Created on August 10, 2025

Gold markets have been bullish again during the course of the week as we broke above the $3500 level. The $3500 level has been like a ceiling in this market for some time and breaking above there obviously will attract a lot of headlines. However, it is probably worth noting that the Friday session is rolling back over so I don’t know that we have the momentum to truly clear this area quite yet. Regardless, this remains a “buy on the dips” type of market. I have no interest in shorting this market although I fully anticipate that it could pull back just a bit.

The NASDAQ 100 rallied during the course of the week, breaking above the 23,250 level again. We have essentially wiped out 80% or so of the losses from the previous week, so it does look like we might be either getting ready to consolidate in an area right around here, or perhaps we are trying to turn around and break above the top of the candlestick from the previous week. I think it does make a certain amount of sense that we see consolidation in the short term, mainly due to the fact that it is August, and the volume suddenly disappears as traders are more worried about vacation. Regardless, the one thing I won’t do is try to short this market.

The Euro rallied during the week, but it is worth noting that we are getting a little bit softer over the last couple of weeks, as we continue to just hang out in the 1.16 level. We are still in the midst of consolidation, so I’m not ready to make some big proclamation here, but I would say that if we broke down below the bottom of the candlestick from the previous week, meaning the 1.14 level, that would be very ugly for the euro. On the other hand, if we can break above the 1.18 level, then perhaps we can go much higher.

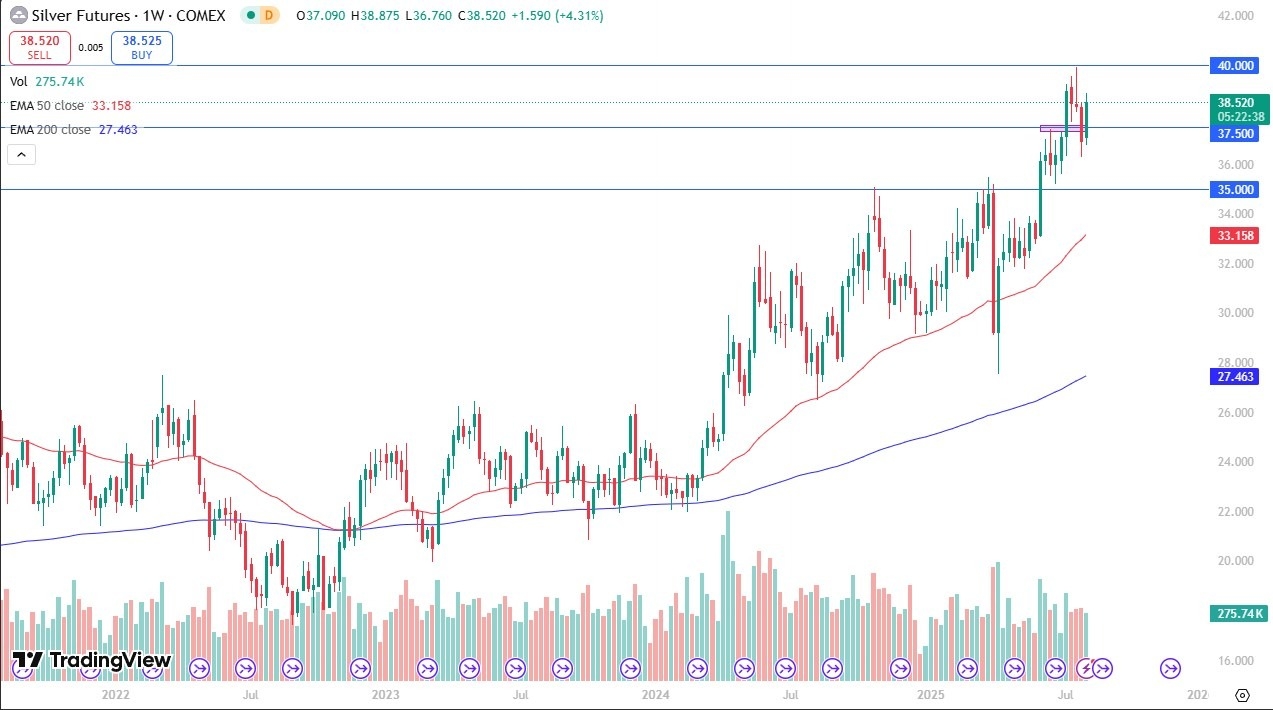

Silver has been very bullish during the course of the week as we have cleared the $37.50 level again. The $37.50 has been important multiple times on the daily chart and has offered both support and resistance. Because of this, I’m watching that very closely as the market will continue to be very noisy, but I think given enough time we will probably revisit the $40 level. If we can break above the $40 level, then it’s likely that silver will continue to go much higher were to turn around and break down below the $36.50 level, then silver may have some correction ahead.

The British pound has rallied pretty significantly during the trading week as the 1.3250 level has offered a bit of a floor. Ultimately, the market looks as if it will try to get to the 1.3550 level, an area that’s been resistant. On the other hand, if we were to break down below the 1.3250 level, then it’s likely that the British pound could drop down to the 50 Week EMA. After that, we could be looking at a move down to the 1.2850 level where the 200 Week EMA currently resides.

The British pound has rallied pretty significantly during the trading week as the 1.3250 level has offered a bit of a floor. Ultimately, the market looks as if it will try to get to the 1.3550 level, an area that’s been resistant. On the other hand, if we were to break down below the 1.3250 level, then it’s likely that the British pound could drop down to the 50 Week EMA. After that, we could be looking at a move down to the 1.2850 level where the 200 Week EMA currently resides.

The US dollar initially tried to rally against the Mexican peso during the week, but the 19 MXN level has offered a bit of a ceiling. As we close the week, it looks like we are sitting just above the 18.50 MXN level, which opens up the move down to the 17.50 MXN level. Ultimately, this is a pair that could go as low as 16.50 MXN, but it will take some time to get down there. Keep in mind that the interest rate differential continues to favor the Mexican peso, and I think in the environment where the Mexicans were given 90 more days as an extension to tariffs, it will start to feel a bit better about the Mexican economy overall.

The Australian dollar has been bullish during the course of the week, but still finds itself hanging around the 0.6550 level, a place that’s been like a magnet for price all summer. If we turn around a break down below the bottom of the candlestick from the previous week, then it’s possible that the Australian dollar could drop down to the 0.62 level. On the other hand, if we can somehow break above the 0.66 level, then the Australian dollar may have a real shot at going higher. Ultimately, this is a market that has been very choppy and somewhat sideways.

Bitcoin has gone back and forth during the course of the week, after initially pulling back. That being said, we still see the $120,000 level above is a significant barrier, and if we can break above that level, then it’s likely that Bitcoin will continue to go much higher, perhaps reaching the $130,000 level next, as this market does like to move in $10,000 increments. At this point, it looks like the $110,000 level is a bit of a floor.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.