Goldman Sachs and U.S. Treasury Secretary Scott Bessent expect a stablecoin gold rush, driven by new regulations and massive potential for payment market expansion. Stablecoins, which must be backed by U.S. dollars or Treasuries, could boost demand for government bonds, though some argue this mostly redistributes money, rather than increasing the net demand for debt.

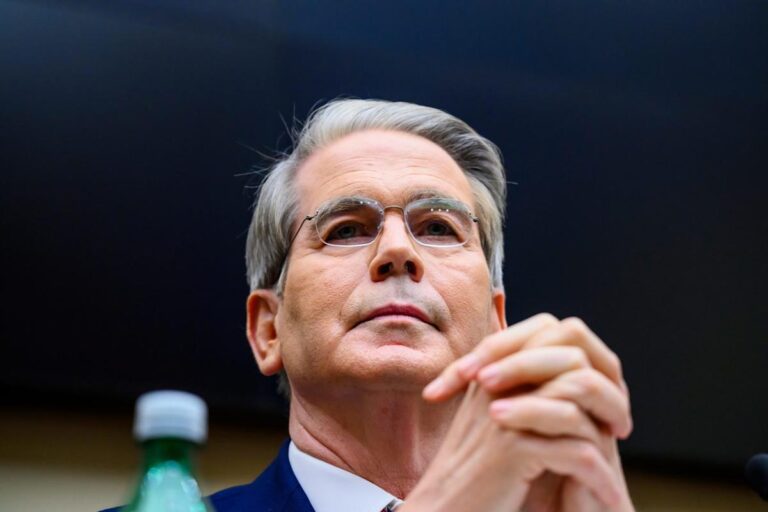

U.S. Treasury Secretary Scott Bessent believes stablecoins will buoy the market for U.S. Treasuries, and the government will sell more short-term debt to meet that demand, according to the Financial Times. “Bessent has signaled to Wall Street that he expects stablecoins, digital tokens that are backed by high-quality securities such as Treasuries, to become an important source of demand for U.S. government bonds,” the FT reported.

The FT’s sources asked for anonymity, but there was no need for them to be coy: Bessent said in a press statement back in July that he expected demand for cryptocurrencies—backed 1 to 1 with U.S. dollar instruments—to support the price of bonds:

“This groundbreaking technology will buttress the dollar’s status as the global reserve currency, expand access to the dollar economy for billions across the globe, and lead to a surge in demand for U.S. Treasuries, which back stablecoins. The GENIUS Act provides the fast-growing stablecoin market with the regulatory clarity it needs to grow into a multitrillion-dollar industry,” he said at the time.

The GENIUS Act, announced last month, “aligns State and Federal stablecoin frameworks, ensuring fair and consistent regulation throughout the country,” the White House said at the time.

So how big a deal will this be?

Goldman Sachs thinks we’re at the beginning of a stablecoin gold rush, according to a research paper published today by the bank’s Will Nance and others.

“Stablecoins are a $271bn global market, and we believe USDC [the stablecoin issued by Circle] benefits from market share gains on and off of partner Binance’s platform, as ongoing stablecoin legislation legitimizes the ecosystem, and the crypto ecosystem expands, also potentially catalyzed by legislation. Based on current trends and announced initiatives, we see $77bn of growth in USDC, or a 40% CAGR, from 2024-27E,” they wrote.

The potential total market for stablecoins is in the trillions, Goldman says. “Visa sizes the addressable market for payments at ~$240 trillion in annual payment volume, with consumer payments representing ~$40 trillion of annual spending. B2B payments comprise roughly ~$60bn while P2P payments and disbursements comprise the remainder.

Story Continues