As global markets navigate the uncertainties stemming from geopolitical tensions and anticipate the Federal Reserve’s upcoming interest rate decision, investors are closely monitoring the impact on small-cap stocks within indices like the S&P 600. Amid this backdrop of volatility and fluctuating oil prices, identifying promising investment opportunities in less-explored areas of the U.S. market can be a strategic move for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingWest Bancorporation169.96%-1.41%-8.52%★★★★★★Morris State Bancshares9.62%4.26%5.10%★★★★★★FineMark Holdings122.25%2.34%-26.34%★★★★★★Metalpha Technology HoldingNA81.88%-4.97%★★★★★★FRMO0.09%44.64%49.91%★★★★★☆Valhi43.01%1.55%-2.64%★★★★★☆Gulf Island Fabrication19.65%-2.17%42.26%★★★★★☆Pure Cycle5.11%1.07%-4.05%★★★★★☆Solesence82.42%23.41%-1.04%★★★★☆☆Reitar Logtech Holdings31.39%231.46%41.38%★★★★☆☆

Click here to see the full list of 287 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Next Technology Holding Inc. offers software development services across the United States, Hong Kong, and Singapore with a market capitalization of $610.77 million.

Operations: Revenue is primarily generated from software development services in the United States, Hong Kong, and Singapore. The company’s market capitalization stands at approximately $610.77 million.

Next Technology Holding, a smaller player in the tech space, has seen its earnings skyrocket by 759.7% over the past year, outpacing the broader software industry. Despite this impressive growth, their revenue remains modest at US$2 million. The company’s financial health seems solid with a net debt to equity ratio of 0.2%, which is considered satisfactory. However, recent volatility in share price and substantial shareholder dilution highlight potential risks. Their price-to-earnings ratio of 2.9x suggests good value compared to the US market average of 17.8x but compliance issues with Nasdaq listing rules add uncertainty to its future prospects.

Simply Wall St Value Rating: ★★★★★★

Overview: StealthGas Inc., along with its subsidiaries, offers seaborne transportation services to liquefied petroleum gas (LPG) producers and users globally, with a market capitalization of approximately $250.35 million.

Operations: StealthGas generates revenue primarily from its transportation-shipping segment, amounting to $167.72 million.

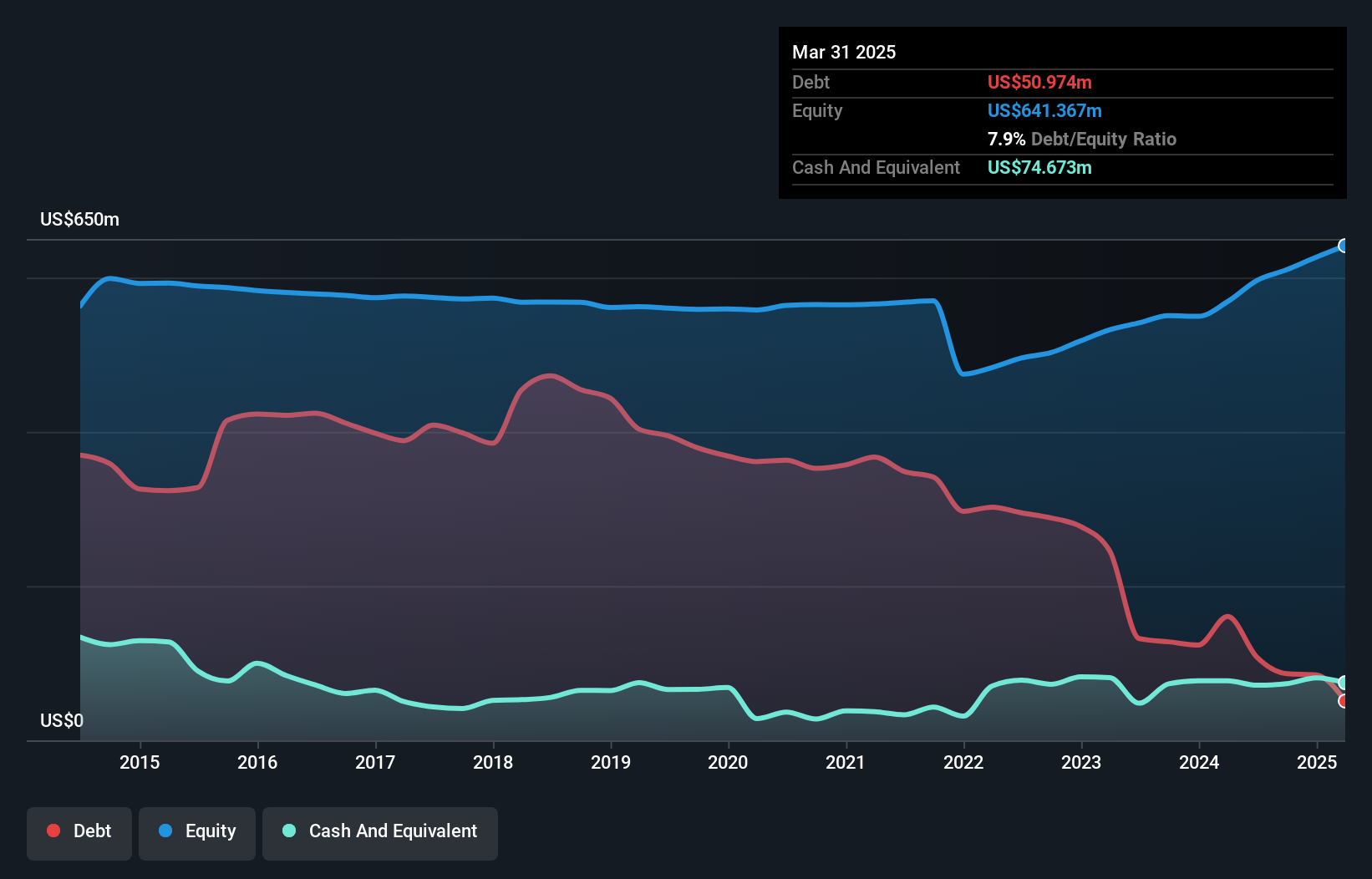

StealthGas, a niche player in the oil and gas sector, is trading at an attractive valuation, significantly below its estimated fair value. Over the past year, its earnings surged by 22.1%, outpacing the industry average of -9.7%. The company’s debt-to-equity ratio has impressively decreased from 64.8% to 7.9% over five years, indicating robust financial management and more cash than total debt enhances its stability. Furthermore, StealthGas repurchased over 4 million shares recently for $21.24 million, reflecting confidence in its future prospects despite a slight dip in net income to $14.11 million this quarter compared to last year’s $17.73 million.

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc. is a company that, along with its subsidiaries, offers property and casualty insurance services to individuals and businesses across the United States, with a market capitalization of approximately $720 million.

Operations: UFCS generates revenue primarily from its property and casualty insurance segment, amounting to $1.29 billion. The company’s net profit margin is a key metric reflecting its profitability from operations.

United Fire Group (UFG) has shown promising signs of growth, with a notable increase in net written premiums to US$331.12 million for Q1 2025, up from US$296 million the previous year. The company reported net income of US$17.7 million compared to US$13.5 million a year ago, reflecting enhanced profitability despite challenges like elevated expense ratios and market risks. UFG’s price-to-earnings ratio stands at 11x, below the industry average of 14.1x, suggesting potential valuation appeal at its current share price near US$28 amidst projections for continued revenue growth and strategic operational improvements.

Where To Now?

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Next Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com