Debanking is back in the spotlight this week after President Trump said Tuesday that the country’s two largest US banks, JPMorgan Chase (JPM) and Bank of America (BAC), denied him as a customer.

“The banks discriminated against me very badly, and I was very good to the banks,” Trump said on CNBC’s “Squawk Box,” adding that “they discriminate against many conservatives.”

For years, Republicans have claimed that US banks have denied accounts to certain customers for political reasons as have some Democrats. Crypto companies have warned more recently that they weren’t permitted to get banking services during the Biden era.

“I had hundreds of millions. I had many, many accounts loaded up with cash. I was loaded up with cash, and they told me, ‘I’m sorry, sir, we can’t have you. You have 20 days to get out,'” Trump said of his experience losing bank accounts with JPMorgan Chase.

The president said he then went to Bank of America “to deposit a billion dollars plus” and was similarly denied.

“He said, ‘We can’t do it,'” Trump told “Squawk Box” in reference to Bank of America CEO Brian Moynihan. The president pointed to pressure on banks from Washington, D.C., regulators as a key reason for why he and others were denied banking services.

“I ended up going to small banks all over the place,” Trump added.

The president’s comments came in response to a Wall Street Journal report late Monday stating that the White House is preparing to draft a related executive order around debanking that would fine banks found discriminating against customers on political grounds.

Bank of America did not offer a response to Trump’s comments.

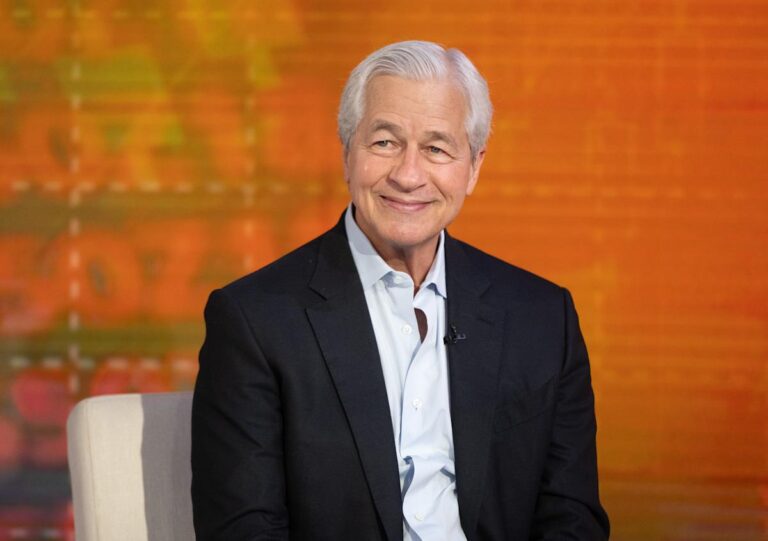

“We don’t close accounts for political reasons, and we agree with President Trump that regulatory change is desperately needed. We commend the White House for addressing this issue and look forward to working with them to get this right,” a JPMorgan spokesperson said in emailed comments.

Both of these giant lenders and their CEOs have denied debanking customers on political grounds.

Learn more about high-yield savings accounts, money market accounts, and CD accounts.

Trump first brought visibility to the debanking issue back in January when he confronted Bank of America’s Brian Moynihan about it during a live Q&A at the World Economic Forum in Davos, Switzerland.

“I hope you start opening your bank to conservatives,” Trump told Moynihan. The president also appeared to include JPMorgan Chase CEO Jame Dimon in his confrontation. “I don’t know if the regulators mandated that because of Biden or what, but you and Jamie and everybody else, I hope you open your banks to conservatives, because what you’re doing is wrong,” Trump added.

Story Continues