Quick overview

Chainlink (LINK) continues to follow our projections with impressive technical precision. In our May 25 forecast, we identified clear signs of bearish vulnerability, warning that a rejection at $16.95 would likely accelerate a corrective move toward $12.81 and potentially deeper into the $11.52 support region.

That scenario unfolded almost perfectly, with LINK retracing down to test both levels in sequence. Now, however, the narrative has shifted, and the technical landscape hints at a bullish reversal taking shape — bolstered by key support flips, rising price momentum, and stabilizing macro market sentiment.

Technical Outlook

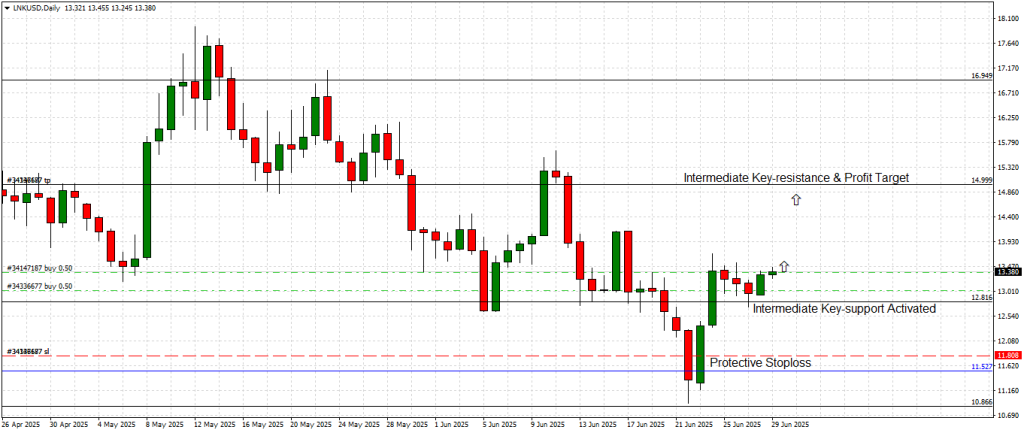

The daily chart (see attached) illustrates a clear structural rebound:

After bottoming near $11.52, LINK rebounded sharply.

The recent breakout above $12.81, a critical intermediate resistance-turned-support, signals a market structure shift.

A successful retest of this level from above confirms it as new support, adding conviction to the bullish thesis.

As of this writing, LINK is trading around $13.38, with short-term momentum pointing toward a test of the Intermediate Key-Resistance at $14.99, which serves as our official profit target for this bullish wave.

On a break above $14.99, the next significant upside level is $16.95, the major resistance level that triggered the last bearish rejection. Clearing this would open the path for a more sustained rally, especially given the improved macro environment and altcoin sector strength.

Higher Timeframe Confirmation

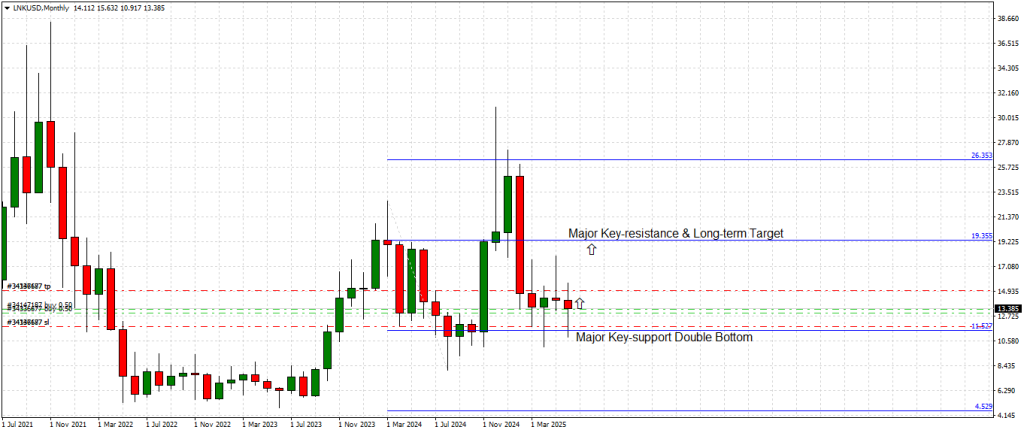

The Monthly chart provides a compelling complementary view:

LINK has printed a double bottom structure around $11.52, a historically reliable bullish reversal pattern.

A clear re-test and hold above $12.81 adds further confirmation.

The next major resistance level resides at $19.35, a long-term horizontal level and prior market pivot point.

Beyond this, a secondary upside target is marked at $26.35, though this would likely require broader market tailwinds to reach in the medium term.

As long as LINK holds above $12.81, the bullish scenario remains active, with price expected to gravitate toward the $14.99 target.

Chainlink Technology Update (June 2025)

From a fundamentals perspective, Chainlink continues to solidify its position as the leading decentralized oracle network. Recent updates include:

Launch of Chainlink CCIP (Cross-Chain Interoperability Protocol) v1.1, now integrating with several layer-2 scaling solutions, enabling secure cross-chain token transfers and messaging.

Expanded staking pools for LINK holders, improving network decentralization and incentivizing node operator participation.

Increased enterprise adoption, with recent integrations announced with TradFi institutions leveraging Chainlink’s Proof of Reserve services for on-chain asset auditing.

These enhancements not only strengthen Chainlink’s core infrastructure but also bolster long-term investor confidence, creating a supportive backdrop for the ongoing technical rebound.

Conclusion & Strategy

Chainlink’s price action has executed a textbook bottoming process at key support levels outlined in our prior forecast. With $12.81 flipped to support, bullish momentum is building, setting the stage for a move toward the $14.99 profit target.

Trading Outlook:

A clean break above $14.99 is likely to trigger the next phase of this recovery cycle, with upside potential expanding toward $16.95 and eventually $19.35 on higher timeframes.