Market snapshot

ASX 200 futures: +0.1% to 8,565 points

Australian dollar: +0.4% to 65.2 US cents

Dow Jones: +0.8% to 42,515 points

S&P 500: +0.9% to 6,033 points

Nasdaq: +1.5% to 19,701 points

FTSE: +0.3% to 8,875 points

EuroStoxx: +0.4% to 546 points

Spot gold: -1.4% to $US3,404/ounce

Brent crude: -1.9% to $US72.82/barrel

Iron ore: -0.1% to $US95.38/tonne

Bitcoin: 2.8% to $US108,641

Prices current around 7:30am AEST.

Live updates on the major ASX indices:

Just nowMon 16 Jun 2025 at 11:44pm

ACCC’s to take on first ‘super complaint’

Consumer Action Law Centre chief executive, Stephanie Tonkin says she is thrilled by the decision of the Australian Competition and Consumer Commission (ACCC) to launch a detailed review into the national impact and harms of unsolicited selling.

Consultation on the inquiry which opens today.

“This decision by our national, economy-wide regulator shows the dynamic power of the ‘designated complaint’ super-complaint process in action.”

In its complaint, Consumer Action recommended that the Government legislate a complete ban on unsolicited selling under Australian Consumer Law (ACL), along with the regulatory reform of lead generation practices.

This would most likely lead to a complete ban on cold-calling and door-knocking.

“Unsolicited sales are tricky as they happen out of sight, most often in regional areas, where people are persuaded to sign up in their homes for very expensive products they can’t afford, but are pressured into purchasing. Nothing short of a complete ban of these practices will fix this problem.

“Today, we are hearing about the unsolicited door-to-door selling and telemarketing of many items, most notably, solar panels -in the past it was encyclopedias and educational software- it’s an ongoing systemic issue that impacts thousands of Australians and causes real harm especially to those living in vulnerable circumstances.

“By submitting the very first designated complaint, we’ve been able to shine a light on a relatively hidden practice that’s harmful to thousands of Australian consumers, and for that I want to thank the Albanese Government for its foresight.

“I encourage people who have been impacted by unsolicited selling to come forward to share their stories with the inquiry to help get this practice banned for once and for all.”

Here’s more on the complaint, and how it came about.

7m agoMon 16 Jun 2025 at 11:37pm

‘Super-complaint’ brings action as ACCC takes on door-knocking and cold-calling

The super-complaint is here.

For decades, consumer groups have been playing Whack-A-Mole with dodgy operators and shonks.

Here’s what the game looks like: When you whack one, another appears somewhere else.

Loading

Fun to play, but a lot of harm comes when bad actors can work across a sector because it consumes huge resources to shut them down … and someone else starts up over there doing a similar thing.

But things are changing, and the designated complaint process has begun.

It’s another another avenue for reform, beyond the courts, and could help tackle issues that impacts thousands of Australians every year and causes untold financial and emotional harm.

We’re talking about it today because the first one has been accepted, with the Australian Competition and Consumer Commission (ACCC) to launch a detailed review into the national impact and harms of unsolicited selling.

20m agoMon 16 Jun 2025 at 11:24pm

‘Super tax’ popular, think-tank research suggests

A plan to reduce the generosity of superannuation tax concessions for the wealthy is popular among voters, according to a new poll conducted for The Australia Institute.

Under the proposed changes, Australians with super balances over $3 million would pay 30% tax — rather than 15% — on earnings above $3 million.

Despite this being flagged about a year ago and noted in the recent election, it has become a bonfire of debate, seemingly centered in media consumed by people who could be affected by the change.

The Australian Tax Office suggests the current average super balance in Australia is about $182,000 for men and $146,000 for women. Among those aged 60 to 65, it’s around $402,000 for men and $318,000 for women.

Even those opposed to the tax say it won’t hit a lot of people — yet. They are generally concerned about two aspects: the lack of indexation (meaning more and more people will pay it over time) and the tax on unrealised assets.

The poll, conducted by YouGov, shows a majority support the proposed changes. The percentage who oppose it is larger than but similar to the figure that don’t know or are unsure.

25% of Australians say they “strongly support” reducing tax concessions for people with super balances over $3 million, while 27% support the changes.14% of Australians say they “strongly oppose” reducing tax concessions for people with super balances over $3 million, while 12% oppose the changes. One in five of Australians think the changes will have an impact on their retirement plans, but the reality is that only one in 200 people have super balances that would be affected by the changes.

Richard Denniss, Executive Director of The Australia Institute. says there is public support for the tax reform:

“Twice as many Australians support the proposal to reduce tax concessions on superannuation balances over $3 million as oppose the idea.

“Given that most Australians have less than $200,000 in super, it should come as no surprise that the vast majority of ordinary Australians don’t share the hysteria about this small change expressed by some very vocal critics.

“This polling shows that the wailing of the worried wealthy, which has dominated much of the media coverage of the government’s proposed changes to superannuation, has not translated into any widespread concern among the 99 percent of Australians who have less than $3 million in super.

“Young people who can’t afford rent, young families who can’t afford childcare and older women retiring with little or no super are all facing much bigger and more pressing problems than a small reduction in tax concessions on the superannuation balances of the richest one per cent.

“While it is up to the Liberal Party to decide which people and which problems they want to prioritise, it’s surprising that so soon after losing a record number of young voters and women voters that Sussan Ley would choose to make such a big fuss over an issue that overwhelmingly affects wealthy older men.

“One of the most interesting results is that independent voters, the voters who have cost the Liberal party so many of their once safest seats, are the most supportive of Labor’s proposed changes.”

27m agoMon 16 Jun 2025 at 11:17pm

Santos lobbed $36 billion takeover deal

Probably the biggest market news of yesterday was oil and gas giant Santos receiving a takeover deal from a subsidiary of the Abu Dhabi National Oil Company.

Our colleague Patricia Karvelas had Treasurer Jim Chalmers on Afternoon Briefing yesterday and put to him concerns from the South Australian government and others.

PK: Treasurer, the South Australian government has commented and says it needs to be convinced that a takeover bid for the oil and gas company Santos represents a good deal. This deal will create a big foreign investment decision for you. It lands on your lap. There is a lot of concerns about selling gas assets to a foreign government owned company. Are you concerned?

JC: First of all, there will be a range of views, including the South Australian governments, I think it is appropriate people express a view. This is potentially a very large transaction. There are, as I understand, a number of steps that have to happen before it becomes a transaction. I will listen very closely, if it comes to it, to the advice of the Foreign Investment Review Board but I won’t pre-empt that advice.

PK: OK, but you understand the principle here, that selling gas assets to a foreign government-owned company would obviously raise alarm bells for many?

JC: I’m sure you understand as well, Patricia, as the custodian of the foreign investment regime, someone who has asked from time to time to make decisions, including big decisions like this could potentially be that it is not a good idea for me to pre-empt. People have a view, I welcome people expressing their view, I am unable to – because I may have to make a decision on this at some stage. It would be a big decision. And I do intend to take the advice seriously and I don’t intend to pre-empt it.

35m agoMon 16 Jun 2025 at 11:09pm

Conflict: How Israel and Iran could reignite inflation and derail the world economy

My colleague Nassim Khadem has put together this great report that explains why analysts are so concerned about the potential impact of this growing conflict.

Loading…

Analysts fear a prolonged conflict could plunge the world into a global energy crisis that could last years

43m agoMon 16 Jun 2025 at 11:01pm

Is this the end of the US as the world’s ‘safe haven’ for capital

Fascinating analysis from my colleague Ian Verrender about the impact President Trump is having on capital markets.

Loading

“Money has suddenly found itself looking for alternatives to traditional safe havens as the United States brings down the shutters, demanding local companies bring their foreign investments home and as its financial strength begins to fray.

“America remains the world’s biggest economy with the deepest pools of capital, making it the centre for global finance, if only because there is little alternative right now.

“But the clumsy attempts by President Donald Trump to rectify its trade imbalances, the reckless fiscal policies, his complete lack of consistency on almost everything and the nation’s descent into authoritarian rule have diminished America’s reputation, perhaps permanently.”

There’s growing unrest on the streets, the administration’s “undermining of the legal system, the media, the bureaucracy, learning institutions and the scientific community” all of which have shaken the faith of investors in America’s reputation as “The Land of the Free”.

“The new US president wanted a new world order. But this may not be exactly what he had in mind.”

Check it out here:

57m agoMon 16 Jun 2025 at 10:47pm

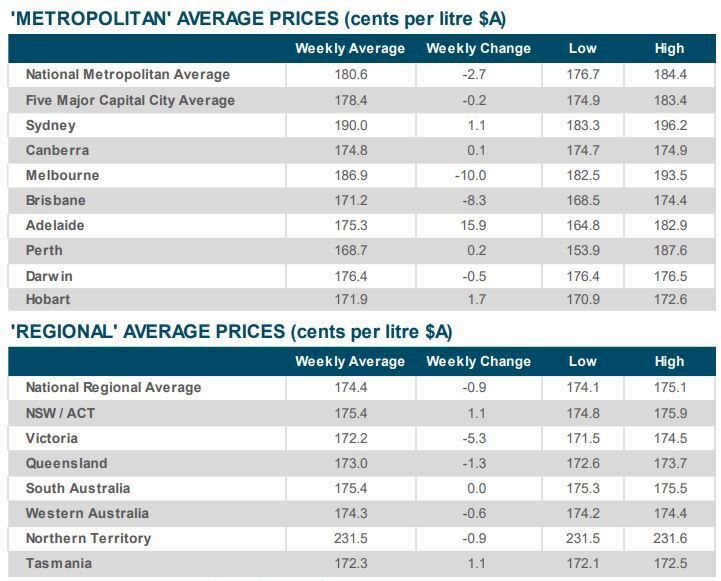

Petrol down 2.1 cents in a week

The national average price of a litre of unleaded petrol slid 2.1 cents to 178.6 cents in the week to Sunday.

Weekly data from the Australian Institute of Petroleum details the shift, which still puts the average below the 12-month average figure of 181.7 cents.

The data was from before the spike in crude oil prices caused by the worsening conflict in the Middle East between Israel and Iran.

The area is a key oil-producing region, so instability or any impact on production volumes or shipping will force up prices globally.

57m agoMon 16 Jun 2025 at 10:47pm

‘Yeah, but where I live …’

OK, I’ll spare you the explanation of the different price cycles in difference cities.

Here’s the data on last week’s results showing how much a litre of unleaded fuel will cost you.

And here’s the ACCC’s explanation of what’s going on.

1h agoMon 16 Jun 2025 at 10:32pm

Michael Every: This won’t be over quickly

Rabobank’s global strategist Michael Every is a respected analyst with a long history of clear-eyed takes on the world economy.

He says the conflict between Israel and Iran is “no longer theatre, no longer a signalling mechanism”, rather it’s an “attempt by Israel to take out Iran’s nuclear program and potentially remove the regime entirely, or at least weaken it to the point where it falls”.

Loading…

The Israel-Iran conflict won’t be over quickly, he warns.

1h agoMon 16 Jun 2025 at 10:24pm

Entrepreneur? What even is that?

Looking at the CEDA data, Australia’s worst result remains its poor level of entrepreneurship, with its ranking dropping to 68th of 69 nations this year.

CEDA chief economist Cassandra Winzar says that’s a big problem:

“Along with poor perceptions of the efficiency of our large corporations (62nd) and another fall in perceptions of workforce productivity (60th), this report also highlights the important role that Australian businesses play in driving national competitiveness and productivity.”

“We also ranked a relatively disappointing 54th on companies’ use of digital tools and technologies. Employers should enable and encourage workers’ adoption of AI tools where appropriate, including by providing training, to ensure we are not left behind.”

1h agoMon 16 Jun 2025 at 10:15pm

Australia more competitive in football than in competitiveness

Australia has dropped five places in a global ranking of international competitiveness due to our slow economic growth and a drop in business efficiency.

The nation fell from 13th to 18th in the IMD World Competitiveness Yearbook 2025, which ranks the competitiveness of 69 nations, released today.

To contrast, the Matildas are ranked the 15th best football team in the world.

Loading

(The Socceroos are considered to be the best 26th best football team in the world).

Back to the economy – we have fallen: last year’s ranking was Australia best performance since 2011.

CEDA is a partner of the yearbook and chief economist Cassandra Winzar says the result shows Australian businesses and policymakers should “focus on measures to strengthen the economy, in particular reviving our flagging productivity”.

Australia’s overall economic performance fell from 7th to 16th, while business efficiency – which includes criteria such as productivity, management practices and labour market – dropped from 22nd to 37th.

We dropped from 20th to 60th in real GDP growth per capita, reflecting our relatively soft economic growth and high population growth in comparison to other nations over 2024.

“With inflation looking to be under control in the short term, we must now tackle the longer-term challenges holding back our economy.

“Key to this is lifting weak productivity through measures such as streamlining regulation, encouraging business investment and undertaking broad-based tax reform.

“We hope the Albanese government’s recently announced productivity roundtable yields tangible policy outcomes that can lift us out of this funk.

“CEDA has long been calling for tax reform to be part of the Federal Government’s agenda, and this report makes the need even more clear, given our consistently high levels of company and personal income taxes (ranked 59th and 58th respectively).

“The uncertainty caused by US President Donald Trump’s trade war and growing international conflict only strengthen the need to tackle these challenges to help the economy weather these storms.”

Overall, Switzerland reclaimed the top ranking in 2025, followed by Singapore, with Hong Kong rounding out the top three.

The rankings are part of the Swiss-based Institute for Management Development’s(IMD’s) World Competitiveness Yearbook 2025, which has ranked the prosperity and competitiveness of countries since 1989.

The year book’s rankings are based on four main factors: economic performance, government efficiency, business efficiency and infrastructure.

2h agoMon 16 Jun 2025 at 9:37pm

More info coming on interest rate cut dissenters (potentially)

We could soon learn about the hawk/dove leanings of different Reserve Board members when it comes to interest rate decisions.

Reuters is reporting that our central bank is leaning towards publishing unattributed votes from its monetary policy committee only when there is no consensus, with a formal decision on the issue set to be made at the July board meeting.

Reserve Bank of Australia governor Michele Bullock and Treasurer Jim Chalmers met last Wednesday in Sydney to discuss the remaining changes under the planned reforms of the central bank, according to a statement from the Treasury.

They discussed a recommendation from an independent RBA review in 2023 to publish an unattributed record of votes in the post-meeting statements.

Here’s some of the statement:

“The disposition of both the government and the RBA is to implement this recommendation so that where consensus has not been achieved, an unattributed record of votes will be published.

“A final decision on implementation of this recommendation will be considered by the Board as part of its broader consideration of the statement at its next meeting on 7-8 July.”

The Monetary Policy Committee consists of six external members appointed by the treasurer and three “ex officio” members comprising the RBA governor, deputy governor and treasury secretary.

The RBA has already implemented most of the recommendations from the review, including splitting the board in two, with one group dedicated to monetary policy and the other focusing on operations.

The rate-setting board got two new members earlier this year.

Marnie Baker, former CEO at Bendigo and Adelaide Bank, and Renee Fry-McKibbin, an economics professor who was on the RBA review panel, will join the monetary policy board, replacing Carol Schwartz and Elana Rubin, who moved to the new governance board.

Good morning!

Hello, I’m Daniel Ziffer from the ABC business team and I’ll be taking you through the morning on our business, finance and economics blog.

Loading

Overnight, Wall Street indices were higher, markedly so for the Nasdaq.

The blue-chip Dow Jones of 30 mega-companies like Boeing and Visa was +0.8% to 42,515 points.

The broader S&P 500 that covers 500 of the largest listed companies in theUS +0.9% to 6,033 points.

The tech-heavy Nasdaq was +1.5% to 19,701 points.

Our market is set to open flat, with the ASX 200 futures index tipping a lift of +0.06%, +5 points to 8,565 points.

There’s lots to get to, all of it news, analysis and information and none of it financial advice.

Let’s get started!