Indian stock market: The domestic equity market indices, Sensex and Nifty 50, are expected to open lower on Friday, following weak global market cues after US President Donald Trump slapped several countries with steep tariffs.

Asian markets declined, while the US stock market ended lower overnight as investors reacted to Trump tariffs and corporate earnings.

On Thursday, the Indian stock market ended lower amid high volatility, after US tariffs on Indian goods dampened investor sentiment.

The Sensex declined 296.28 points, or 0.36%, to close at 81,185.58, while the Nifty 50 settled 86.70 points, or 0.35%, lower at 24,768.35.

“As the new series begins, the market is likely to consolidate, but global developments and corporate earnings will continue to drive volatility. We maintain our cautious stance and recommend a stock-specific approach, given the mixed trends across sectors. Traders should also avoid averaging down on loss-making positions,” said Ajit Mishra – SVP, Research, Religare Broking Ltd.

Here are key global market cues for Sensex today:

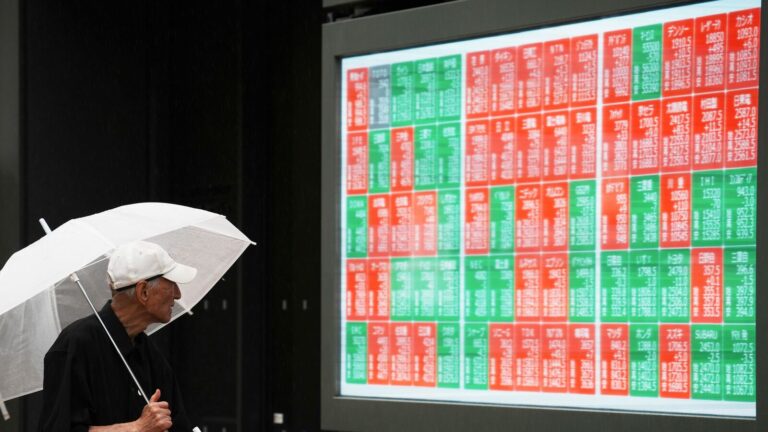

Asian Markets

Asian shares fell on Friday after the US slapped dozens of trading partners with steep tariffs. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%, bringing the total loss this week to 1.5%.

Japan’s Nikkei 225 fell 0.71%, while the Topix index was flat. South Korea’s Kospi index plunged 3.45%, while the Kosdaq declined by 2%. Hong Kong’s Hang Seng index futures indicated a weaker opening.

Gift Nifty Today

Gift Nifty was trading around 24,725 level, a discount of nearly 146 points from the Nifty futures’ previous close, indicating a gap-down start for the Indian stock market indices.

Wall Street

US stock market ended lower on Thursday following the latest round of corporate earnings and economic data.

The Dow Jones Industrial Average dropped 330.30 points, or 0.74%, to 44,130.98, while the S&P 500 fell 23.51 points, or 0.37%, to 6,339.39. The Nasdaq Composite closed 7.23 points, or 0.03%, lower at 21,122.45. For the month, the S&P 500 gained 2.17%, the Nasdaq rose 3.7%, and the Dow climbed 0.08%.

Microsoft share price rallied 3.5%, Meta Platforms shares surged 11.3% to close at a record high, while Broadcom stock declined 2.9% and Nvidia stock price fell 0.78%. In extended trade, Apple share price was up 2.4%% while Amazon shares shed 2.6%.

Trump Tariffs

US President Donald Trump signed a sweeping executive order on Thursday imposing reciprocal tariffs ranging from 10% to 41% on American imports from a wide array of countries. These include a 35% duty on many goods from Canada, 50% for Brazil, 25% for India, 20% for Taiwan and 39% for Switzerland.

US Inflation

US inflation increased in June as tariffs boosted prices for imported goods. The personal consumption expenditures (PCE) price index rose 0.3% last month after an upwardly revised 0.2% gain in May. Economists polled by Reuters had forecast the PCE price index climbing 0.3% following a previously reported 0.1% rise in May. In the 12 months through June, the PCE price index advanced 2.6% after increasing 2.4% in May.

US Jobless Claims

The number of Americans filing new applications for unemployment benefits increased marginally last week. Initial claims for state unemployment benefits rose 1,000 to a seasonally adjusted 218,000 for the week ended July 26. Economists polled by Reuters had forecast 224,000 claims for the latest week.

Apple Q3 Results

Apple reported $94.04 billion in revenue for its fiscal third quarter ended on June 28, up nearly 10% from a year earlier and beating analyst expectations of $89.54 billion, according to LSEG data, Reuters reported. Its earnings per share of $1.57 topped expectations for $1.43 per share. Sales of iPhones were up 13.5% to $44.58 billion, beating analyst expectations of $40.22 billion.

Apple forecast revenue for the current quarter ending in September in the “mid to high single digits,” which would exceed the 3.27% growth to $98.04 billion that analysts expected, according to LSEG data. Apple share price was up 2.4% in after-hours trading.

Japan Manufacturing PMI

Japan’s manufacturing activity shrank in July after briefly stabilising in the previous month. The S&P Global Japan manufacturing purchasing managers’ index (PMI) fell to 48.9 in July from 50.1 in June, dropping below the 50.0 threshold that separates growth from contraction. The PMI was little changed from the flash reading of 48.8.

Crude Oil Prices

Crude oil prices were little changed after falling more than 1% in the previous session as traders digested the impact of new higher US tariffs. Brent crude futures rose 0.06% to $71.74 a barrel, while US West Texas Intermediate crude rose 0.01% to $69.27.

US Dollar

The dollar headed for its best week in almost three years against its major peers. The US dollar index – which measures the currency against a basket of six major peers including the euro, yen, Swiss franc and Canada’s loonie – pushed as high as 100.10 overnight, topping 100 for the first time since May 29, Reuters reported. The yen changed hands at 150.64 per dollar, and the euro hovered around $1.1420.

(With inputs from Reuters)

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.