(Bloomberg) — Under the surface of the US stock market’s march to record highs this month, there are signs the rally is running out of gas.

Most Read from Bloomberg

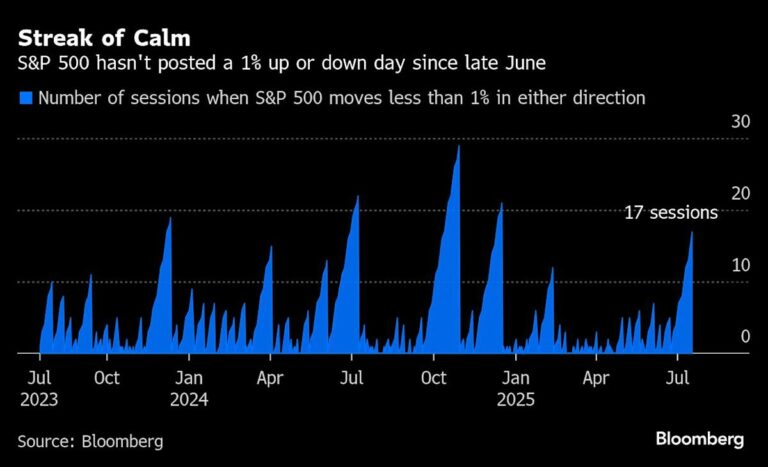

The S&P 500 Index has gone 17 sessions without a move of 1% in either direction, the longest stretch of relative tranquility since December. For Matt Maley at Miller Tabak & Co., the diminished movement shows the market’s momentum is waning after its scorching rebound from April’s tariff-fueled lows.

Amid a barrage of headlines about the Federal Reserve chair’s job security and President Donald Trump’s trade war over the past few weeks, investors appear to be tiring of waiting for more stocks to join the tech-led market surge, said Maley, the firm’s chief market strategist.

“Whenever a narrow rally losses steam, it usually signals that investors are starting to look for signs of a broader rally,” he said. “When they don’t get it, they tend to pull back for a while.”

It’s hard to blame them for retrenching at the moment, with earnings season just getting underway, trade negotiations in flux and expectations growing that the Fed is months away from potentially cutting interest rates.

As Aaron Nordvik at UBS Securities LLC sees it, the tailwinds that were driving shares higher are now easing, such as the stock market’s history of strength in July.

“I’ve been quite bullish for a while now, but most of the good news is now in the price,” said Nordvik, a macro equity strategist at the firm. While he says a sharp slump is unlikely, in his view the risk-reward profile for equities is less attractive than even just a couple weeks ago.

This week has the potential to stir up volatility. Two members of the so-called Magnificent Seven megacap tech stocks that powered the market higher in recent years are set to report results — Tesla Inc. and Google parent Alphabet Inc. The stakes will again be high for the cohort as Wall Street looks for an update on their spending plans, especially related to artificial intelligence.

Then comes the Fed’s July 30 policy decision. The central bank is widely expected to keep rates on hold. But all eyes will be on Chair Jerome Powell to see whether he’ll respond to Trump’s relentless pressure on him to cut borrowing costs, or reports that the president was on the brink of seeking to fire him.

Momentum Reading

For now, stocks are near an all-time high, sustained by a broad sense that the US economy is holding up in the face of the president’s tariffs, while inflation remains muted.

Story Continues