As the U.S. stock market reaches new highs, with the S&P 500 closing at a record level, investors are closely monitoring economic indicators such as employment data and potential Federal Reserve interest rate cuts. In this dynamic environment, small-cap stocks often present unique opportunities for growth due to their potential for innovation and agility in adapting to changing market conditions. Identifying undiscovered gems within this sector requires a keen eye for companies with strong fundamentals and promising business models that can thrive amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingSouthern Michigan Bancorp117.38%8.87%4.89%★★★★★★Morris State BancsharesNA3.34%3.70%★★★★★★Oakworth Capital87.50%15.82%9.79%★★★★★★First Northern Community BancorpNA8.05%12.27%★★★★★★FineMark Holdings115.14%2.22%-28.34%★★★★★★Sound GroupNA6.23%45.48%★★★★★★Pure Cycle5.02%4.35%-2.25%★★★★★☆Gulf Island Fabrication20.48%3.25%43.31%★★★★★☆Linkhome Holdings7.03%215.05%239.56%★★★★★☆Greenfire Resources35.48%-1.31%-25.79%★★★★☆☆

Click here to see the full list of 285 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc. operates as a provider of property and casualty insurance for individuals and businesses across the United States, with a market capitalization of approximately $775.98 million.

Operations: United Fire Group generates revenue primarily from its property and casualty insurance segment, which accounted for $1.32 billion. The company’s net profit margin reflects its financial performance efficiency in managing costs relative to its revenue stream.

United Fire Group (UFG) is navigating the property and casualty insurance landscape with notable challenges and opportunities. The company has seen a significant earnings growth of 149.9% over the past year, outpacing the industry’s 6%. UFG’s debt to equity ratio has risen from 0% to 13.9% in five years, yet it maintains more cash than total debt. Despite forecasts suggesting a decline in profit margins from 6.9% to 3.2%, revenue is expected to grow by an annual rate of 12.31%. Recent board changes, including appointing Gilda L. Spencer as a director, signal strategic moves towards enhancing governance and risk management expertise within UFG’s operations.

Simply Wall St Value Rating: ★★★★★☆

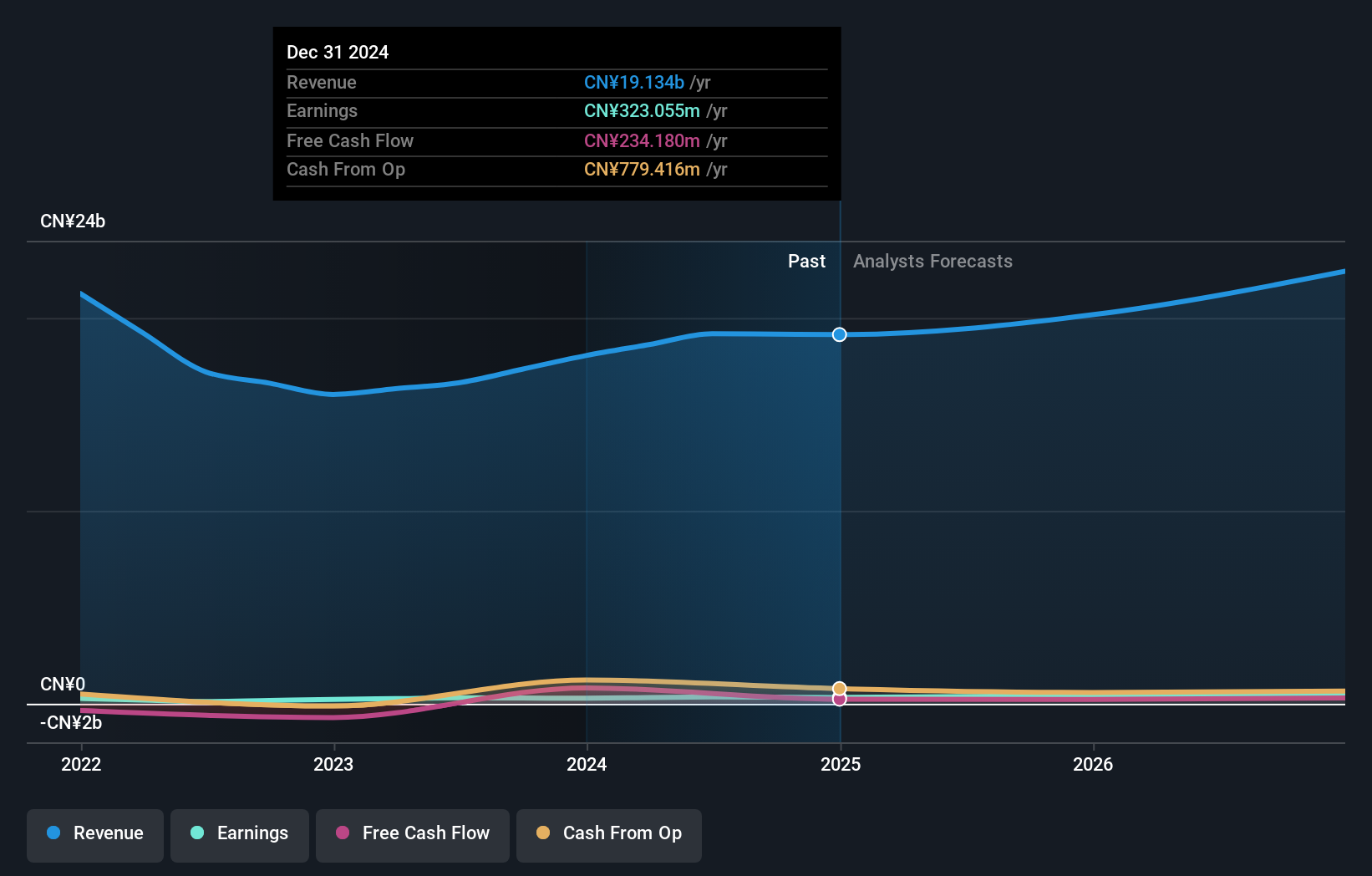

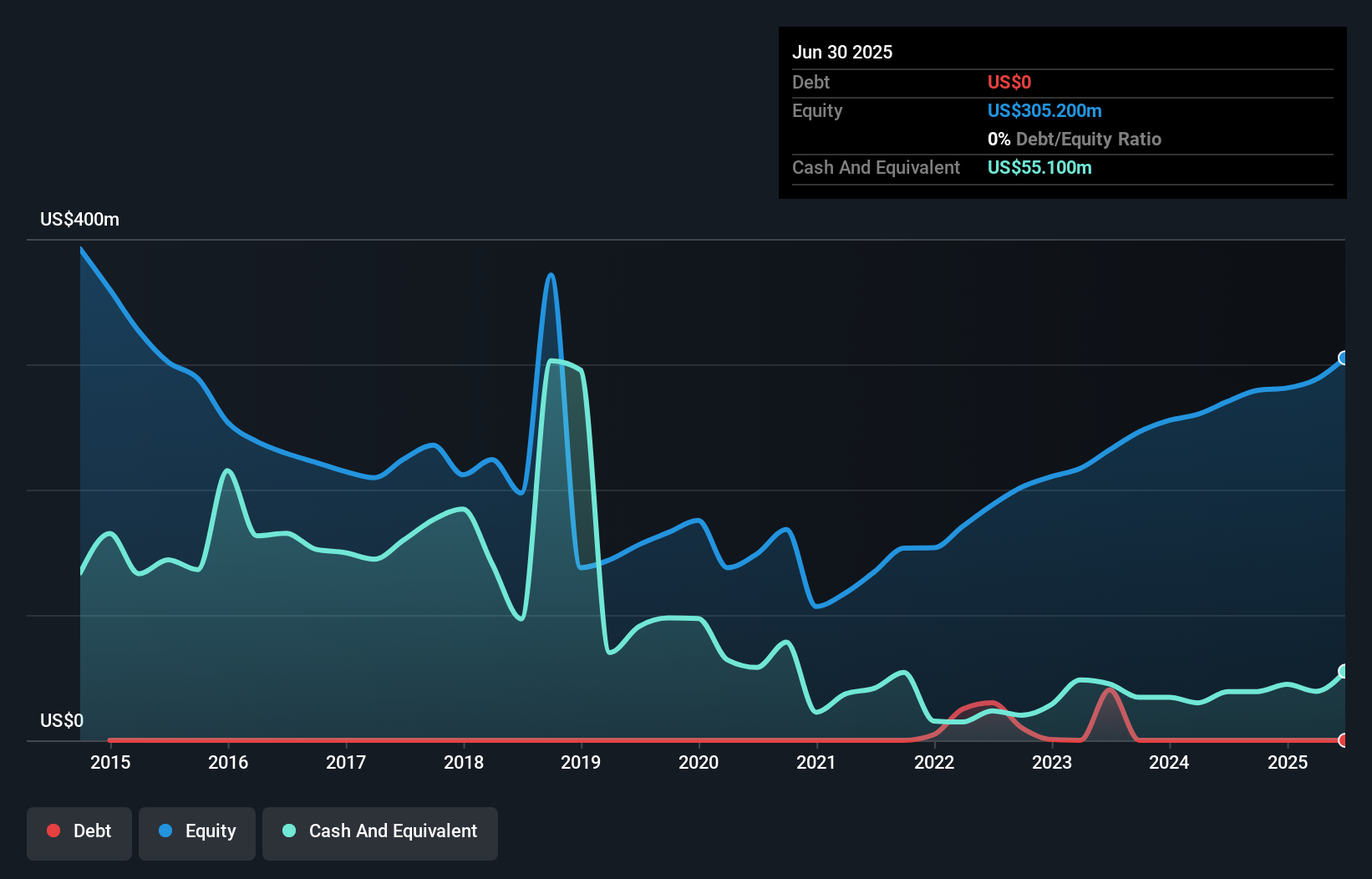

Overview: China Yuchai International Limited manufactures, assembles, and sells diesel and natural gas engines for various applications including trucks, buses, construction equipment, and marine use with a market cap of $1.27 billion.

Operations: China Yuchai generates revenue primarily from the sale of diesel and natural gas engines used in trucks, buses, construction equipment, and marine applications. The company’s cost structure includes expenses related to manufacturing and assembly processes. Notably, its net profit margin has shown variability over recent periods.

China Yuchai International, with its focus on diesel and natural gas engines, has seen significant earnings growth of 29.1% over the past year, outpacing the Machinery industry average of -3.1%. The company reported half-year sales of CNY 13,806 million (approximately US$2.12 billion), up from CNY 10,306 million a year ago. Despite a debt-to-equity ratio increase to 20.9% over five years, it holds more cash than total debt and trades at a P/E ratio of 20.1x below industry average. However, challenges like regulatory shifts towards electrification may affect its long-term prospects despite recent strong financial performance.

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of various industrial and MRO products in the United States and Canada, with a market cap of approximately $1.43 billion.

Operations: The Industrial Products Group (IPG) is the primary revenue segment, generating $1.32 billion. The company’s market cap stands at approximately $1.43 billion.

Global Industrial, a nimble player in the trade distributors sector, is making waves with its strategic shift towards high-value accounts and digital transformation. The company reported Q2 2025 sales of US$358.9 million, up from US$347.8 million a year prior, while net income rose to US$25.1 million from US$20.3 million last year. Despite past negative earnings growth of 4.9%, it trades at an attractive 28% below estimated fair value and remains debt-free for five years running, offering free cash flow positivity as well as room for acquisitions amidst potential risks like rising input costs and market competition challenges.

Next Steps

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com