeast.

Georgia and Florida, key early-season states experienced cooler temperatures and untimely rainfall that delayed harvests and trimmed yields. In contrast, California’s blueberry season played out as expected: Southern California’s Oxnard region peaked in March and April, while Central Valley growers hit peak volume in May and early June.

Shipments from the Pacific Northwest began in June, with early volumes down in Oregon and Washington. Nonetheless, growers in the region report excellent fruit quality thanks to good spring pollination conditions and mild weather.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

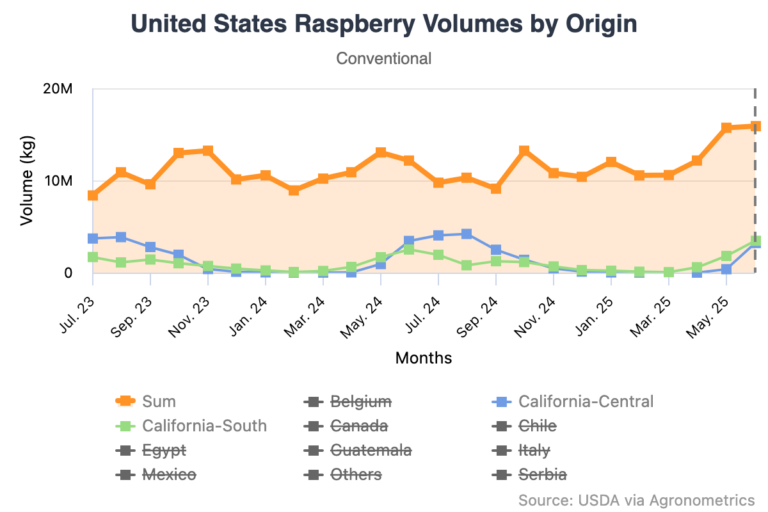

Raspberries: A fan favorite that’s going strong

The 2025 raspberry season is tracking ahead of 2024 in terms of shipment volume. Most fresh market raspberry activity occurs from May through October, peaking in June and July. As of mid-July, USDA reports indicate that domestic raspberry shipments were up over the same period last year, driven by higher output from Southern California.

California remains the epicenter of U.S. raspberry production and ships fruit year-round, with its highest volumes between June and September. Growers report high-quality berries so far this season, contributing to strong retail presentation and consumer satisfaction.

Cold storage volumes for processed raspberries typically peak during July and August. About two-thirds of these berries are stored as individually quick frozen (IQF) products, which fetch a premium over lower-value formats like juice concentrates or bulk-packed fruit.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The 2025 berry season is defined by contrasts. Weather remains a key swing factor, boosting quality in the West while hampering volume in the Southeast. Shipments for strawberries and blueberries are lagging 2024 benchmarks, while raspberries are trending higher.

As summer continues, growers and retailers alike will be watching late-season weather and consumer demand to determine how the market ultimately closes. For now, high fruit quality is the season’s saving grace, offering reassurance amid uneven volumes.