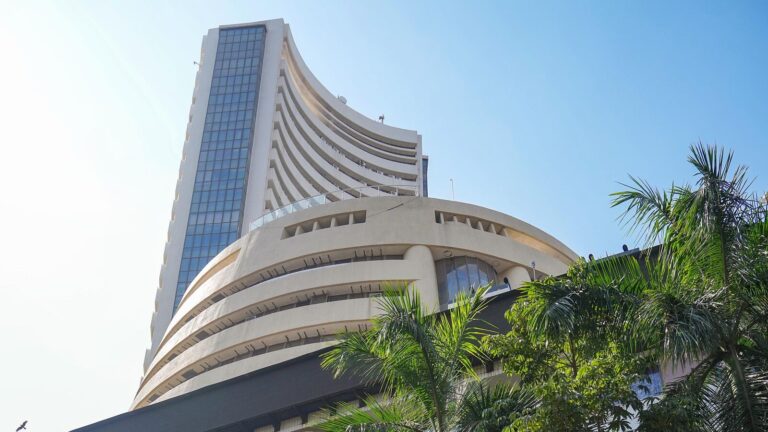

The Indian stock market benchmark indices, Sensex and Nifty 50, are likely to open on a negative note on Monday, following mixed sentiment in global markets.

The trends on Gift Nifty also indicate a negative start for the Indian benchmark index. The Gift Nifty was trading around 24,986 level, a discount of 125.7 points from the Nifty futures’ previous close.

Global market cues remain weak on escalation of Israel-Iran after US dropped a ‘payload of bombs’ on three nuclear sites in Iran, thereby joining the Middle East crisis. In response to US military strikes, Iran’s Supreme National Security Council is reportedly weighing a decision to close the Strait of Hormuz, a vital global energy chokepoint.

On Friday, the domestic equity market ended with sharp gains, with the benchmark Nifty 50 closing above the 25,100 level.

The Sensex jumped 1,046.30 points, or 1.29%, to close at 82,408.17, while the Nifty 50 settled 319.15 points, or 1.29%, higher at 25,112.40.

Here’s what to expect from Nifty 50 and Bank Nifty today:

Nifty OI Data

In the derivatives segment, the highest Call Open Interest (OI) is concentrated at the 25,200 and 25,300 strike levels, suggesting strong resistance around these zones. On the downside, the highest Put Open Interest is observed at the 25,000 and 24,800 strikes, indicating strong support and traders’ confidence in defending these levels, said Choice Broking.

This setup suggests a likely range-bound movement in the near term, with a positive bias as long as the index holds above the key support levels.

Nifty 50 Prediction

Nifty 50 finally witnessed an excellent breakout on June 20 and closed the day higher by 319 points.

“A long bull candle was formed on the daily chart after the formation of narrow range movement on the downside in the last three sessions. This market action is indicating a decisive upside breakout of choppy movement. Nifty 50, on the weekly chart, formed a long bull candle after a sharp weakness of last week and is placed at the upper end of broader high low range. This is a positive indication,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

According to him, the underlying trend of Nifty 50 is positive, and the next upside level to be watched is around 25,250.

“A decisive breakout of the range could pull Nifty 50 towards the next upside target of 25,650 in the near term. Any consolidation or minor dips down to the immediate support of 24,900 could be a buy-on-dips opportunity,” Shetti said.

Om Mehra, Technical Research Analyst, SAMCO Securities, highlighted that the Nifty 50 formed a robust bullish candle on the daily chart.

“Nifty 50 has broken above a declining trendline, which adds further strength to the ongoing bullish momentum. Nifty has also reclaimed both the 9-day and 20-day EMAs, signalling a resumption of the uptrend. The daily RSI, which had been consolidating around the neutral 50 zone, has now turned upward and is placed at 58, indicating improving momentum,” said Om Mehra.

On the hourly chart, the formation of higher highs confirms short-term strength and a potential continuation of the upward trajectory. The support levels are placed at 25,000, followed by 24,950, while the resistances are seen at 25,225 and 25,280, he added.

According to VLA Ambala, Co-Founder of Stock Market Today, Nifty 50 formed a bullish Marubozu on the daily time frame and a bullish Sandwich and a bullish Marubozu on the weekly time frame.

“We can expect Nifty 50 to gather support between 25,000 and 24,950 and meet resistance between 25,260 and 25,300 in the upcoming intraday trading sessions,” Ambala said.

Bank Nifty Prediction

Bank Nifty index rallied 675.40 points, or 1.22%, to close at 56,252.85, forming a strong bullish candle in the daily chart.

“Bank Nifty gained 1.31% last week, rebounding from the prior week’s decline and closing firmly above both the 21-day and 55-day EMAs — indicating renewed short-term strength. RSI stands at 64, reflecting bullish momentum. Gains were further supported by the RBI’s relaxation in project financing norms, which lifted sentiment in financial stocks. The index is holding well above the crucial 56,000 support; below this, 55,400 is the next level to watch,” said Puneet Singhania, Director at Master Trust Group.

On the upside, he believes 56,500 remains the key resistance — breakout above it could lead to a rally toward 57,100. Traders should watch for price action near support zones for potential entry opportunities.

Bajaj Broking Research said that the Bank Nifty formed a bull candle with a higher high and higher low and a firm closing above the 56,000 levels.

“We expect the index to maintain positive bias and head towards 56,700 and 57,400 levels in the coming weeks. The immediate bias remains positive above 55,500 levels. The daily 14 periods RSI has generated a buy signal thus validates positive bias in the index,” said Bajaj Broking Research.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.