As the U.S. stock market navigates a mixed landscape with major indices showing varied performances, investors are keenly watching economic indicators and potential interest rate cuts that could influence small-cap stocks. With the Dow Jones Industrial Average recently achieving its first record closing high of the year and investor optimism growing amid strong corporate earnings reports, this environment presents an opportunity to explore lesser-known equities that may offer unique growth potential. Identifying promising stocks often involves looking for companies with strong fundamentals and innovative strategies that align well with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingSouthern Michigan Bancorp117.38%8.87%4.89%★★★★★★Oakworth Capital87.50%15.82%9.79%★★★★★★Metalpha Technology HoldingNA75.66%28.60%★★★★★★FineMark Holdings115.14%2.22%-28.34%★★★★★★Senstar TechnologiesNA-20.82%14.32%★★★★★★Valhi44.30%1.10%-1.40%★★★★★☆FRMO0.10%42.87%47.51%★★★★★☆Pure Cycle5.02%4.35%-2.25%★★★★★☆Rich Sparkle Holdings26.73%-6.13%1.75%★★★★★☆Solesence91.26%23.30%4.70%★★★★☆☆

Click here to see the full list of 286 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individuals, small businesses, and corporate clients with a market cap of $273.89 million.

Operations: Fidelity D & D Bancorp generates revenue primarily from its banking, trust, and financial services segment, totaling $85 million. The company’s net profit margin is a key financial metric to consider when evaluating its performance.

Fidelity D & D Bancorp, with its $2.7 billion in total assets and $217.9 million in equity, stands out for its robust financial health. The bank’s reliance on customer deposits as 98% of its funding highlights a low-risk profile. It boasts a net interest margin of 2.7% and maintains an allowance for bad loans at just 0.2% of total loans, reflecting prudent risk management. Recent earnings growth at 50%, far surpassing the industry’s average of 12.7%, underscores strong performance, while trading at a discount to estimated fair value suggests potential upside for investors seeking opportunities in the financial sector.

Simply Wall St Value Rating: ★★★★★★

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering a range of banking products and services in the United States, with a market capitalization of $768.43 million.

Operations: MetroCity Bankshares generates revenue primarily from its community banking segment, which contributed $145.16 million.

MetroCity Bankshares, with total assets of US$3.6 billion and equity of US$436.1 million, presents an intriguing opportunity in the financial sector. The bank’s reliance on customer deposits as its primary funding source makes it less risky compared to external borrowing. Total loans stand at US$3.1 billion against deposits of US$2.7 billion, showcasing a solid lending base with a net interest margin of 3.5%. Earnings have surged by 21% over the past year, outpacing industry growth rates and reflecting robust financial health supported by a sufficient allowance for bad loans at 0.5% of total loans.

Simply Wall St Value Rating: ★★★★★★

Overview: First Financial Corporation operates through its subsidiaries to offer a range of financial products and services across several states, including Indiana, Illinois, Kentucky, Tennessee, and Georgia, with a market capitalization of approximately $691.49 million.

Operations: First Financial generates revenue primarily from its banking segment, amounting to $230.45 million. The company’s market capitalization stands at approximately $691.49 million.

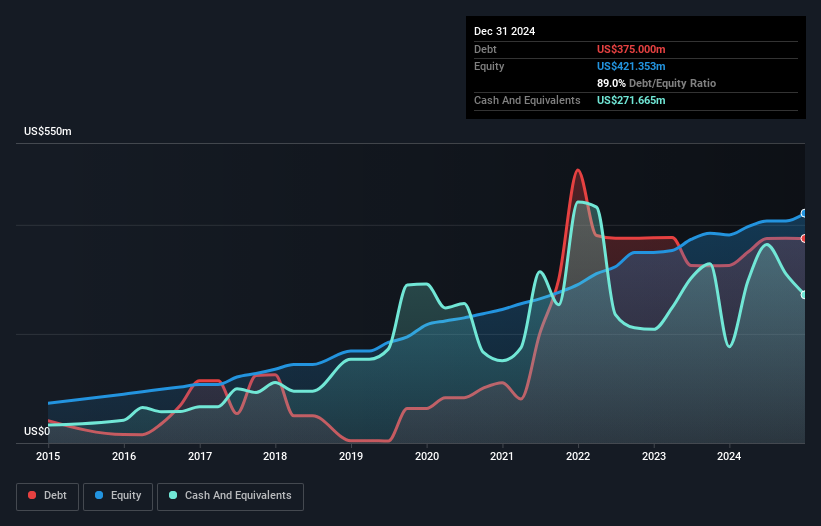

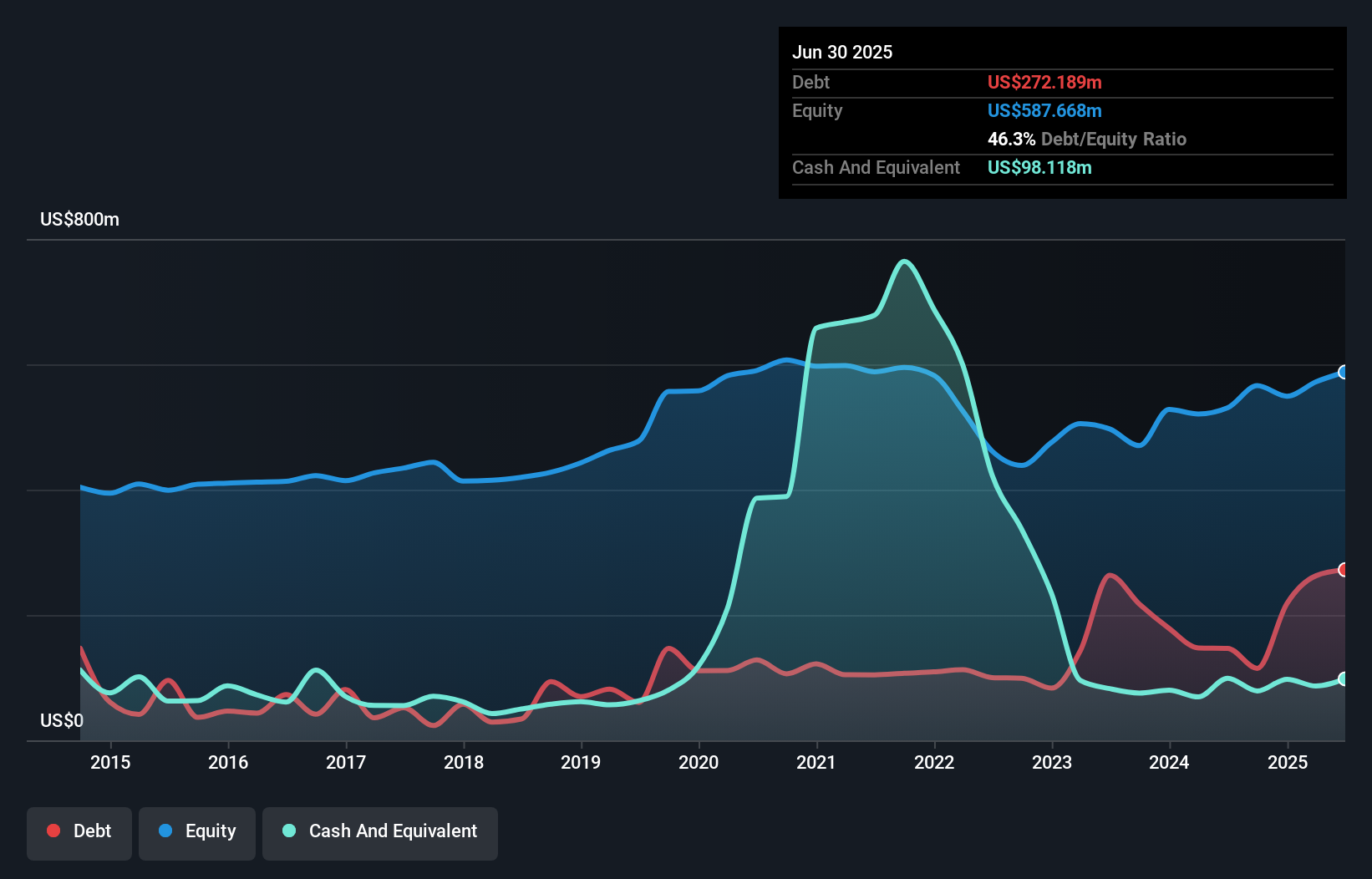

First Financial, with assets totaling US$5.6 billion and equity at US$587.7 million, showcases a strong balance sheet in the banking sector. Total deposits are US$4.7 billion against loans of US$3.8 billion, highlighting robust financial health with an appropriate bad loan ratio of 0.3%. The company has been growing faster than its industry peers, with earnings surging by 21.5% last year compared to the banks’ industry growth of 12.7%. Recently added to multiple Russell Growth Indexes and trading below fair value by 54%, it seems well-positioned for potential future growth opportunities within its sector.

Key Takeaways

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com