The U.S. stock market is experiencing a surge, with the S&P 500 and Nasdaq Composite reaching all-time highs following a favorable inflation report that has bolstered investor optimism about potential interest rate cuts by the Federal Reserve. Amid this backdrop of strong market performance, discovering stocks that are underappreciated yet poised for growth can be particularly rewarding, as these “undiscovered gems” may offer unique opportunities in an environment where major indices continue to climb.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingFirst Bancorp75.89%1.93%-1.42%★★★★★★ASA Gold and Precious MetalsNA12.79%-0.59%★★★★★★Sound Financial Bancorp34.70%2.11%-11.08%★★★★★★FineMark Holdings115.14%2.22%-28.34%★★★★★★FRMO0.09%44.64%49.91%★★★★★☆Rich Sparkle Holdings26.73%-6.13%1.75%★★★★★☆Gulf Island Fabrication20.48%3.25%43.31%★★★★★☆Reitar Logtech Holdings31.39%231.46%41.38%★★★★☆☆Solesence91.26%23.30%4.70%★★★★☆☆Linkhome Holdings1.64%391.96%428.09%★★★★☆☆

Click here to see the full list of 286 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Value Rating: ★★★★★☆

Overview: International General Insurance Holdings Ltd. is a company with a market cap of approximately $1.03 billion, focused on providing specialty insurance and reinsurance products across various sectors globally.

Operations: IGI generates revenue primarily from its specialty insurance segments, with Specialty Short-Tail contributing $247.32 million and Specialty Long-Tail adding $134.10 million. The Reinsurance segment accounts for $93.12 million in revenue, while a segment adjustment of $55.88 million is noted in the financials.

International General Insurance Holdings stands out with its debt-free status and strong earnings growth of 13.2% over the past year, surpassing the insurance industry’s 8.7%. The company trades at a notable 20.8% below its estimated fair value, offering an attractive entry point for investors. Recently, IGI doubled its quarterly dividend to $0.05 per share, signaling confidence in future cash flows. With strategic expansions into MENA and Asia-Pacific regions focusing on infrastructure and engineering sectors, IGI aims to diversify revenue streams while maintaining high-quality earnings through disciplined underwriting practices despite potential risks like currency fluctuations and competition pressures.

Simply Wall St Value Rating: ★★★★★★

Overview: NetScout Systems, Inc. offers service assurance and cybersecurity solutions to safeguard digital business services globally, with a market cap of approximately $1.55 billion.

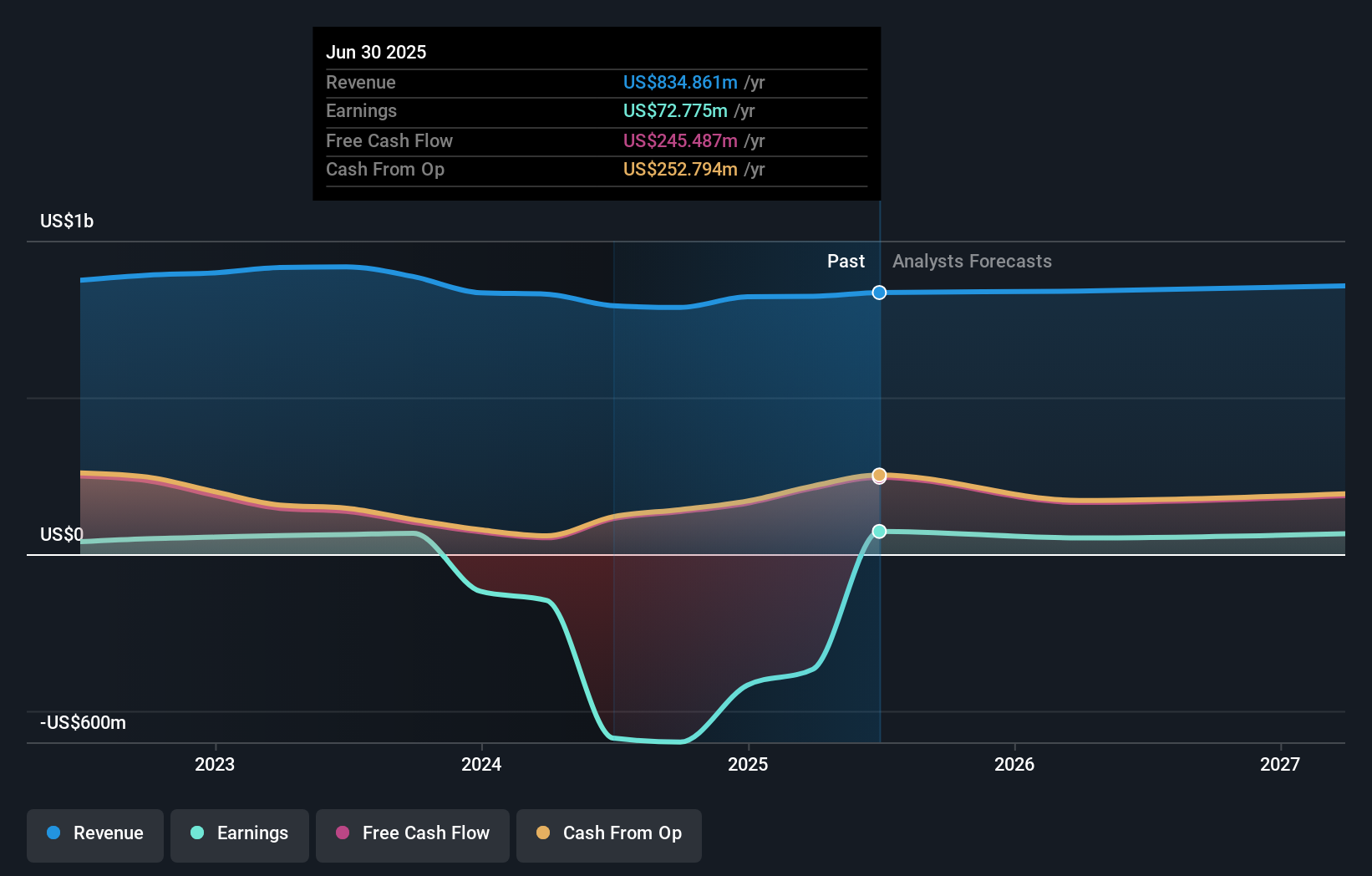

Operations: NetScout’s revenue is primarily derived from its Computer Networks segment, totaling approximately $834.86 million. The company has a market capitalization of about $1.55 billion.

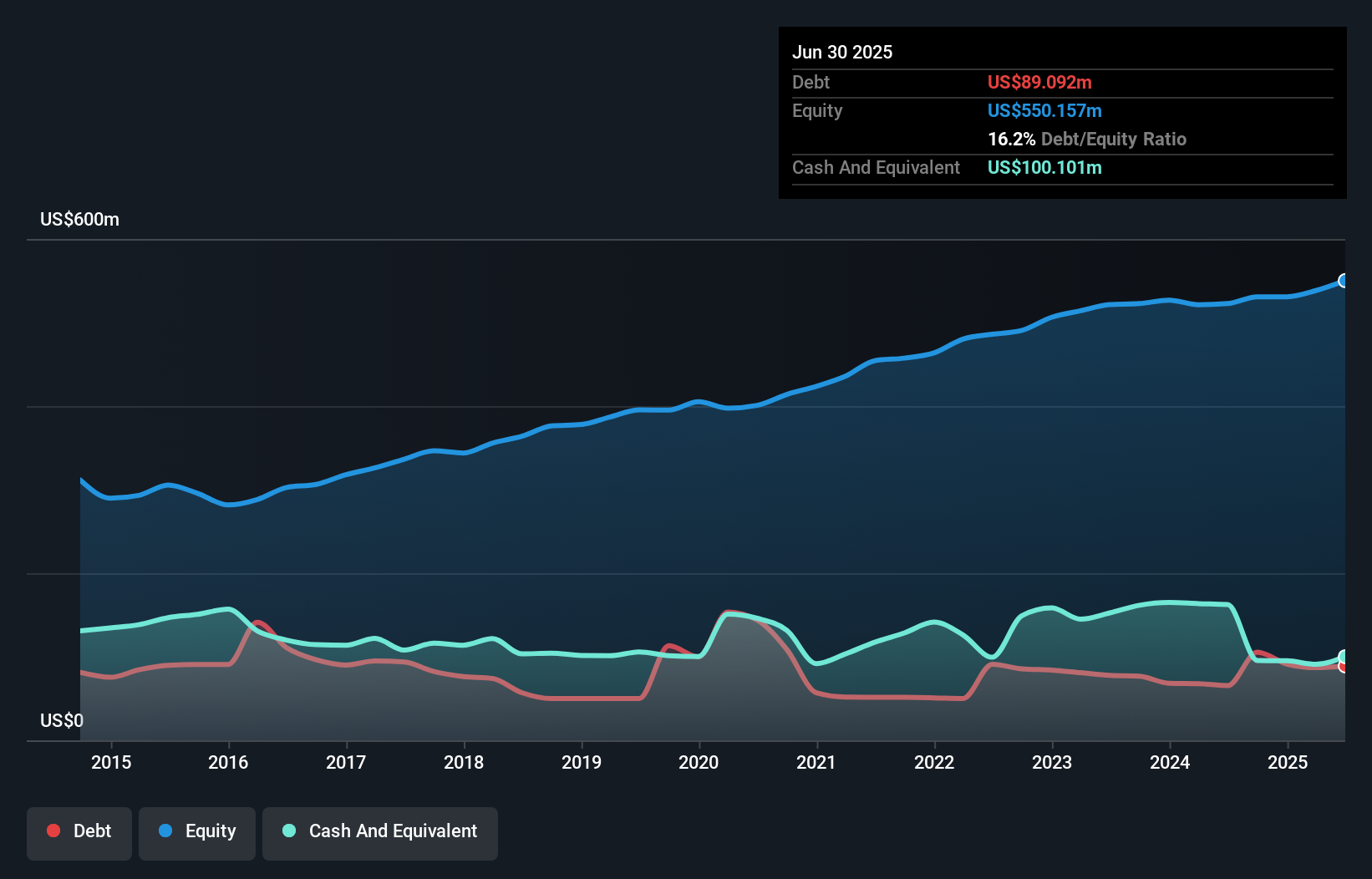

NetScout Systems, a player in the tech space, has shown resilience with no debt on its books, contrasting its past debt-to-equity ratio of 23.3%. Recently profitable and trading at 63% below estimated fair value, it offers an intriguing proposition for investors. The company repurchased over 2.7 million shares for $56.92 million since May 2022, potentially boosting earnings per share. Despite challenges like reliance on key customers and revenue volatility due to order timing shifts, NetScout’s AI-driven cybersecurity enhancements could drive future growth amid digital transformations across industries.

Simply Wall St Value Rating: ★★★★★★

Overview: CTS Corporation is engaged in the design, manufacturing, and sale of sensors, connectivity components, and actuators across North America, Europe, and Asia with a market capitalization of approximately $1.15 billion.

Operations: CTS generates revenue primarily from electronic components and parts, totaling $520.94 million. The company’s net profit margin reflects its profitability in relation to total revenue.

CTS Corporation is making waves with its strategic push into high-growth sectors like medical and industrial markets, leveraging smart technologies and automation. The firm’s earnings growth of 16.4% outpaced the electronics industry, which saw a -2.3% change, highlighting its strong performance. Trading at 3.6% below estimated fair value, CTS offers good relative value compared to peers. The debt-to-equity ratio improved from 35.9% to 16.2% over five years, indicating prudent financial management. Recent buybacks of 1,353,005 shares for $107.83 million reflect confidence in future prospects amidst challenges such as weak transportation sales and global trade tensions.

Where To Now?

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if NetScout Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com