Smart Marketing in Uncertain Times

Diesel discussions dominate energy headlines

A convergence of bullish factors turbocharged the price rally

Analysts remained concerned about Q4 trend reversals

Natural gas futures price volatility declines, offers opportunities

Sincerely,

David Thompson, CMT

Executive Vice President

Powerhouse

(202) 333-5380

The Matrix

Diesel fuel – its price, its refining margin, its supply & demand, its trade flow – everything about diesel has been in the spotlight lately. Since April, when fears of global economic weakness drove diesel futures prices to their recent lows, the prompt month contact has rallied more than 25%. The convergence of several factors created the move higher.

European diesel prices soared as power outages knocked Spanish refineries offline

A 150kb/d refinery shuttered in England and a 200kb/d refinery in Israel was damaged during the 12-day war with Iran

U.S. refineries throttled down for planned maintenance

Simultaneously, the supply of heavy and medium grades of crude oil with their higher diesel yields was curtailed by sanctions on Venezuela and wildfires in Canada.

Additionally, U.S. distillate demand is running roughly 5% ahead so far in 2025 than a year ago. Consumption is also increasing on a year-over-year levels in China and India.

Finally, overall market sentiment has improved as the Trump Administration has announced frameworks for deals with major trading partners, removing some degree of uncertainty.

The uncertainty alluded to in this week’s title comes from the inevitable market reaction.

U.S. refiners are capturing historically high crack spread margins by running their facilities at a 95.5% utilization rate.

The price of diesel in Europe is high enough for French energy major to pay the cost of cleaning a VLCC that previously had carried crude oil and re-tasking it for the purpose of bringing diesel from Saudi Arabia.

OPEC+ is likely to announce another large production increase in September.

As noted in our previous edition, the seasonal peak in oil demand is now typically occurring in the 3rd quarter. Many analysts forecast an oversupply of crude oil by the end of the year, potentially reversing the current bullishness in the market.

The price rally is also challenging to the marketing efforts of heating oil dealers and diesel jobbers who haven’t yet established price protection. At the end of April, diesel futures prices were 45 cents per gallon cheaper than the year before. This makes any marketing effort much easier. As July nears its close, diesel futures are now nearly 10

cents per gallon more expensive than year ago levels. Backwardation has roared back into the market and a sales tailwind has seemingly turned into a headwind.

Savvy marketers tack into these headwinds to continue moving forward. Backwardation can make multi-month price cap programs more attractive. When prices are volatile, customers value the combination of upside protection with the ability to have a lower

price if the market moves lower. Times of uncertainty are a great time to reach out to customers and set yourself from the competition.

Supply/Demand Balances

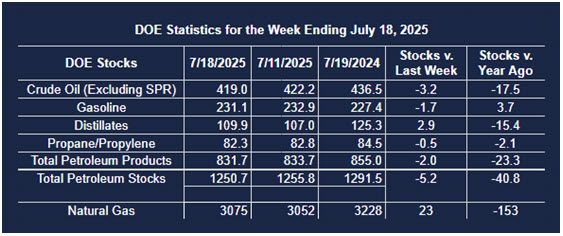

Supply/demand data in the United States for the week ended July 18, 2025, were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased (⬇) 5.2 million barrels to 1.2507 billion barrels during the week ended July 18th, 2025.

Commercial crude oil supplies in the United States were lower (⬇) by 3.2 million barrels from the previous report week to 419.0 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.7 million barrels to 8.7 million barrels

PADD 2: Up (⬆) 1.2 million barrels to 102.7 million barrels

PADD 3: Down (⬇) 1.0 million barrels to 237.8 million barrels

PADD 4: Down (⬇) 0.8 million barrels to 23.1 million barrels

PADD 5: Down (⬇) 1.9 million barrels to 46.7 million barrels

Cushing, Oklahoma, inventories were up (⬆) 0.5 million barrels to 21.9 million barrels.

Domestic crude production decreased (⬇) 102,000 barrels per day from the previous report at 13.273 million barrels per day.

Crude oil imports averaged 5.976 million barrels per day, a daily decrease (⬇) of 403,000 barrels. Exports increased (⬆) 337,000 barrels daily to 3.855 million barrels per day.

Refineries used 95.5% of capacity; an increase (⬆) of 1.6% from the previous report week.

Crude oil inputs to refineries increased (⬆) 87,000 barrels daily; there were 16.936 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 224,000 barrels daily to 17.272 million barrels daily.

Total petroleum product inventories decreased (⬇) by 1.9 million barrels from the previous report week, down to 831.7 million barrels.

Total product demand increased (⬆) 2,586,000 barrels daily to 21.770 million barrels per day.

Gasoline stocks decreased (⬇) 1.7 million barrels from the previous report week; total stocks are 231.1 million barrels.

Demand for gasoline increased (⬆) 478,000 barrels per day to 8.967 million barrels per day.

Distillate fuel oil stocks increased (⬆) 2.9 million barrels from the previous report week; distillate stocks are at 109.9 million barrels. EIA reported national distillate demand at 3.343 million barrels per day during the report week, a decrease (⬇) of 79,000 barrels daily.

Propane stocks fell (⬇) 0.5 million barrels from the previous report to 82.3 million barrels. The report estimated current demand at 942,000 barrels per day, an increase (⬆) of 505,000 barrels daily from the previous report week.

Natural Gas

The EIA reports that the average historical volatility for front-month natural gas futures prices has declined from 81% in Q4 of 2024 to 69% in mid-2025. A drop in price volatility will likely result in lower price for natural gas options. As planning turns to the winter months, this is a welcome development for options buyers.

According to the EIA:

Net injections into storage totaled 23 Bcf for the week ended July 18, compared with the five-year (2020–24) average net injections of 30 Bcf and last year’s net injections of 20 Bcf during the same week. Working natural gas stocks totaled 3,075 Bcf, which is 171 Bcf (6%) more than the five-year average and 153 Bcf (5%) lower than last year at this time.

According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 22 Bcf to 41 Bcf, with a median estimate of 28 Bcf.

The average rate of injections into storage is 22% higher than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 8.1 Bcf/d for the remainder of the refill season, the total inventory would be 3,924 Bcf on October 31, which is 171 Bcf higher than the five-year average of 3,753 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2025 Powerhouse Brokers, LLC, All rights reserved