Market snapshot

Australian dollar: +0.5% to 65.05 US cents Wall Street: Dow Jones (-0.7%), S&P 500 (-0.8%), Nasdaq (flat at 0.0%)Europe: FTSE (-0.5%), DAX (-1.1%), Stoxx 600 (-0.9%)Spot gold: -0.1% to $US3,383/ounce Brent crude: -0.5% to $US76.07/barrel Iron ore: -1.8% to $US92.40/tonne Bitcoin: +0.9% to $US105,460

Prices current around 16:20pm AEST

Live updates on the major ASX indices:

ASX closes up

The Australian share market has finished the day down -0.1% at 8,531 points with quite a few losers.

Overall, the market had 104 stocks in the red, 10 unchanged and 86 stocks gaining.

When looking at the sectors, Academic and Educational Services finished at the top; up +2.8%, followed by Energy; up +0.8% and then Technology; up +0.7%.

Basic Materials finished at the bottom; down -1.1%, followed by Utilities; down -1.0%.

Among companies, the top mover was Light and Wonder Inc, up +4.1%, followed by TechnologyOne Ltd, up +0.8% and Ampol Ltd, up +0.7%.

It wasn’t a good day for Lovisa Holdings, down -1.7%.

James Hardie Industries PLC was also down at -1.4%, as was Mineral Resources, down -1.1%.

The Australian dollar is pretty flat, down +0.5% at 65.06 US cents.

The US market has also finished the Aussie day down -0.8% at 5,983 points.

And that’s it from The Business Team today – we’ll see you bright and early tomorrow!

4h agoWed 18 Jun 2025 at 5:44am

Japan’s Ishiba departs G7 without US trade deal and political future in doubt

Reuters has reported that Japanese Prime Minister Shigeru Ishiba’s bid to get US President Donald Trump to relax tariffs imperiling his country’s economy and his political future fell flat this week, underlining the gulf between the allies as more levies are set to kick in.

Monday’s brief encounter did little to palter the grim forecast for the Japanese industry girding for broader 24% levies due on July 9.

The lack of progress could knock confidence in Ishiba’s diplomacy just as he prepares to contest a dicey upper house election next month that some political analysts say could result in his ouster.

“Despite our persistent efforts to find common ground through serious discussions, yesterday’s meeting with President Trump confirmed that we still have discrepancies in our understanding,” Ishiba told reporters on Tuesday before his departure from Canada.

Trump earlier told reporters on Air Force One that “there was a chance of a deal” but appeared in little mood to cede ground.

“Ultimately you have to understand we’re just going to send a letter saying this is what you’re going to pay otherwise you don’t have to do business with us,” he said.

4h agoWed 18 Jun 2025 at 5:25am

China’s financial opening up offers opportunities for global capital, regulator says

China’s financial opening up and rapidly growing consumer market will benefit the country and provide better asset allocation opportunities for global capital, Li Yunze, the head of China’s financial regulator has said.

According to Reuters, total assets under foreign banks and insurance institutions in China have exceeded 7 trillion yuan, Li, director of the National Financial Regulatory Administration, told the Lujiazui Forum, a high-profile financial gathering.

“Foreign institutions are important bridges and links for attracting investment, talent, and are important participants and active contributors to the construction of China’s modern financial system,” he said.

China will create a transparent, stable and predictable market environment for foreign players and will explore options to open up a wider range of financial areas, said Li.

Li added that China’s rapidly growing consumer market would also bring more opportunities for foreign institutions.

“China is accelerating to become the world’s largest consumer market,” said Li. “Deeply cultivating the Chinese market will surely achieve great results.”

In addition, Li estimated that there will be more than 400 million people aged 60 and over in China by 2035, creating a “silver economy” worth 30 trillion yuan.

4h agoWed 18 Jun 2025 at 5:10am

Does Optus still use commission-based selling?

The ABC has asked Optus if it still uses commission-based selling in any of its stores in light of the news it participated in unconscionable conduct selling products to vulnerable customers. In a statement, a spokesperson has said:

We’ve introduced new incentive structures for retail staff, to increase quality control and customer experience metrics – as part of our whole of business review of systems and processes.We continuously review our rewards, benefits and incentives to ensure we’re driving the right customer outcomes, and a big component of this is geared around compliance metrics and customer experience.There is an ongoing stream of work in place to determine the best processes for the future

Optus has agreed to a 100 million penalty and is subject to court approval.

4h agoWed 18 Jun 2025 at 4:58am

Top China military official disappears in latest purge under Xi Jinping amid rising factional politics

General He Weidong, China’s second-ranking military official and co-vice chairman of the powerful Central Military Commission (CMC), has not been seen in public since March 11.

His name was also absent from the official list of attendees at the funeral of his former colleague, Xu Qiliang, who was also a co-vice chairman of the CMC.

You can catch up on the story from ABC journalist Bang Xiao below:

5h agoWed 18 Jun 2025 at 4:46am

Deep-sea mining update

Slovenia, Cyprus, Latvia and the Marshall Islands have joined the call for a moratorium against commercial deep-sea mining.

There are now 37 countries calling for this.

It comes as the 3rd UN Ocean Conference (UNOC3) concluded last week in France, with the deep sea placed at the heart of international ocean governance.

In his opening address at the conference, UN Secretary-General António Guterres warned that “the deep sea cannot become the Wild West.”

It reflects growing political, scientific and public recognition that deep-sea ecosystems must be safeguarded from commercial mining, as we continue to learn more about them.

You can catch up on my reporting of the deep sea from May, after US President Donald Trump signed an executive order to open both US and international waters to deep-sea mining, ignoring a global treaty that controls the high seas.

5h agoWed 18 Jun 2025 at 4:27am

ICYMI: Oil company Santos and Abu Dhabi

Our chief business correspondent Ian Verrender asks the question: Has the Santos takeover handed the government a gift on energy security?

You can catch up on the analysis below:

5h agoWed 18 Jun 2025 at 4:08am

ASX trading higher

The ASX200 is trading 5 points (+0.05%) higher this afternoon at 8546.

Market analyst Tony Sycamore says that at two and a half days into a new week, “the ASX200 has managed to etch out just a 59 point (0.7%) range.

“The average range over the past nine weeks has been 165 points or almost 2%.

“This suggest there is room for some fireworks/movement into the weeks end as the spring winds increasingly tighter.

He says a sustained break of support at 8500 would increase the likelihood the ASX200 put in place a medium-term top last week at the 8639 high and that a deeper pullback is underway with the 200-day moving average at 8200 viewed as the initial target.

“Until then, allow the ASX200 to extend its gains towards 8800.”

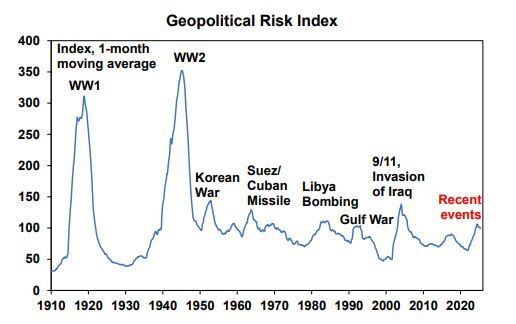

Measuring geopolitical risk

Deputy Chief Economist at AMP, Diana Mousina says the recent missile strikes in Israel and Iran are a reminder that geopolitical events can always flare up and cause risks to the global order and markets.

She says geopolitical risk has been trending higher since 2021, but that the 20 years prior to the pandemic was actually a relatively quiet geopolitical period, known as the “peace dividend” after the Cold War.

“Spikes in the Geopolitical Risk Index have historically been associated with initial moderate falls in share markets. Economic factors are always occurring alongside geopolitical events which impact share returns so it’s hard to pinpoint the exact short-term impact of geopolitical risks on markets. But what is interesting is that usually a year after the initial event, shares tend to be higher,” she says.

She says one way to measure changes in geopolitical events is through a “Geopolitical Risk Index” which was constructed by Dario Caldara and Matteo Iacoviello based on a tally of newspaper articles since 1900. The chart below shows the changes in the long-term index, with events that caused the largest spikes in the index highlighted in the chart.

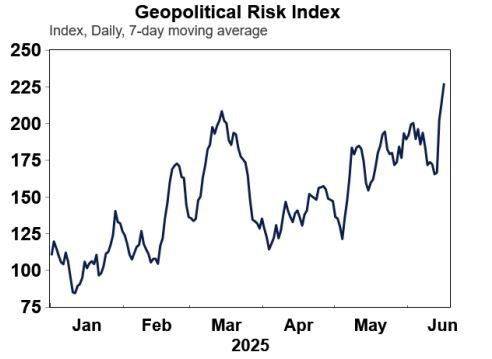

And a more detailed daily version of the daily geopolitical risk index shows the index at a current high for the year.

Market snapshot

Australian dollar: +0.3% to 64.9 US cents Wall Street: Dow Jones (-0.7%), S&P 500 (-0.8%), Nasdaq (-1.0%)Europe: FTSE (-0.5%), DAX (-1.1%), Stoxx 600 (-0.9%)Spot gold: -0.1% to $US3,385/ounce Brent crude: +0.5% to $US76.83/barrel Iron ore: -1.8% to $US92.40/tonne Bitcoin: +0.6% to $US105,060

Prices current around 13:25pm AEST

Live updates on the major ASX indices:

6h agoWed 18 Jun 2025 at 3:15am

ICYMI: Optus to face $100 million penalty for unconscionable conduct selling products to vulnerable customers

You can read the full report from our digital lead Stephanie Chalmers below:

Treasurer delivers key National Press Club address to set out second term agenda

A cross-post from my colleague Courtney Gould, who is live blogging Treasurer Jim Chalmers’s National Press Club address:

Jim Chalmers has three priorities for this term of government.

1.Productivity,2.Budget sustainability,3.Resilience in the face of global volatility.

First cab off the rank is productivity and will be kickstarted by the productivity roundtable the treasurer is hosting in August.

It’s a similar approach the government took three years ago when it hosted the Jobs and Skills Summit.

But speaking to critics of the plan, Chalmers argues this isn’t just a rinse and repeat situation.

“It’s not to retract or retrace the steps we took in the first term but to renew and refresh our reform efforts,” he says.

“Not because we won a big majority but because we have a big opportunity and because we embrace this big responsibility.”

You can follow more of what the treasurer has to say on the ABC’s excellent live politics blog:

6h agoWed 18 Jun 2025 at 3:00am

Macquarie Group company’s private ATMs are helping fuel the illegal tobacco trade

Investigative journalists Rory Callinan and Liam Walsh have exposed the prestigious, Australian-founded Macquarie Group, is raking in dollars from the nation’s booming illegal tobacco trade.

“The link between the prominent investment house and the illegal trade has been uncovered by an ABC investigation tracking the vast flow of money from the underworld industry that costs the government billions and is linked to violent organised crime.”

It is through privately owned cash-dispensing ATMs, placed in tobacconists, despite their links to criminals and illegal tobacco sales.

“Macquarie’s link to the trade is via its 47 per cent ownership in private company Next Payments, which is supplying the private ATMs to businesses.”

You can read the full report here.

Optus CEO Stephen Rue responds to ACCC announcement

Optus CEO Stephen Rue says the misconduct by the telco was inexcusable and unacceptable.

“I would like to sincerely apologise to all customers affected by the misconduct in some of our stores.

“Optus failed these customers, and the company should have acted more quickly when the misconduct was first reported.

“I am leading the implementation of extensive changes across the company with active responses to the issues raised well underway.

He says impacted customers are receiving refunds as part of a remediation approach which is informed by financial counsellors and industry partners to make sure it is fair and reasonable.

“However, there is much more to do as we work to regain our customers’ trust and improve support and protections for them, especially for those who are vulnerable.”

Mr Rue says he has made numerous executive and senior leadership changes, and disciplinary action has been taken in some circumstances, terminating retail sales staff who were found to be responsible for inappropriate sales practices.

“This is not what Optus stands for and we will hold ourselves to a higher standard going forward,” he said.

Optus has also agreed to pay $1 million to support digital literacy initiatives for First Nations Australians.

7h agoWed 18 Jun 2025 at 2:30am

Communications consumer body welcomes news Optus will pay one of the largest consumer law penalties in Australian history

ACCAN CEO Carol Bennett says, “unconscionable conduct is a high bar and one that Optus has spectacularly surpassed in its behaviour preying on some of our most vulnerable communities and consumers, including Indigenous communities.

“We thank the ACCC for acting on behalf of those who were exploited by this appalling behaviour.”

The ACCC has provided further details of shocking conduct towards First Nations people, consumers with intellectual disabilities, consumers with limited financial means and other vulnerabilities.

“Phone and internet products are not a luxury – they are fundamental and essential services. To manipulate, abuse and exert control over people reliant on the product or service being sold represents a cruel and uncaring approach. It beggars belief that Optus or any telco could feel this behaviour is acceptable,” Ms Bennett says.

In ACCAN’s recent consumer sentiment research, 41% of consumers said they didn’t trust their telco to act in their interests.

Another 24% said they felt pressured into signing up for a more expensive plan than they wanted.

“It’s no wonder that Optus ranks 3rd in the list of most distrusted companies behind only Woolworths and Coles in a recent Roy Morgan Poll. Optus have a lot of ground to make up to regain the trust of the Australian public for this and other behaviours in recent years,” she says.

ACCAN and 22 other consumers groups have consistently raised the need for the self regulatory Telecommunications Consumer Protections (TCP) Code to be overhauled to better protect consumers.

“While the action from the ACCC is welcome, there is a significant amount of conduct that falls below the very high legal bar for unconscionable conduct, that needs to be regulated to provide appropriate safeguards for the community,” Ms Bennett says.

Financial counsellors welcome record penalty for Optus mis-selling

Financial Counselling Australia welcomes the $100 million record penalty against Optus for unconscionable conduct saying the penalty sends a strong message to the telecommunications industry: mis-selling to vulnerable customers will not be tolerated.

People affected include people with intellectual disability, cognitive impairment, or low financial confidence. Many affected were First Nations consumers living in remote areas with no mobile coverage.

It says this misconduct was the result of corporate arrogance, a lack of oversight, and business models that failed to prioritise the protection of vulnerable customers.

“It is appropriate that the penalty for this unconscionable conduct would be the largest ever imposed on the sector. We commend the action taken by the ACCC, including a remediation program that aims to bring justice to those who were so callously ripped off.”

Peter Gartlan, co-CEO of Financial Counselling Australia says “this case is deeply disappointing. The financial counselling sector has been raising concerns about Optus’s conduct for years. It’s unacceptable that it took ACCC action for Optus to take its responsibility to vulnerable customers seriously.”

Lynda Edwards, Director of First Nations Policy and Campaigns at Financial Counselling Australia says “financial counsellors and capability workers see the impacts of this kind of conduct every day in our communities”.

“People were sold services they didn’t ask for and couldn’t use, in places where there was no coverage. It’s yet another example of systems failing First Nations people. Fines are important, but what we really need is structural reform and genuine cultural safety built into how businesses engage with First Nations communities.”

7h agoWed 18 Jun 2025 at 1:59am

Economists from NAB say uncertainty remains high ahead of July reciprocal tariffs.

The pause on reciprocal tariffs above 10% is due to end next month – on July 9 and currently, there is a lack of clarity regarding negotiations, as we hear mixed messages from US officials.

Decisions on sector specific tariffs are also yet to be announced.

Senior economists Gerard Burg and Tony Kelly from NAB say revisions to various forecasts mean that we now see the global economy growing by 3% in 2025, up from 2.9% previously.

They say India is the main upward revision, as the robust quarterly momentum from last year continues into this year.

“In some cases, such as the Euro-zone and Canada, growth has been boosted by a bring forward in activity ahead of tariffs but this is now unwinding. The outlook for 2026 is marginally softer – at 2.8% (2.9% previously). Consistent with the broad theme of uncertainty, there are wider than normal confidence bands around our forecasts at present.”

Transmission and lower power prices

Energy advisory firm Nexa welcomes Minister Bowen’s pledge to reform how electricity prices are set but warns that power prices won’t come down until transmission is built out effectively.

CEO of Nexa Advisory Stephanie Bashir says:

“As the energy sector evolves, large-scale storage projects continue to face challenges. The federal and state governments must do better to align approvals processes which are needed alongside the Capacity Incentive Scheme (CIS).

“We have seen a lack of coordination between the federal government CIS and the state governments’ Renewable Energy Zones (REZ). The most recent issue being the Junction Rivers Project in NSW which received a CIS Agreement but did not secure rights to a REZ.”

She says transmission continues to be the missing link and until it’s sorted, bills will continue to be high for consumers.

“There is low hanging fruit that could support storage now. Virtual transmission projects – large batteries that provide the additional capacity – can now be placed on existing lines. This not only allows for renewable projects to connect, it solves the transmission constraints in some areas. We need to solve for the missing market issue and value the services these batteries provide. That must be prioritised,” she says.

“Effective coordination, addressing the low hanging fruit and getting batteries online are the key steps needed now to accelerate the missing link of transmission.”

Franklin Templeton examines the impact of the Israel-Iran conflict on the global economy and capital markets

Global investment management organisation Franklin Templeton says that due to Iran’s position as “a moderate-sized oil producer and exporter”, oil prices have jumped after the news of Israel’s military actions.

Crude oil prices jumped US$4–US$5 per barrel, an increase of some 4%–6%.

Stephen Dover, Chief Market Strategist, Head of Franklin Templeton Institute says: “The concern is that an escalation of the military conflict could disrupt more significant supplies of crude oil and natural gas from larger producers in the Persian Gulf region.”

“That said, there are no official confirmations that Iran’s oil production or export facilities have been targeted in Israel’s military strikes,” he says.

“Conflicts in the Middle East raise risk premiums, which is a further reason why global equity markets have dipped. But as long as the conflict does not escalate significantly further, we believe risk premiums and oil prices should return to lower levels. And even if Iran’s crude oil production or exports are disrupted, their relatively small share in global production will likely minimize the impact on global energy prices.”

Iran produces around 3.8 million barrels per day, around 4% of global production, and exports 1.8 million barrels per day, consuming the remainder domestically.

“The impacts of modestly higher oil prices are likely to be small for global growth, inflation and earnings: The world economy remains supported by monetary and fiscal easing (above all in Germany and China, but also in the United States), from the presence of low levels of US unemployment and solid US household balance sheets, and from receding underlying rates of inflation (potential tariff effects notwithstanding). In our opinion, a modest-sized “oil shock” will likely not risk the global expansion, nor change the inflation calculus significantly.”