US Becomes More Hawkish on Russia

Market participants learn about secondary tariffs

New tariffs would penalize buyers of Russian energy

Sets up a potential conflict between domestic and foreign policy goals

Shale productivity slipping, but mixed by basin

Sincerely,

David Thompson, CMT

Executive Vice President

Powerhouse

(202) 333-5380

The Matrix

Another arcane term from the world of international trade could soon affect energy markets. President Trump announced that the US could impose ‘secondary tariffs’ on Russia in fifty days if no peace deal is reached in the war with Ukraine.

A traditional tariff targets a specific country. A secondary tariff penalizes a third-party country that trades with the targeted nation. In the case of Russia, these secondary tariffs are clearly aimed at China and India, the two largest buyers of Russian energy. In the Oval Office, the president mentioned a figure of “around 100%, you’d call them secondary tariffs”.

If the secondary sanctions are imposed, it would mark a significant turning point. At the outset of the war, while scores of punitive measures were levied against Russia, the US largely sidestepped the kind of biting sanctions that could have driven world energy prices higher. President Trump’s repeatedly stated domestic policy aim of lowering energy costs for American consumers could be directly challenged if the secondary tariffs result in Russian energy supply effectively being removed from the global market.

The US also announced a resumption of defensive and offensive arms shipments to be supplied to Ukraine via NATO. This combination of weapons and words illustrates a noticeable change in US policy towards the conflict.

These developments also re-introduces uncertainty and volatility for the next few months. Marketers would be well-served to reach out now to talk with customers (and prospects) about how to manage price risk.

Supply/Demand Balances

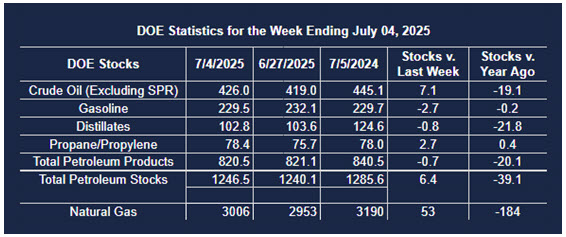

Supply/demand data in the United States for the week ended July 4, 2025, were released by the Energy Information Administration.

Total commercial stocks of petroleum increased (⬆) 6.4 million barrels to 1.2465 billion barrels during the week ended July 4th, 2025.

Commercial crude oil supplies in the United States were higher (⬆) by 7.1 million barrels from the previous report week to 426.0 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.3 million barrels to 9.2 million barrels

PADD 2: Down (⬇) 0.4 million barrels to 102.6 million barrels

PADD 3: Up (⬆) 5.8 million barrels to 240.7 million barrels

PADD 4: Up (⬆) 0.8 million barrels to 24.2 million barrels

PADD 5: Up (⬆) 0.6 million barrels to 49.3 million barrels

Cushing, Oklahoma, inventories were up (⬆) 0.5 million barrels to 21.2 million barrels.

Domestic crude oil production decreased (⬇) 48,000 barrels per day from the previous report at 13.385 million barrels per day.

Crude oil imports averaged 6.013 million barrels per day, a daily decrease (⬇) of 906,000 barrels. Exports increased (⬆) 452,000 barrels daily to 2.757 million barrels per day.

Refineries used 94.7% of capacity; a decrease (⬇) of 0.2% from the previous report week.

Crude oil inputs to refineries decreased (⬇) 99,000 barrels daily; there were 17.006 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 36,000 barrels daily to 17.199 million barrels daily.

Total petroleum product inventories decreased (⬇) by 0.6 million barrels from the previous report week, down to 820.5 million barrels.

Total product demand increased (⬆) 376,000 barrels daily to 20.863 million barrels per day.

Gasoline stocks decreased (⬇) 2.7 million barrels from the previous report week; total stocks are 229.5 million barrels.

Demand for gasoline increased (⬆) 519,000 barrels per day to 9.159 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 0.8 million barrels from the previous report week; distillate stocks are at 102.8 million barrels. EIA reported national distillate demand at 3.668 million barrels per day during the report week, a decrease (⬇) of 375,000 barrels daily.

Propane stocks rose (⬆) 2.7 million barrels from the previous report to 78.4 million barrels. The report estimated current demand at 1,030,000 barrels per day, an increase (⬆) of 568,000 barrels daily from the previous report week.

Natural Gas

Analysts at Morgan Stanley have analyzed natural gas production trends on the basin and company level. They anticipate that as the sector matures, shale operators will continue to shift to less productive acreage. Not all basins are behaving equally as the graphic below illustrates.

Early 2025 data suggest that at least one large driller in the Marcellus has seen strong improvement in production gains but it remains to be seen if the Utica and Haynesville trends change.

According to the EIA:

Net injections into storage totaled 53 Bcf for the week ended July 4, compared with the five-year (2020–24) average net injections of 53 Bcf and last year;s net injections of 61 Bcf during the same week. Working natural gas stocks totaled 3,006 Bcf, which is 173 Bcf (6%) more than the five-year average and 184 Bcf (6%) lower than last year at this time.

According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 51 Bcf to 68 Bcf, with a median estimate of 60 Bcf.

The average rate of injections into storage is 24% higher than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 7.7 Bcf/d for the remainder of the refill season, the total inventory would be 3,926 Bcf on October 31, which is 173 Bcf higher than the five-year average of 3,753 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2025 Powerhouse Brokers, LLC, All rights reserved