Key Takeaways

Market participants are bracing for volatility this week after the U.S. launched attacks on three Iranian nuclear sites over the weekend.

President Donald Trump announced Saturday evening that Iran’s nuclear enrichment facilities had been “obliterated” by the strikes. While a full assessment of the damage was pending on Sunday, it’s unclear how Iran might respond, which could lead investors to steer clear of risky assets such as stocks and cryptocurrencies. Oil prices, meanwhile, are expected to continue rising amid concerns that supplies could be disrupted if critical infrastructure is destroyed or shipping lanes are blocked.

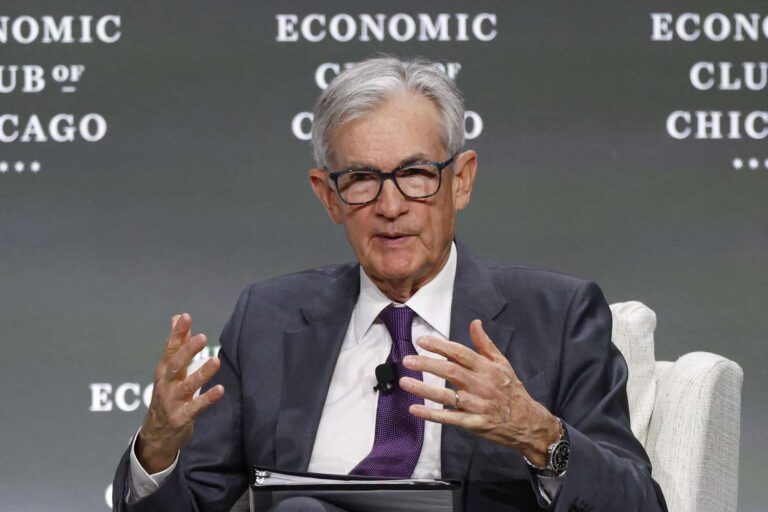

Meanwhile, after the Federal Reserve held interest rates steady last week, Fed Chair Jerome Powell is scheduled to explain the central bank’s views on the economy to legislators when he delivers his periodic testimony to Congress this week.

Central bankers have stood pat as they are concerned inflation will reignite in the wake of tariffs. The Personal Consumption Expenditures (PCE) for May should tell them more when it’s released later in the week. Investors will also be watching for updates on first-quarter gross domestic product (GDP), housing market data, and the latest developments in consumer confidence.

Earnings from shoe retailer Nike (NKE), package delivery service FedEx (FDX), and chipmaker Micron Technology (MU) come as corporations continue to assess the impact that tariffs could have on their operations. And Tesla’s anticipated rollout of its self-driving robotaxi is likely to be on investors’ minds this week.

Read to the bottom for our calendar of key events—and one more thing.

Powell Congressional Testimony Follows Rate Decision

On the heels of last week’s Federal Reserve meeting, Powell will testify before Congress to give lawmakers an update on the central bank’s views on inflation and the economy. Powell is scheduled to testify before the House Financial Services Committee on Tuesday and the Senate Banking Committee on Wednesday. Several other Fed officials are also scheduled to deliver remarks during the week.

The hearings could provide some market-moving moments, especially as political allies of President Donald Trump may take the opportunity to grill Powell. Trump has criticized Powell for the central bank’s reluctance to lower interest rates, a complaint that could be echoed by some lawmakers.

Trump has pointed to lower inflation rates as a reason for the Fed to lower rates. Market watchers will get another look at inflation on Friday with the release of the Personal Consumption Expenditures (PCE) report for May. PCE is important because it’s the data the Fed looks at when gauging whether inflation is returning to its target rate of 2%. Inflation has been declining, with the PCE coming in just over the target rate in April.

Nike, FedEx, Micron Earnings in Focus

Athletic apparel giant Nike, a member of the Dow 30, will lead corporate earnings this week with its scheduled update on Thursday. The struggling shoe maker warned during its prior quarterly report that tariffs could impact the company, coming as it reported declines in revenue and earnings. But analysts said the recent merger of Dick’s Sporting Goods (DKS) and Foot Locker (FL) could help Nike boost sales.

FedEx scheduled earnings on Tuesday come as the shipping stalwart warned of lower revenue and profits during its prior quarterly report. Investors watch FedEx earnings because they can provide a view of shipping volumes, which in turn can offer insight into the overall health of the economy, and especially on global trade.

Investors will also be watching Micron Technology’s scheduled report on Wednesday, which comes after the chipmaker pledged a $200 billion investment to boost semiconductor production in the U.S.

Tesla (TSLA) is tentatively scheduled to roll out its robotaxi service in Austin, Texas, on Sunday, June 22, though product updates have been delayed in the past. Expect Tesla’s robotaxi to grab headlines and potentially move the EV maker’s stock throughout the week, especially if Sunday’s launch is delayed.

Quick Links: Recap Last Week’s Trading | Latest Markets News

This Week’s Calendar

Monday, June 23

Existing home sales (May)

Fed speakers: Federal Reserve Governors. Christopher Waller, Michelle Bowman, Adriana Kugler, New York Fed President John Williams, Chicago Fed President Austan Goolsbee

Key Earnings: FactSet (FDS), Commercial Metals Company (CMC), and KB Home (KBH)

More Data to Watch: S&P flash Purchasing Managers Index (PMI) (June)

Tuesday, June 24

Consumer confidence (June)

Federal Reserve Chair Jerome Powell testifies before the House Financial Services Committee

Fed Speakers: Federal Reserve Gov. Michael Barr, New York Federal Reserve President John Williams, Boston Fed President Susan Collins, Cleveland Fed President Beth Hammack

Key Earnings: FedEx, Carnival (CCL), TD Synnex (SNX), and AeroVironment (AVAV)

More Data to Watch: S&P Case-Shiller home price index (April)

Wednesday, June 25

New home sales (May)

Federal Reserve Chair Jerome Powell testifies before Senate Banking Committee

Key Earnings: Micron, Paychex (PAYX), General Mills (GIS) and Jeffries (JEF)

Thursday, June 26

Pending home sales (May)

Fed Speakers: Federal Reserve Gov. Michael Barr. Cleveland Fed President Beth Hammack and Richmond Fed President Tom Barkin

Key Earnings: Nike, McCormick (MKC), Walgreens Boots Alliance (WBA) and Acuity (AYI)

More Data to Watch: Gross domestic product (GDP) – second revision (Q1), durable-goods orders (May), initial jobless claims (Week ending June 21), advanced U.S. trade balance (May), advanced retail inventories (May), and advanced wholesale inventories (May)

Friday, June 27

Personal Consumption Expenditures (May)

Fed Speakers: Federal Reserve Gov. Lisa Cook and Cleveland Fed President Beth Hammack

Key Earnings: Apogee Enterprises (APOG)

More Data to Watch: Consumer sentiment – final (June)

One More Thing

The U.S. has a lot of millionaires and is adding 1,000 more every day, more than anywhere else in the world. Investopedia’s Nisha Gopalan looked at wealth creation in both the U.S. and around the globe. Read more about it here.