Intel (INTC) stock gained as much as 3% early Monday morning before giving up these gains in early trading after President Trump said he “loved” seeing the company’s share price go up.

In a post on Truth Social early Monday, Trump said the government paid “ZERO” for Intel, adding, “I will make deals like that for our Country all day long.”

“I will also help those companies that make such lucrative deals with the United States,” Trump added.

“I love seeing their stock price go up, making the USA RICHER, AND RICHER.”

Read more about Intel’s stock moves and today’s market action.

Late Friday, Intel and the government disclosed the details of the agreement, which will see the government take an equity stake in the company worth $8.9 billion. Including the $2.2 billion CHIPS Act grant Intel has already received, the deal puts the government’s investment in Intel at $11.1 billion.

The government’s equity stake amounted to 433.3 million shares in Intel at $20.47 per share, equal to a 9.9% stake in the company.

Trump’s post on Monday came about an hour after Kevin Hassett, the director of the National Economic Council, said that the administration will continue to look to make similar investments across industries.

In an interview on CNBC, Hassett said, “The president has made it clear all the way back to the campaign, he thinks that in the end, it would be great if the US could start to build up a sovereign wealth fund.”

“So I’m sure that at some point there’ll be more transactions, if not in this industry then other industries,” Hassett added.

On Friday, Intel stock rose 5% on reports the government was preparing to take a 10% stake in the chipmaker, which has fallen behind its peers during the AI boom. Shares slipped about 1.5% in late trading after details of the deal were announced.

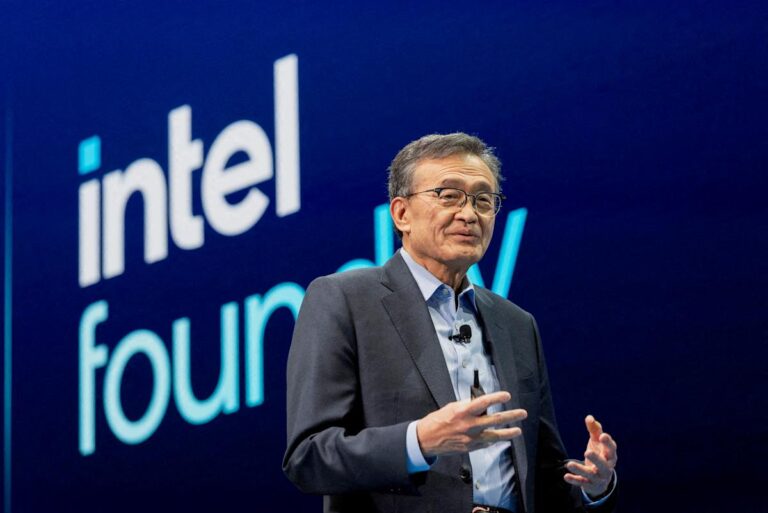

“President Trump’s focus on U.S. chip manufacturing is driving historic investments in a vital industry that is integral to the country’s economic and national security,” Intel CEO Lip-Bu Tan said in a statement on Friday.

Story Continues