As the U.S. market navigates fluctuating labor data and anticipates potential interest rate cuts, investors are keeping a close eye on the performance of key indices like the S&P 500 and Dow Jones Industrial Average, which have recently shown resilience amidst economic uncertainties. In this dynamic environment, identifying promising stocks often involves looking beyond immediate market leaders to uncover lesser-known companies with strong fundamentals and growth potential—true hidden opportunities in today’s investment landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingSouthern Michigan Bancorp117.38%8.87%4.89%★★★★★★Oakworth Capital87.50%15.82%9.79%★★★★★★ASA Gold and Precious MetalsNA12.79%-0.59%★★★★★★First Northern Community BancorpNA8.05%12.27%★★★★★★Metalpha Technology HoldingNA75.66%28.60%★★★★★★Pure Cycle5.02%4.35%-2.25%★★★★★☆Linkhome Holdings7.03%215.05%239.56%★★★★★☆Gulf Island Fabrication20.48%3.25%43.31%★★★★★☆Elron Ventures5.70%13.72%25.56%★★★★☆☆Greenfire Resources35.48%-1.31%-25.79%★★★★☆☆

Click here to see the full list of 285 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Value Rating: ★★★★★★

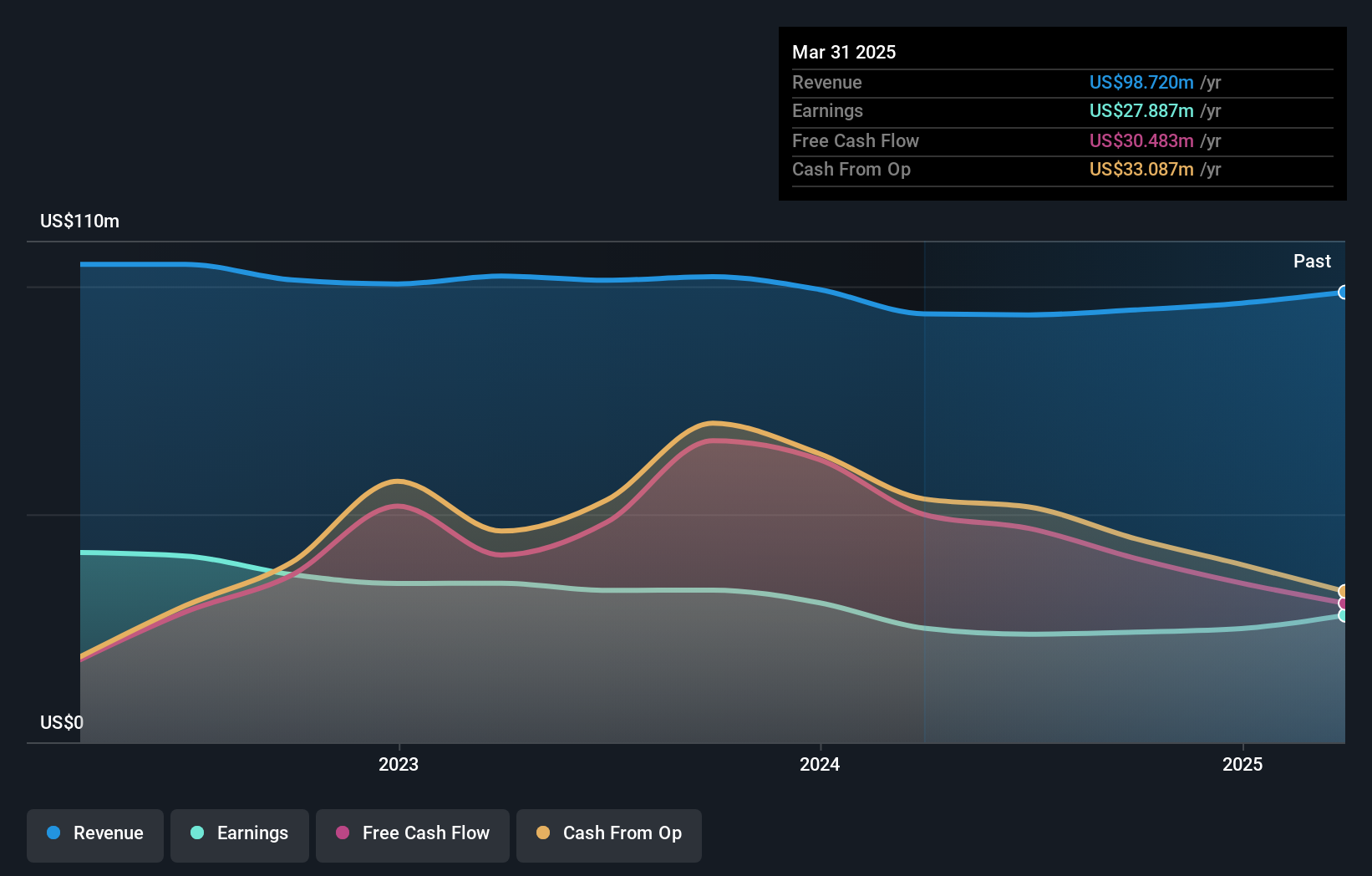

Overview: AudioCodes Ltd. offers advanced communications software, products, and productivity solutions for the digital workplace globally, with a market cap of $276.51 million.

Operations: AudioCodes generates revenue primarily from its communications equipment segment, which reported $243.25 million. The company has a market cap of $276.51 million.

AudioCodes, a nimble player in the communications sector, is leveraging its debt-free status to strategically focus on AI technology and partnerships like Cisco Webex Calling’s Cloud Connect. Trading at 87.9% below its estimated fair value, it presents an intriguing opportunity despite recent challenges such as a significant earnings forecast decline of 87.5% annually over three years. The company repurchased shares worth $18.1 million this year and declared a $0.20 dividend per share for August 2025, indicating confidence in future prospects even as net income fell from $3.77 million to $0.306 million year-over-year for Q2 2025.

Simply Wall St Value Rating: ★★★★★★

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle-market businesses and individuals, with a market cap of $310.90 million.

Operations: PCB Bancorp’s revenue is derived entirely from its banking industry segment, amounting to $102.26 million.

PCB Bancorp, with total assets of US$3.3 billion and equity of US$376.5 million, showcases a robust financial profile. The bank’s deposits and loans both stand at US$2.8 billion, supported by a net interest margin of 3.2%. Its allowance for bad loans is sufficient at 0.3% of total loans, highlighting prudent risk management practices. Earnings have surged by 29% over the past year, outpacing the industry average growth rate of 12%. Additionally, PCB trades at nearly 32% below its estimated fair value and has been actively repurchasing shares recently—repurchasing approximately 98,628 shares for US$1.77 million this year alone—indicating confidence in its valuation prospects.

Simply Wall St Value Rating: ★★★★★★

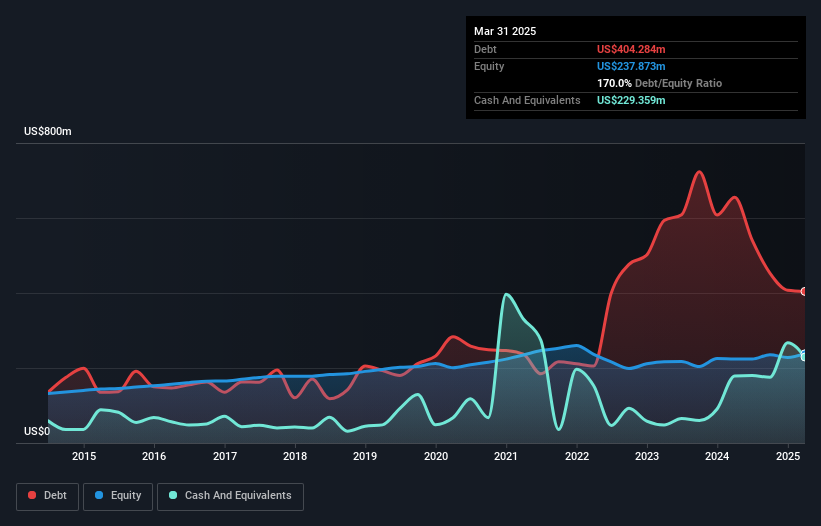

Overview: West Bancorporation, Inc. is a financial holding company offering community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market cap of $339.15 million.

Operations: The primary revenue stream for West Bancorporation comes from its community banking segment, generating $87.10 million. The company’s net profit margin stands out at 33%, reflecting its efficiency in converting revenue into profit.

West Bancorporation, a financial holding company with total assets of US$4.1 billion, is making strides in the Midwest urban centers with its community banking and trust services. The bank’s earnings grew by 34.7% over the past year, surpassing industry growth of 12.8%, while maintaining high-quality earnings and a sufficient allowance for bad loans at 0%. With total deposits at US$3.4 billion against loans of US$2.9 billion, it enjoys primarily low-risk funding sources from customer deposits. Despite geographic concentration risks in Iowa and Minnesota, its strategic digital investments are likely to support future stability amidst growing client bases and deposit balances.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if West Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com