The United States market has shown robust performance, rising 1.7% in the last week and 18% over the past year, with all sectors contributing to this upward trend and earnings projected to grow by 15% annually in the coming years. In such a dynamic environment, identifying high growth tech stocks involves assessing factors like innovation potential, scalability, and their ability to capitalize on technological advancements within these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

NameRevenue GrowthEarnings GrowthGrowth RatingSuper Micro Computer25.17%38.20%★★★★★★Circle Internet Group30.81%60.66%★★★★★★Ardelyx20.96%62.26%★★★★★★TG Therapeutics26.14%39.04%★★★★★★Alkami Technology20.57%76.67%★★★★★★AVITA Medical27.39%61.05%★★★★★★Alnylam Pharmaceuticals24.07%59.30%★★★★★★Ascendis Pharma34.90%59.91%★★★★★★Caris Life Sciences24.80%72.64%★★★★★★Lumentum Holdings21.59%106.24%★★★★★★

Click here to see the full list of 220 stocks from our US High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★☆

Overview: UroGen Pharma Ltd. focuses on developing and commercializing treatments for urothelial and specialty cancers, with a market cap of $783.57 million.

Operations: UroGen Pharma Ltd. generates revenue primarily from its biotechnology segment, amounting to $91.87 million. The company is involved in creating and marketing therapies specifically targeting urothelial and specialty cancers.

UroGen Pharma’s recent advancements underscore its commitment to innovation in non-muscle invasive bladder cancer treatments. The FDA’s approval of ZUSDURI and the ongoing Phase 3 UTOPIA trial highlight its R&D focus, with significant investment in proprietary RTGel® technology, which facilitates sustained drug release. Despite facing regulatory challenges as seen with UGN-102, UroGen’s robust pipeline and strategic R&D spending are pivotal. The company’s ability to navigate FDA processes and deliver on clinical promises will be crucial for its trajectory in a competitive biotech landscape.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on developing, manufacturing, and distributing cellular therapies and specialty biologic products for sports medicine and severe burn care markets in North America, with a market cap of $1.91 billion.

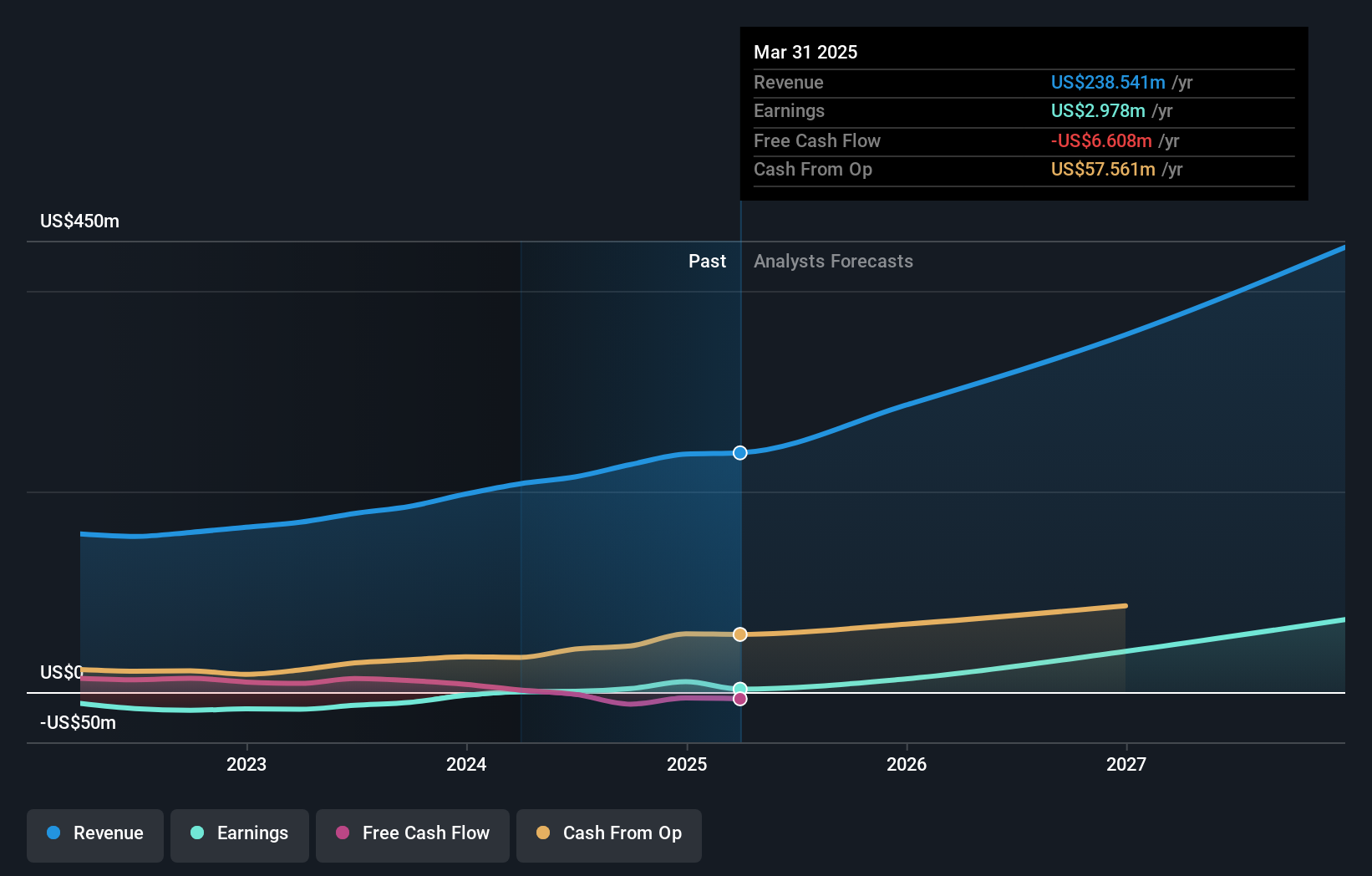

Operations: The company generates revenue primarily from its biotechnology segment, which reported $238.54 million. It specializes in cellular therapies and biologic products tailored for sports medicine and severe burn care within the North American market.

Vericel’s dynamic presence in the biotech sector is underscored by its impressive annual revenue and earnings growth, at 21.2% and 46.3% respectively, signaling robust market performance. The company’s recent inclusion in the Russell 2000 Growth-Defensive Index reflects its strategic positioning within high-growth indices, further bolstered by a significant earnings surge of 560.3% over the past year. Despite a challenging quarter with a net loss increase, Vericel maintains optimistic revenue growth projections between 22% to 25% for the upcoming quarter, underpinning its resilience and adaptability in a competitive landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Calix, Inc. is a company that offers cloud and software platforms, systems, and services across various regions globally, with a market cap of approximately $3.62 billion.

Operations: The company generates revenue primarily from developing, marketing, and selling communications access systems and software, totaling approximately $869.19 million.

Calix’s recent strategic maneuvers, including a significant shelf registration and robust share repurchase program, underscore its aggressive capital management approach amidst a challenging financial landscape marked by a net loss reduction from $7.96 million to $0.199 million year-over-year for Q2 2025. The launch of CommandIQ® 3.0 highlights its innovative thrust in the AI-driven smart home market, aiming to enhance broadband service providers’ engagement and ARPU through advanced features like personalized user interfaces and integrated cybersecurity measures. This product evolution is pivotal as Calix transitions from traditional hardware offerings to comprehensive solutions that encapsulate software prowess and subscriber-centric services, positioning it uniquely within the tech landscape despite slower revenue growth projections compared to industry giants.

Turning Ideas Into Actions

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com