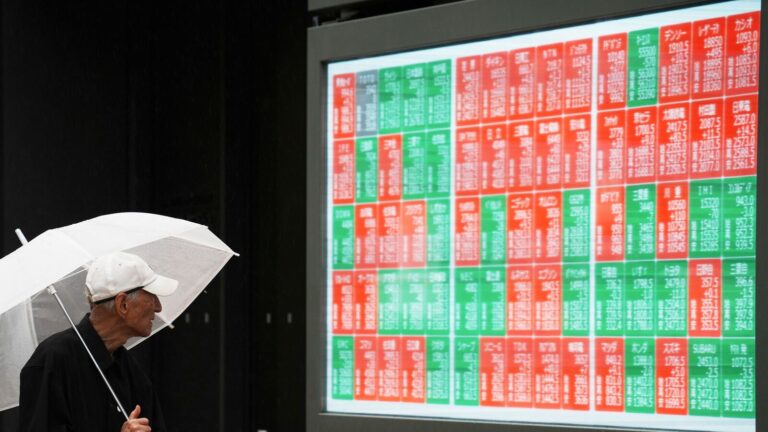

Indian stock market: The domestic equity benchmark indices, Sensex and Nifty 50, are expected to open higher on Tuesday, extending gains from previous session, following upbeat global market cues.

Asian markets gained, while the US stock market ended mostly higher overnight, with the S&P 500 and the Nasdaq notching record high close.

On Monday, the Indian stock market indices ended higher, lifted by a rally in banking heavyweights, with the benchmark Nifty 50 reclaiming 25,000 level.

The Sensex gained 442.61 points, or 0.54%, to close at 82,200.34, while the Nifty 50 settled 122.30 points, or 0.49%, higher at 25,090.70.

“The market currently reflects a tug-of-war between bulls and bears, with the focus primarily on earnings for further direction. Given the prevailing volatility driven by earnings announcements, participants should prioritize risk management over aggressive positioning,” said Ajit Mishra – SVP, Research, Religare Broking Ltd.

Here are key global market cues for Sensex today:

Asian Markets

Asian markets traded higher on Tuesday, following overnight rally on Wall Street. Japan’s Nikkei gained 1.1%, while the Topix index surged 0.96%. South Korea’s Kospi index rose 0.1% while the Kosdaq advanced 0.7%. Hong Kong’s Hang Seng index futures indicated a stronger opening.

Gift Nifty Today

Gift Nifty was trading around 25,183 level, a premium of nearly 55 points from the Nifty futures’ previous close, indicating a positive start for the Indian stock market indices.

Wall Street

US stock market ended mostly higher on Monday as tariff negotiations between the US and its trading partners gathered pace ahead of the August 1 deadline.

The Dow Jones Industrial Average fell 18.66 points, or 0.04%, to 44,323.53, while the S&P 500 rose 8.89 points, or 0.14%, to 6,305.68. The Nasdaq Composite closed 78.52 points, or 0.38%, higher at 20,974.18.

Google-parent Alphabet share price rallied 2.7%, Tesla stock price fell 0.35%, while Apple shares gained 0.62% and Amazon stock rose 1.43%. Nvidia share price declined 0.60% and Verizon shares rallied over 4%.

India-US Trade Deal Talks

A team of US trade officials will visit India in August for the next round of talks for the proposed bilateral trade deal between the two nations, reported news agency PTI. Last week, India and the US officials concluded the fifth round of trade talks in Washington.

Core Sector Growth

India’s eight core infrastructure sectors’ growth slowed down to 1.7% in June 2025 from 5% in the same month last year. The expansion during the month under review is slightly up as compared to May, when these sectors grew 1.2%.

Jane Street Saga

Sebi has allowed Jane Street to resume trading after the US high-frequency trading firm deposited ₹4,840 crore in an escrow account last week. Jane Street is also directed to cease and desist from, directly or indirectly engaging in any fraudulent, manipulative or unfair trade practices.

Dollar

The US dollar traded in a tight range on Tuesday after a brief fall at the start of the week. The US dollar index, which measures the greenback against a basket of currencies including the yen and the euro, rose slightly to 97.94, after having fallen 0.6% on Monday. The Japanese currency was last a touch weaker at 147.65, sterling traded 0.03% lower at $1.3488, and the euro fell 0.12% to $1.1684.

US Treasury Yields

US Treasuries rallied, pushing yields lower. The yield on benchmark US 10-year notes fell 4.7 basis points to 4.384%. The 30-year bond yield fell 5 bps to 4.9491% and the 2-year note yield fell 1.4 bps to 3.863%.

Gold Prices

Gold prices rose to their highest point in more than a month, supported by a weaker US dollar and lower Treasury yields. Spot gold price was steady at $3,390.73 per ounce, after hitting its highest since June 17 earlier in the session. US gold futures held their ground at $3,404.20.

Crude Oil Prices

Crude oil prices fell on concerns that a brewing trade war between the US and the European Union will curb fuel demand growth. Brent crude futures fell 0.35% to $68.97 a barrel, while US West Texas Intermediate crude price was at $66.99 a barrel, down 0.31%.

(With inputs from Reuters)

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.