(Bloomberg) — Gold hit a fresh all-time high as the prospect of US interest-rate cuts boosted the metal’s appeal and traders sought safety following a recent selloff in equity and bond markets.

Bullion climbed as much as 1.1% to top $3,573 an ounce, exceeding Tuesday’s peak. Prices have advanced about 6% over the past seven sessions, underpinned by increased haven demand amid renewed worries over the Federal Reserve’s future and concerns about sovereign debt levels in developed-world countries.

Most Read from Bloomberg

Gold has risen more than a third this year, making it one of the best-performing major commodities. The latest run has been propelled by expectations the US central bank will lower rates this month, after Fed Chair Jerome Powell cautiously opened the door to a cut. A key US jobs report this Friday is likely to show signs of an increasingly subdued labor market, supporting the case for rate cuts. Lower rate environments tend to benefit non-yielding gold.

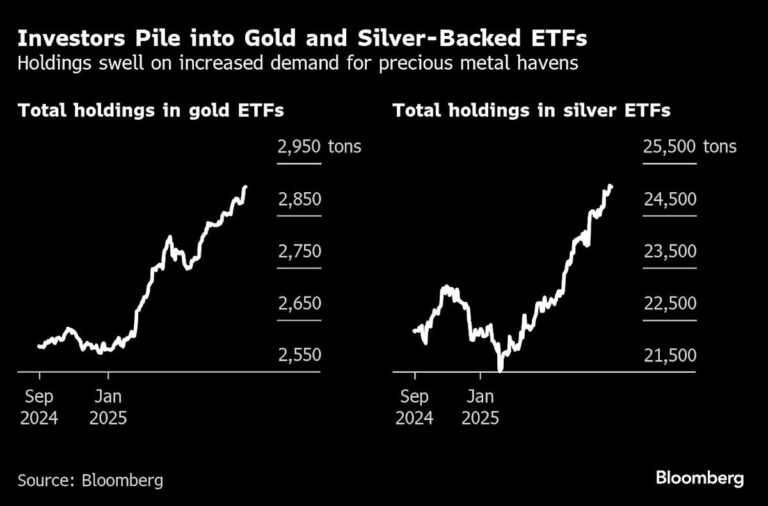

Both gold and silver have more than doubled over the past three years, with mounting risks in geopolitics, the economy and global trade driving demand for the time-honored haven assets. An escalation in President Donald Trump’s attacks against the Fed this year has increased worries over the central bank’s independence being under threat.

Markets are now waiting for a landmark ruling on whether Trump has legitimate grounds to remove Fed Governor Lisa Cook from the central bank. If deemed legal, the move would allow the president to replace her with a dovish-leaning official.

Investors are also anticipating an announcement from the White House over the selection of the next Fed Chair when Powell steps down from his role in May. Treasury Secretary Scott Bessent will start interviewing candidates on Friday, the Wall Street Journal reported.

Separately, Trump said his administration would ask the Supreme Court for an expedited ruling in hopes of overturning a federal court decision that many of his tariffs were illegally imposed. The legal setback has increased uncertainty for American importers and also potentially delays the economic dividends promised by the administration.

Gold’s impressive performance this year has been surpassed by silver. The metal is up about 43%, with prices on Monday breaching $40 an ounce for the first time since 2011.

Story Continues