In the current U.S. market landscape, major indices like the S&P 500 and Nasdaq have experienced fluctuations with recent slips following record highs, particularly as tech stocks face downward pressure. Amid this backdrop of mixed performance and economic optimism tied to potential trade deals and interest rate cuts, identifying promising high-growth tech stocks requires careful consideration of factors such as innovation potential, market positioning, and resilience to broader market volatility.

Top 10 High Growth Tech Companies In The United States

NameRevenue GrowthEarnings GrowthGrowth RatingSuper Micro Computer24.99%39.09%★★★★★★Circle Internet Group32.27%62.96%★★★★★★Mereo BioPharma Group53.64%66.60%★★★★★★Ardelyx21.03%60.42%★★★★★★TG Therapeutics26.46%38.75%★★★★★★AVITA Medical27.42%61.04%★★★★★★Alnylam Pharmaceuticals23.72%59.95%★★★★★★Alkami Technology20.53%76.67%★★★★★★Ascendis Pharma35.07%59.92%★★★★★★Lumentum Holdings23.02%103.97%★★★★★★

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★★☆

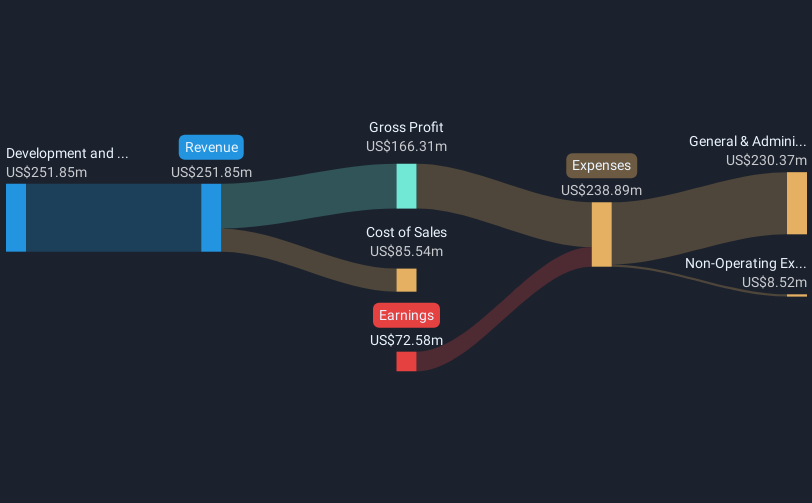

Overview: Bitdeer Technologies Group is a technology company specializing in blockchain and high-performance computing (HPC) with operations in Singapore, the United States, Bhutan, and Norway, and it has a market cap of approximately $2.18 billion.

Operations: The company generates revenue primarily from its data processing segment, which amounted to $300.40 million.

Bitdeer Technologies Group, a player in the high-growth tech sector, has shown robust activity with recent additions to multiple Russell indexes and a significant increase in self-mined Bitcoin by 18.1% from April to May 2025. Despite its unprofitability, the company’s revenue is projected to surge by 50.4% annually, outpacing the US market average of 8.8%. Furthermore, Bitdeer’s aggressive R&D investment aligns with its strategy to capitalize on cutting-edge technology in blockchain and cryptocurrency mining. This strategic focus is underscored by their recent $375 million convertible notes issuance which could fuel further innovation and expansion efforts within this volatile but rapidly evolving industry.

Simply Wall St Growth Rating: ★★★★★★

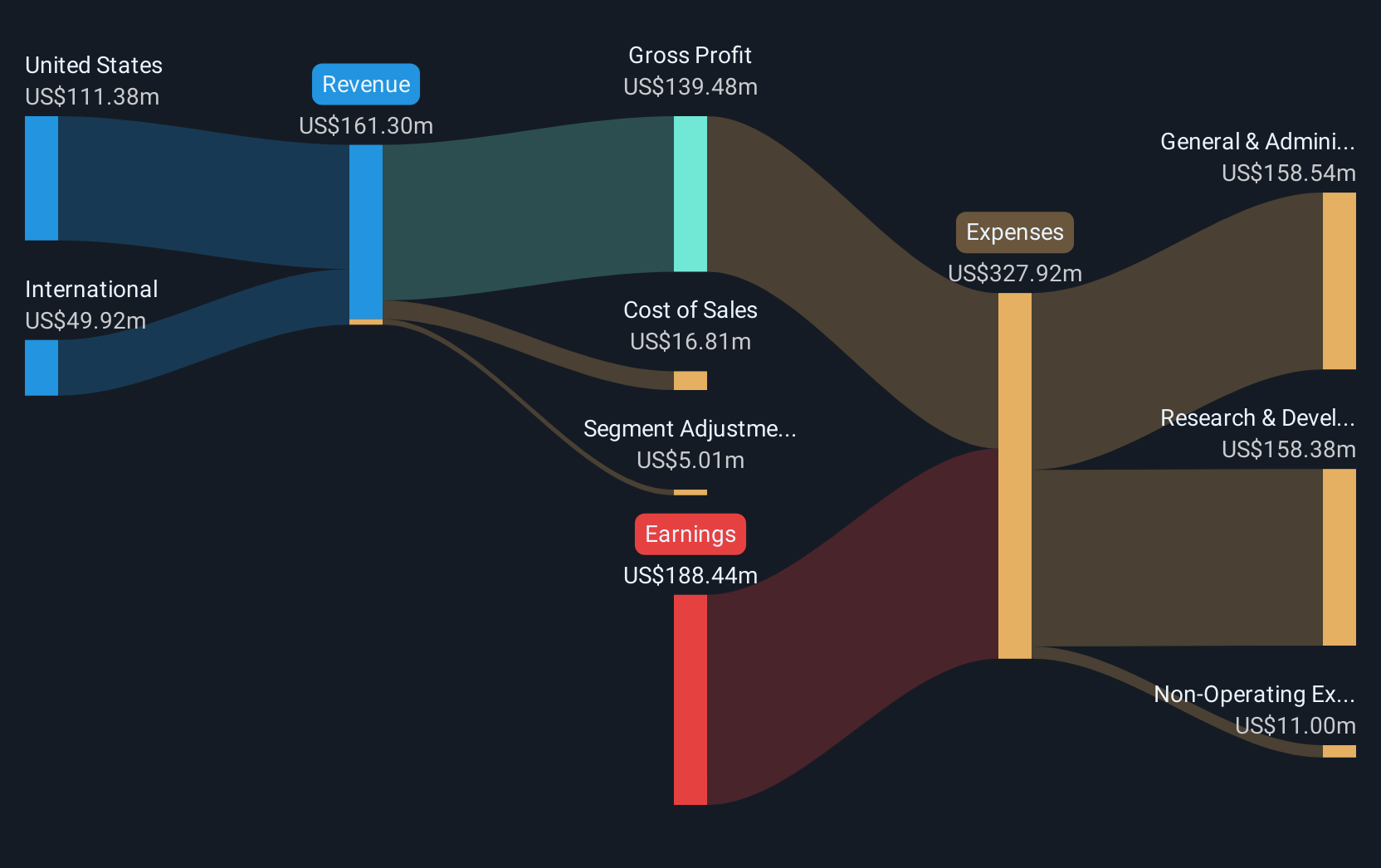

Overview: Ardelyx, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing medicines for unmet medical needs globally with a market capitalization of $882.85 million.

Operations: Ardelyx generates revenue primarily from the development and commercialization of biopharmaceutical products, amounting to $361.71 million. The company operates within the biopharmaceutical industry, targeting unmet medical needs both in the United States and internationally.

Ardelyx, Inc. is navigating a transformative phase with strategic executive appointments and promising product developments. Recently, the company reported a significant revenue jump to $74.11 million in Q1 2025 from $46.02 million in the previous year, marking a robust annual growth rate of 61%. This surge is underpinned by their innovative IBSRELA (tenapanor), which has shown efficacy in treating irritable bowel syndrome with constipation (IBS-C). The recent executive reshuffles, including Mike Kelliher’s promotion to Chief Business Officer and James P. Brady’s appointment as Chief Human Resources Officer, are poised to strengthen Ardelyx’s leadership as it scales operations and deepens its market penetration. These strategic moves could be crucial for Ardelyx as it aims to leverage its specialized R&D capabilities and expand its therapeutic offerings in niche pharmaceutical markets.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company that specializes in treatments for rare neuroendocrine diseases, with a market capitalization of approximately $3.99 billion.

Operations: Rhythm Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to $136.86 million.

Rhythm Pharmaceuticals has recently showcased robust advancements in its product pipeline, particularly with setmelanotide, which is making significant strides in treating rare genetic disorders of obesity. At the recent ENDO 2025 conference, compelling Phase 3 results highlighted setmelanotide’s efficacy, reinforcing Rhythm’s innovative edge in targeted therapies. Despite a challenging financial landscape marked by a net loss reduction to $49.5 million from $141.37 million year-over-year and revenue growth to $32.7 million from $25.97 million, these clinical successes suggest potential for future profitability and market impact. This progress is pivotal as Rhythm aims to transition from developmental phases into a profitable entity with an expected annual revenue growth rate of 43.5% and earnings growth forecast at 65.48%.

Taking Advantage

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com