Market snapshot

Prices current around 12:15pm AEST.

Live updates on the major ASX indices:

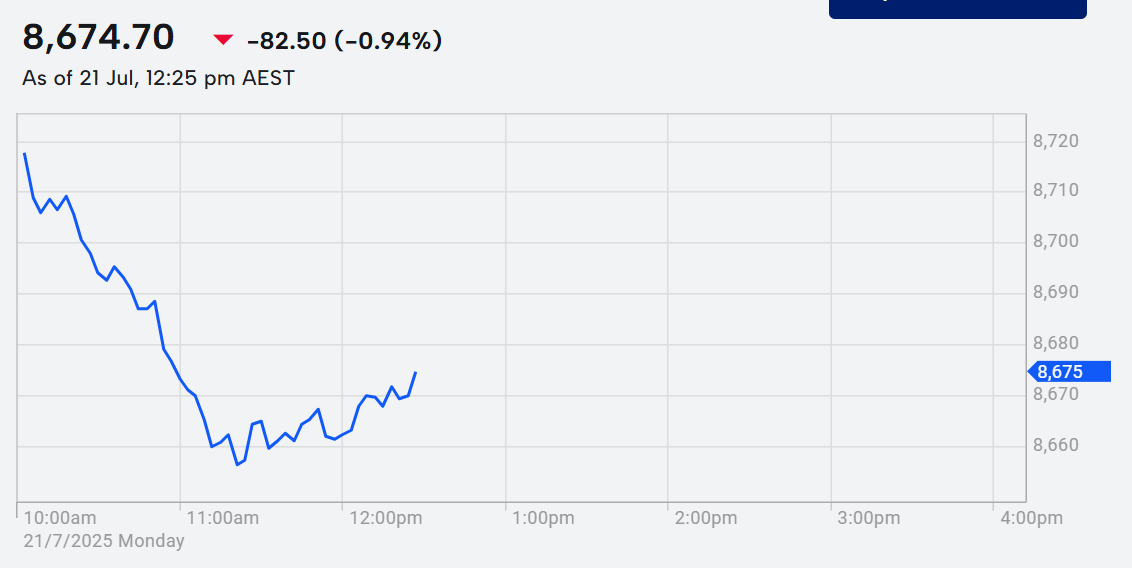

ASX sharply lower

The ASX is sharply lower as we push towards 1pm AEST on Monday.

Just before 12:30pm, the benchmark index was down 1% to 8,674 points.

The sell-off follows Friday’s record close on the ASX.

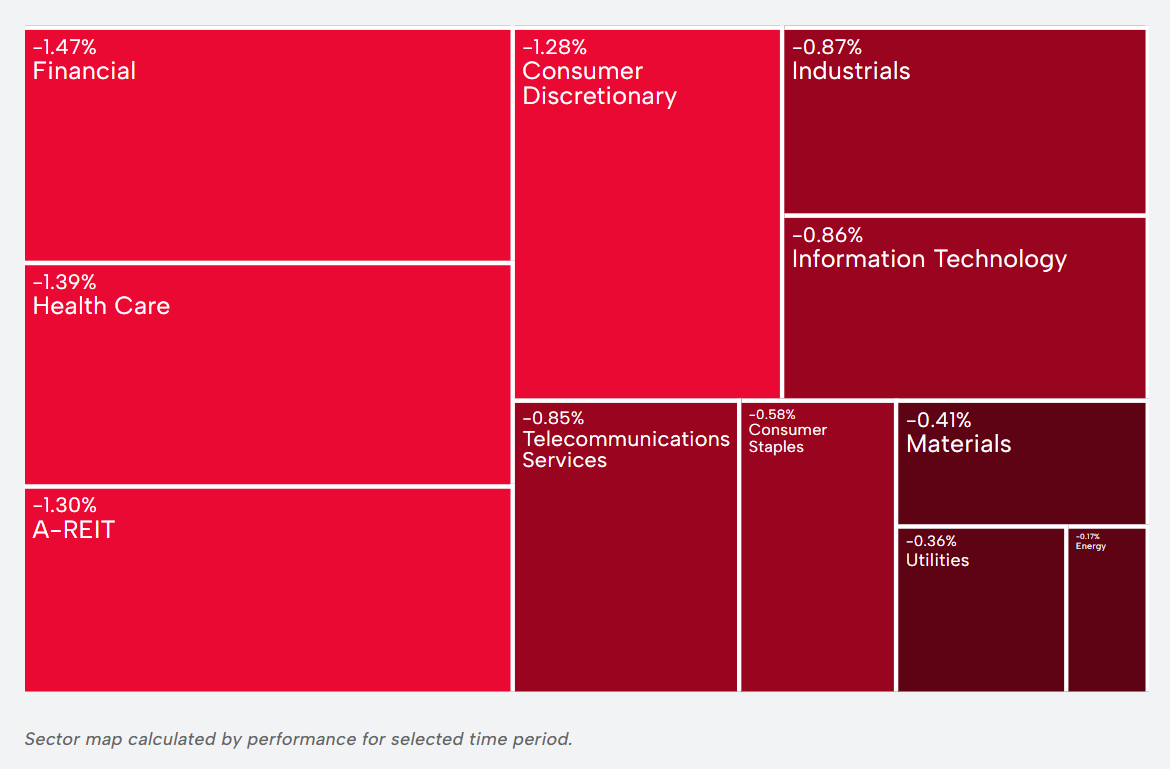

All 11 sectors are lower with the biggest sell-offs in financials, health care and real estate.

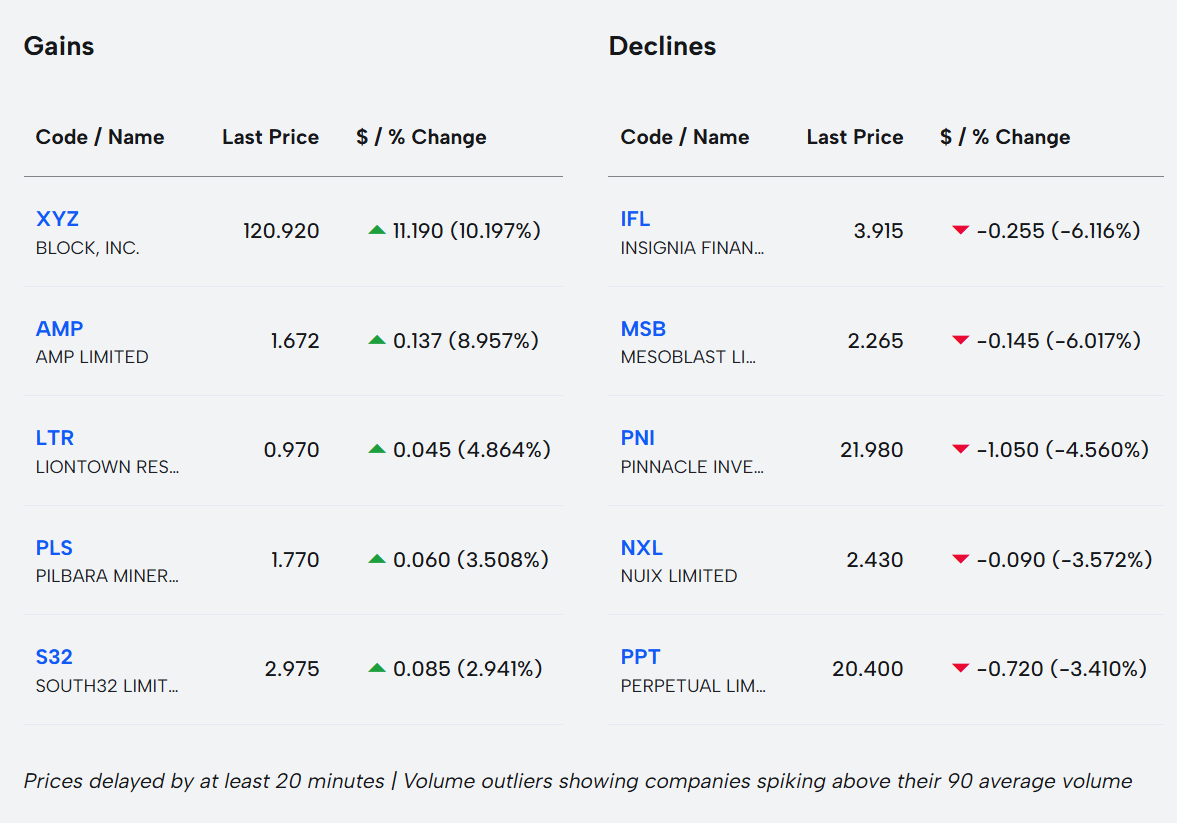

Here’s a look at the biggest gains and declines:

49m agoMon 21 Jul 2025 at 2:06am

Illicit tobacco ‘out in the open’ amid calls to manage supply

Illicit tobacco is on the rise — in 2023, it was estimated that its consumption may account for close to 30 per cent of the total tobacco market in Australia, although these estimates by the legal tobacco industry are disputed.

The vast price difference between legal products and those on the black market is because of the tax excise that is added to legal cigarettes, which can be up to 70 per cent of the total retail price.

University of Sydney public health professor Becky Freeman says, despite having some of the lowest smoking rates our country has seen, we are seeing illegal tobacconists “popping up everywhere” because “cigarettes are so incredibly profitable”.

The current revenue for the government from tobacco excise sits at about $7.4 billion — a drop from $12.6 billion in 2022-2023 and $16.3 billion in 2019-2020.

During a press conference last month, Treasurer Jim Chalmers said there were two reasons for the decline.

“The good reason is fewer people smoking, the bad reason is we know that we’ve got a challenge when it comes to illegal tobacco,” he says.

Read the full story from business reporter Adelaide Miller:

NZ inflation at highest in year but below forecasts

New Zealand’s annual inflation rate has picked up, but below economists’ forecasts.

Annual inflation came in at 2.7 per cent in the second quarter, its highest level in a year, and speeding up from the 2.5 per cent rate in the first quarter, Statistics New Zealand said in a statement on Monday. However, economists had forecast inflation at 2.8 per cent.

On a quarter-on-quarter basis, the consumer price index rose half a per cent, compared with a 0.9 per cent increase in the first quarter. Economists in a Reuters poll had forecast a 0.6 per cent rise for the quarter.

The Reserve Bank of New Zealand held rates steady this month, the first pause in its current easing cycle which began last August.

After today’s consumer price index (CPI), markets are now pricing in a 75 per cent chance of an 0.25 percentage point cut when the RBNZ meets in August.

“Measures of core inflation remained stable and well anchored within the target band,” UBS economists wrote in a note.

“We are more confident that current change in global tariffs will not be inflationary for New Zealand in coming quarters.

“…following today’s data, we see a very high probability (>90%) that the RBNZ will cut in August, and we feel a bit more confident that the RBNZ will end up delivering another cut in November (~75% probability).”

Reporting with Reuters

South32 shares rise on production update

Shares in miner South32 are up 2.6 per cent, putting it among the best performers of the session.

The company reported fourth quarter manganese ore production ahead of analysts’ estimates, recovering from the disruption of severe storms at the start of the year.

“Australian Manganese successfully resumed export shipments during the quarter, marking a significant recovery from the impacts caused by Tropical Cyclone Megan,” S32 chief executive Graham Kerr said in a statement to the ASX.

Overall production came in above guidance, while sales volumes increased by 21 per cent in the quarter.

RBC Capital Markets analyst Kaan Peker described it as a good result overall, noting production guidance was met or exceeded across most assets and realised pricing was also better than expected.

However, he did note some higher costs for the miner’s Hillside aluminium smelter in South Africa, as well as uncertainty around its Cannington silver, lead and zinc mine in Queensland, with South32 saying it’s “reviewing the mine plan in response to increasing underground complexity”.

1h agoMon 21 Jul 2025 at 1:32am

Ageism in the workplace

Re: ageism – I’m 48. I’ve been looking for a job for 4 years. I am highly qualified with over a decade of experience in the field I want to work in, and a graduate degree, also in that field. It’s the typical story – I took a break for caring duties and now I want to re-enter the workplace. I can’t even get a look-in from K-mart. It’s incredibly demoralising.

– not too old at all

Lots of comments such as this after the release of that Australian Human Rights Commission report earlier, always shattering.

Amazing that with such substantial staff shortages in so many fields, employers don’t want experienced people.

Good luck with finding something that values your skills and experience.

1h agoMon 21 Jul 2025 at 1:25am

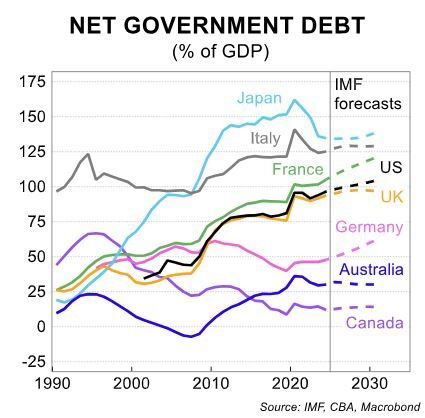

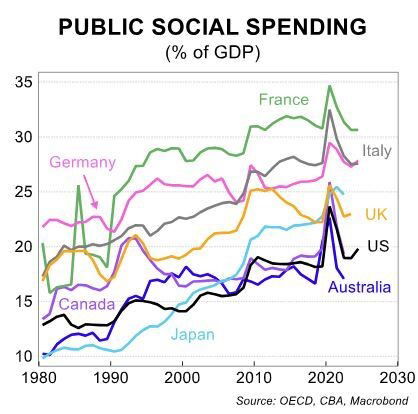

Two graphs that paint a somewhat different picture to what you might hear

Gotta hand it to the person who came up with the mantra that a picture is worth 1,000 words.

To listen to much of our discourse about government debt and public spending, you’d think we’re in some kind of tinpot dictatorship that’s spending all of its cash on public-pleasing largesse and Colosseums.

(Let’s keep this conversation away from the controversial Hobart stadium and the impact of that on the on-going Tasmanian election!)

But two charts from CBA this morning show something pretty stark: this is an economy you’d kind of want.

Here’s net government debt.

Despite the growth of the NDIS and some welfare payments, we actually spend far less on social supports than other nations.

(Notably, and not in a good way, our unemployment benefits are among the lowest in the OECD group of nations.)

1h agoMon 21 Jul 2025 at 1:06am

Vale Peter Ryan

Very sad news of the passing of Peter Ryan. Ex Marist boy (Eastwood) as I was. What a wonderful human being and exceptional journalist he was. His voice captured your attention with ease as he passed on his years of knowledge and wisdom to his audiences. He leaves an extraordinary legacy and I extended my deepest condolences to his family and friends.

– Peter

Thanks for sharing Peter.

Loading…

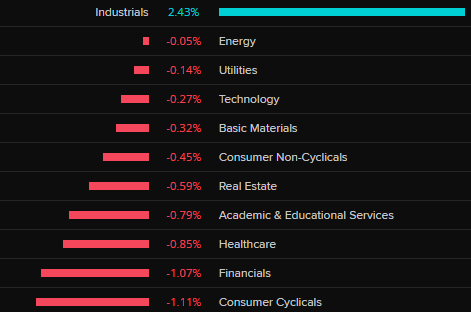

ASX off 0.8pc with most sectors losing ground

The ASX 200 has dropped 0.8 per cent in early trade.

Most sectors are lower, with the exception of industrials.

Here are the best performing stocks so far:

Block +10.7%AMP +7.7%Clarity Pharmaceuticals +4.1%Liontown Resources +2.7%South32 +1.6%

And the worst:

Mesoblast -9.5%Insignia Financial -5.8%Regis Resources -3.4%Corporate Travel Mgmt -3.4%News Corp -2.9%

2h agoMon 21 Jul 2025 at 12:47am

Let’s change capital gains tax, says think tank

A new paper from Professor Richard Holden and McKell Institute CEO Edward Cavanough calls for a major shake-up of capital gains tax via a “circuit breaker” proposal to the stalled national housing debate.

The left-wing think tank suggests that instead of simply increasing or decreasing the CGT discount, the paper takes a more nuanced approach:

1.Increase the CGT discount on new attached builds to 70 per cent, from 50 per cent2.Decrease the CGT discount on existing detached dwellings to 35 per cent, from 50 per cent3.Leave the CGT discount on new detached dwellings unchanged at 50 per cent

This proposal would “grandfather” (maintain essentially forever) all existing investments.

The institute estimates this proposal would generate a 1.2 per cent “uplift” on supply, helping Australia get back on track to its target of 1.2 million homes by 2030. It could see up to 130,000 additional homes built by 2030.

The paper will be submitted to the government’s imminent productivity roundtable.

“Labor has resisted change to the CGT discount for too long,” Mr Cavanough said.

“It needs to creatively reform this poorly targeted tax concession so it works both in the interests of aspirational Australians and society more broadly.

“We have to stop seeing capital gains tax as some kind of grand moral question. That approach has caused a stalemate in this country that has stalled the progress we need on fixing the housing crisis.

“The CGT tax discount is neither good nor evil. But it should be better calibrated to actually achieve our social aims. Instead of encouraging property investors to bid up the price of existing housing stock we should be encouraging them to contribute to the construction of new dwellings. Our modelling shows that with a couple of simple tweaks the government could stimulate supply without affecting the budget bottom line.”

Professor Holden said the “hard reality is Australia just isn’t going to hit its objective of 1.2 million additional homes by 2030 if we retain existing settings”.

“A key problem with our existing tax settings on property is they orient too much investment toward established dwellings, at the cost of new supply,” he said.

“There is nothing wrong with the commonly held desire of everyday investors to secure their future by investing in the housing market. But this desire should be harnessed to achieve our national objectives on housing supply.”

You can read more about the proposal here:

2h agoMon 21 Jul 2025 at 12:41am

Let’s get METAL, says opposition

Radio National Breakfast had Alex Hawke — shadow minister for industry and innovation and manager of opposition business — on earlier, talking about what he thinks needs to be happen with metals manufacturing in Australia.

He talks about our high-cost environment but also our high quality goods in this area. Mr Hawke says we need steel manufacturing here, and more should be done to lower the costs for manufacturers, and make it easier for these goods to be made here rather than just selling off the raw materials to another country to process.

All of this reminds me, Metallica is touring soon.

Loading

Also, here’s the interview with Alex Hawke.

2h agoMon 21 Jul 2025 at 12:33am

AMP charged life insurance premiums to people it knew were dead

Sorry, have to step into the time machine.

In one of the — and there’s quite a list — most galling moments of the Hayne royal commission, AMP executives were grilled about the practice of charging life insurance premiums to customers it definitely knew were dead.

Here is ABC business digital editor Stephanie Chalmers, writing at the time:

Despite internal concerns and customer complaints since at least 2016, AMP continued to deduct premiums from some superannuation accounts after being notified of the customer’s death, with the intention of refunding them when the death benefit is paid out.

Under questioning by commissioner Kenneth Hayne, AMP customer and wealth executive Paul Sainsbury admitted the refunds do not include the extra money that would have been earned if the premiums had not continued to be taken out of the superannuation accounts.

Hayne: So the time value of money goes to AMP’s benefit?

Sainsbury: Potentially.

Hayne: Charging premiums for life insurance to someone who is dead, that’s the position, isn’t it?

Sainsbury: Yes, that’s the way the system is treating it today for a portion of our business.

Later, Mr Sainsbury added:

“[The investigation is] still ongoing, but it does appear as though there are other fee types that have been deducted post the date of death that will need to be refunded as well.”

2h agoMon 21 Jul 2025 at 12:27am

AMP Super gets people to give it money for the first time in eight years

In the 2018-2019 Banking Royal Commission, AMP was rightly hammered for conflicts of interest, lying to regulators, ripping off its own customers and generally being a fantastic place to go if you really hated your own money.

In the wake of it, each quarter revealed a growing toll… billions of dollars in ‘outflows’ – money leaving the stewardship of the financial octopus – from superannuation customers who looked at the mess and thought literally anywhere would be a better place to store their money.

Today, a landmark moment.

As AMP’s second quarter figures for 2025 reveal “positive net cashflows for the quarter of $33 million, the first time since Q2 2017” and a reversal of Q2 2024 result of $99 million leaving.

CEO Alexis George calls it a “significant milestone” for the super business of AMP.

“This reflects our continued efforts to build a compelling member proposition which is delivering outstanding investment returns, service and education”

By funds under management (FUM) AMP is the 8th biggest in Australia, according to recent KPMG research, just ahead of CBUS and industry funds like REST and HESTA.

By account numbers it is 10th.

AMP shares have soared +5.5% on that and other news, to $1.62 at the time of writing.

2h agoMon 21 Jul 2025 at 12:26am

RBA rate pause has ‘psychological’ impact, former deputy governor notes

Westpac chief economist Luci Ellis, a former RBA deputy governor, has some interesting thoughts on the ‘hold’ decision that shocked markets last week.

“While there was nothing economically to be gained by the RBA waiting to cut rates, neither was there any material policy cost. Psychological and organisational factors therefore might have come into play, with the RBA taking the opportunity to assert some independence.

“Not paying enough attention to these psychological issues was a mistake, and thus a learning opportunity.

“Psychological factors are also at play in global tariff negotiations. If people think you will chicken out, you set out to prove them wrong. Asserting dominance is another psychological factor at work in the international sphere. This complicates analysis and prediction, but economic fundamentals still matter as well.”

2h agoMon 21 Jul 2025 at 12:18am

Market snapshot

Prices current around 10:15am AEST.

Live updates on the major ASX indices:

ASX falls from record levels at the open

The Australian share market has kicked off its trading week in the red.

The ASX 200 is down 0.6 per cent, as is the All Ordinaries.

Temu doubles Australian ad spend in response to US tariffs

Online shopping platforms based overseas are spending millions of extra dollars on advertising in Australia as they seek to expand their presence outside the US, following the introduction of President Donald Trump’s heavy new import tariffs.

US market intelligence firm Sensor Tower says Temu has increased its Australian advertising spend by 110 per cent — and the platform’s monthly users have increased by 50 per cent for the June quarter.

Shein, another Chinese marketplace app, increased its monthly Australian advertising spend by 160 per cent, for a 15 per cent increase in monthly users.

The ad spending spree has prompted concerns from some about the potential for unsafe products to enter the country, with consumer advocacy group Choice calling for stronger protections for Australians buying imported goods from online marketplaces.

Read more from reporter James Taylor:

2h agoSun 20 Jul 2025 at 11:59pm

New report calls for government spending cuts

The right-wing Centre for Independent Studies think tank has put out a new study suggesting the growth in government spending threatens the nation’s economic future

“Australia’s government expenditure has surged to a post-war high (except for the pandemic-era spike) of 38–39% of GDP, up from 34–35% before the 2008 global financial crisis,” it posits.

“Leviathan on the Rampage: Government spending growth a threat to Australia’s economic future” comes from former World Bank, IMF and federal and state Treasury economist Robert Carling.

It warns that federal spending alone has climbed from 24–25% to 27.6% of GDP since 2012-13, fueled by a “culture of entitlement and relentless program expansion in social services, defence and debt interest”.

Here are its key findings, according to a media release from the Centre:

Real per capita federal spending has risen 1.8% on average annually since 2012-13, far exceeding Australia’s 0.5% productivity growth and more than double real GDP growth.A dozen fast-growing programs — including the NDIS, aged care, defence, schools, Medicare and child care — account for 63% of the increase in federal own-purpose spending in that period and now represent around half of such spending.Public debt interest is projected to rise 9.5% a year for the next decade, as higher rates refinance pandemic-era borrowing and ongoing deficits push debt up further.Off-budget “investments” — from student loans to energy transition funds — add a further $104 billion in hidden spending over five years.

Carling urges immediate expenditure reform, including:

Rolling reviews of major programs to cut waste and lift effectiveness.Fiscal rules to cap per-capita spending growth below GDP growth.Freeze public-service numbers and shift from consultants to permanent staff.Shelve new spending ideas — including universal child care and expanded Medicare dental cover.Return to structural surplus by 2029-30, echoing successful consolidations of the 1980s and 1990s.

You can read more about the proposal here.

3h agoSun 20 Jul 2025 at 11:47pm

The All Ords cracked 9,000 points on Friday. What will happen today?

Big moment for the big index on Friday.

Before we get started, here’s how my colleagues saw it on Friday as the All Ordinaries index broke through 9,000 points for the first time.

The ‘All Ords’ tracks the value of the 500 biggest listed companies on the Australian stock exchange.

3h agoSun 20 Jul 2025 at 11:43pm

US confident it can reach a trade deal with Europe

US Commerce Secretary Howard Lutnick said yesterday he was confident the United States could secure a trade deal with the European Union, but August 1 is a hard deadline for tariffs to kick in.

Lutnick said he had just gotten off the phone with European trade negotiators and there was “plenty of room” for agreement.

“These are the two biggest trading partners in the world, talking to each other. We’ll get a deal done. I am confident we’ll get a deal done,” Lutnick said in an interview with CBS’s Face the Nation.

US President Donald Trump threatened on July 12 to impose a 30% tariff on imports from Mexico and the European Union starting on August 1, after weeks of negotiations with the major US trading partners failed to reach a comprehensive trade deal.

Lutnick said that was a hard deadline.

“Nothing stops countries from talking to us after August 1, but they’re going to start paying the tariffs on August 1.”

Trump announced the tariffs in a letter to European Commission President Ursula von der Leyen. He sent letters to other trading partners including Mexico, Canada, Japan and Brazil, setting blanket tariff rates ranging from 20% to 50%, as well as a 50% tariff on copper.

Lutnick also said he expected Trump to renegotiate the United States-Mexico-Canada Agreement (USMCA) signed during Trump’s first White House term in 2017-21.

Barring any major changes, USMCA-compliant goods from Mexico and Canada are exempt from tariffs.

“I think the president is absolutely going to renegotiate USMCA, but that’s a year from today,” Lutnick said.

– Reuters