As the U.S. stock market grapples with mixed signals from recent inflation data and fluctuating interest rate expectations, small-cap stocks have become a focal point for investors seeking untapped potential amidst broader market volatility. In this dynamic environment, identifying promising opportunities often involves looking beyond the surface to discover lesser-known companies that demonstrate resilience, innovative growth strategies, or niche market leadership.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingFirst Bancorp75.89%1.93%-1.42%★★★★★★ASA Gold and Precious MetalsNA12.79%-0.59%★★★★★★Sound Financial Bancorp34.70%2.11%-11.08%★★★★★★FineMark Holdings115.14%2.22%-28.34%★★★★★★Senstar TechnologiesNA-20.82%14.32%★★★★★★Linkhome Holdings7.03%215.05%239.56%★★★★★☆Rich Sparkle Holdings26.73%-6.13%1.75%★★★★★☆Gulf Island Fabrication20.48%3.25%43.31%★★★★★☆Reitar Logtech Holdings31.39%231.46%41.38%★★★★☆☆Solesence91.26%23.30%4.70%★★★★☆☆

Click here to see the full list of 289 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Ategrity Specialty Insurance Company Holdings, with a market cap of $998.83 million, offers excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States through its subsidiaries.

Operations: ASIC generates revenue primarily from its insurance business, reporting $378.30 million in this segment. The company’s financial performance is influenced by its ability to manage underwriting costs and claims expenses effectively, which impacts its net profit margin.

Ategrity Specialty Insurance Company Holdings, a small player in the insurance sector, recently completed an IPO raising US$113.33 million, offering shares at US$17 each with a slight discount. Its earnings growth of 112% over the past year significantly outpaced the industry average of 7%. The company is trading at 45% below its estimated fair value and boasts high-quality earnings with no debt concerns. With forecasts predicting annual earnings growth of 32%, Ategrity seems poised for potential expansion in its market niche while maintaining financial stability through positive free cash flow.

Simply Wall St Value Rating: ★★★★★★

Overview: OFG Bancorp is a financial holding company offering various banking and financial services in the United States, with a market capitalization of approximately $1.93 billion.

Operations: The company generates revenue primarily from its Banking segment at $467.80 million, followed by Treasury at $114.33 million, and Wealth Management at $37.34 million.

OFG Bancorp, a financial holding company with a significant presence in Puerto Rico, is drawing attention due to its strategic digital banking expansion. With total assets of US$12.2 billion and equity of US$1.3 billion, it has robust fundamentals supported by core deposits totaling US$10.1 billion and loans amounting to US$8 billion. A net interest margin of 5.6% underscores its profitability potential, while an allowance for bad loans at 1.2% indicates prudent risk management. Despite these strengths, the company’s earnings growth of 20% over five years contrasts with just 1% in the past year compared to industry peers at nearly 12%, highlighting competitive pressures and economic exposure risks linked to Puerto Rico’s market dynamics.

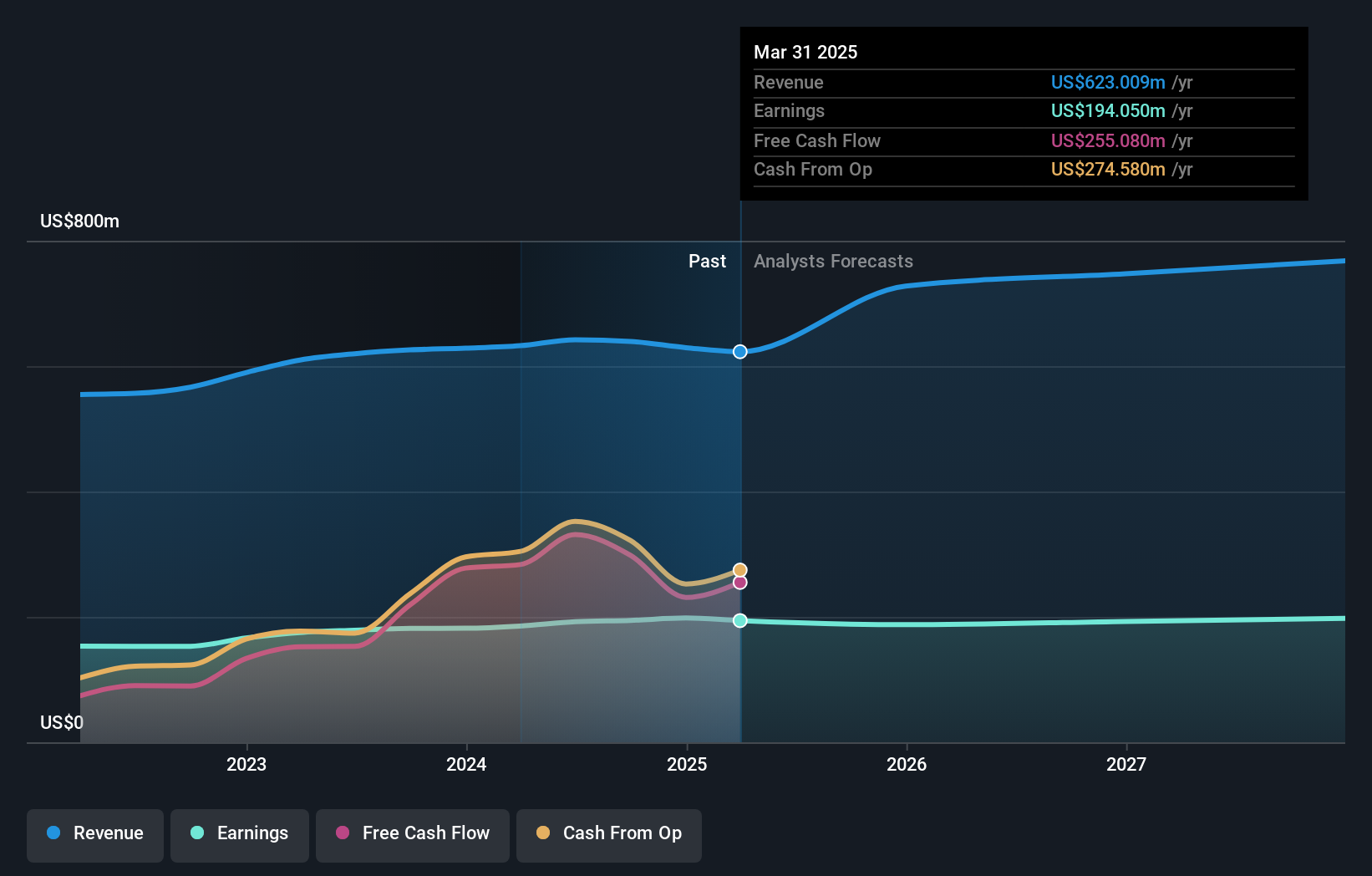

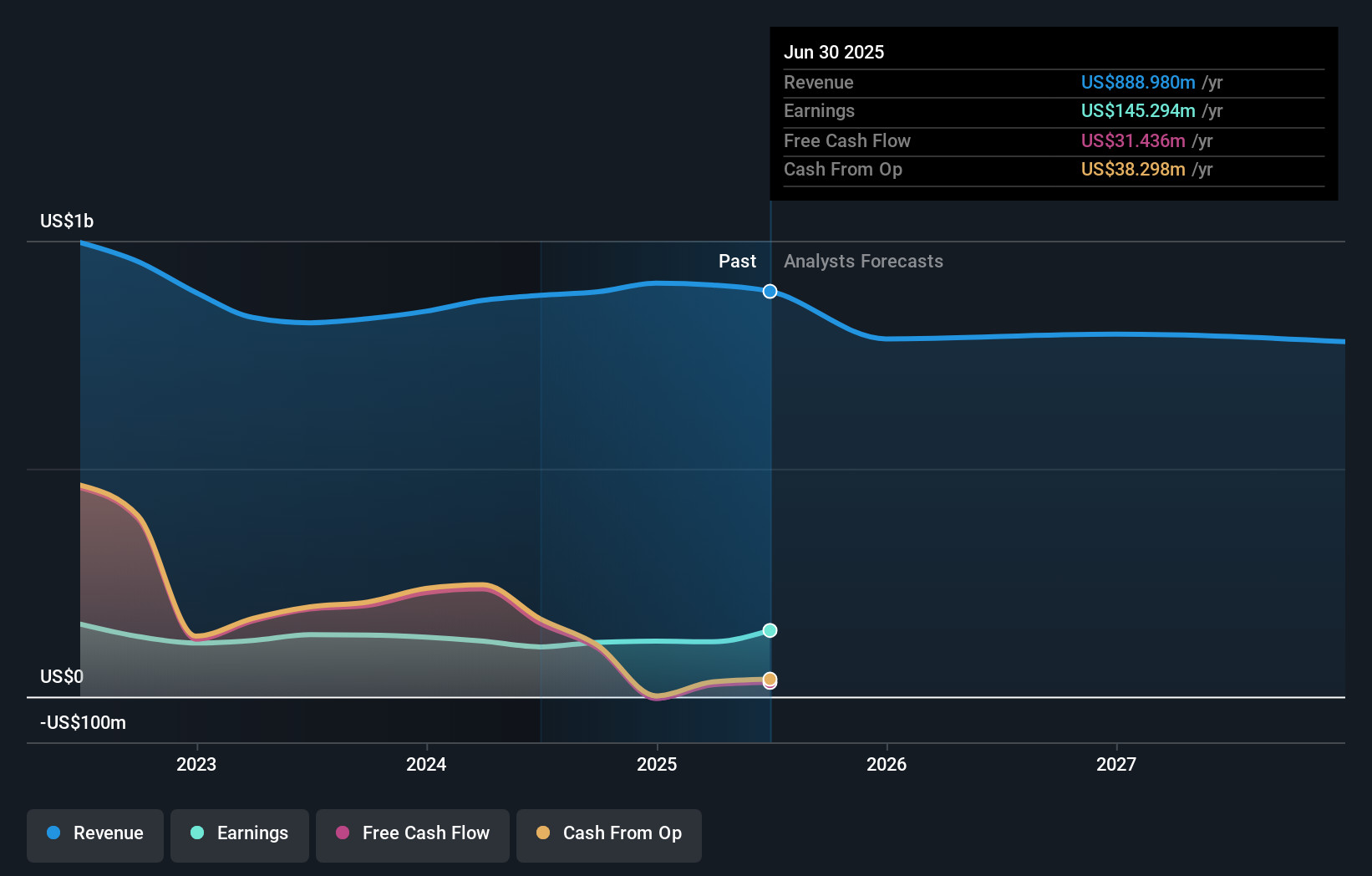

Simply Wall St Value Rating: ★★★★☆☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market capitalization of approximately $1.34 billion.

Operations: Virtus generates revenue primarily through its asset management services, amounting to $888.98 million. The company’s net profit margin is a key financial metric to consider when evaluating its profitability.

Virtus Investment Partners, a nimble player in the investment management sector, has showcased impressive financial resilience. The company’s earnings surged by 33% over the past year, outpacing its industry peers. With a debt-to-equity ratio reduced to 22.6% from 31% over five years, Virtus demonstrates prudent financial management. Trading at 7.9% below its estimated fair value suggests potential for investors seeking undervalued assets. Recent initiatives include expanding ETF offerings with the Virtus AlphaSimplex Global Macro ETF and increasing quarterly dividends to US$2.40 per share, reflecting confidence in sustained profitability despite being dropped from several Russell indexes recently.

Taking Advantage

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com