As the United States market navigates a tech stock slump and anticipates insights from Federal Reserve Chair Jerome Powell, small-cap stocks may present unique opportunities amid broader market volatility. In this environment, identifying promising small-cap companies can be crucial for investors seeking diversification and potential growth, as these “undiscovered gems” often thrive by capitalizing on niche markets or innovative strategies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingFirst Bancorp75.89%1.93%-1.42%★★★★★★Morris State BancsharesNA3.34%3.70%★★★★★★ASA Gold and Precious MetalsNA12.79%-0.59%★★★★★★Affinity Bancshares43.51%4.54%8.05%★★★★★★Mill City Ventures IIINA16.40%-30.66%★★★★★★FineMark Holdings115.14%2.22%-28.34%★★★★★★Senstar TechnologiesNA-20.82%14.32%★★★★★★Valhi44.30%1.10%-1.40%★★★★★☆Pure Cycle5.02%4.35%-2.25%★★★★★☆Solesence91.26%23.30%4.70%★★★★☆☆

Click here to see the full list of 288 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Value Rating: ★★★★★★

Overview: BK Technologies Corporation, with a market cap of $252.55 million, operates through its subsidiary BK Technologies, Inc. to design, manufacture, and market wireless communications products both in the United States and internationally.

Operations: BK Technologies generates revenue primarily from its Land Mobile Radio (LMR) Products and Solutions segment, totaling $78.33 million.

BK Technologies has been making waves with an impressive earnings growth of 336% over the past year, outpacing the Communications industry’s 31%. With no debt on its books now compared to a debt-to-equity ratio of 1.7 five years ago, this company is in a solid financial position. Recent earnings results show net income for Q2 at US$3.74 million, up from US$1.66 million last year. Trading at about 90% below estimated fair value and added to multiple Russell indices recently, BK Technologies seems poised for potential growth despite challenges like reliance on federal contracts and market volatility.

Simply Wall St Value Rating: ★★★★★☆

Overview: DRDGOLD Limited is a South African gold mining company focused on extracting gold from the retreatment of surface mine tailings, with a market cap of $1.26 billion.

Operations: DRDGOLD generates revenue primarily through the extraction of gold from surface mine tailings in South Africa. The company has seen fluctuations in its net profit margin, which was recorded at 15% most recently.

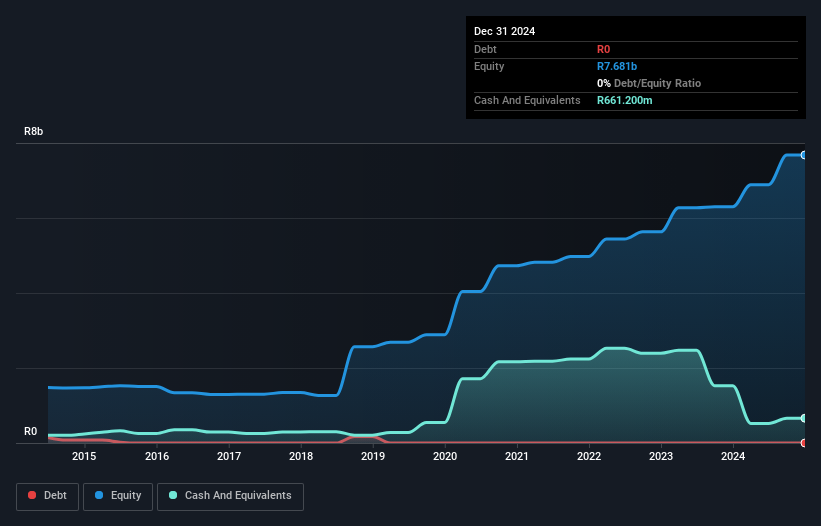

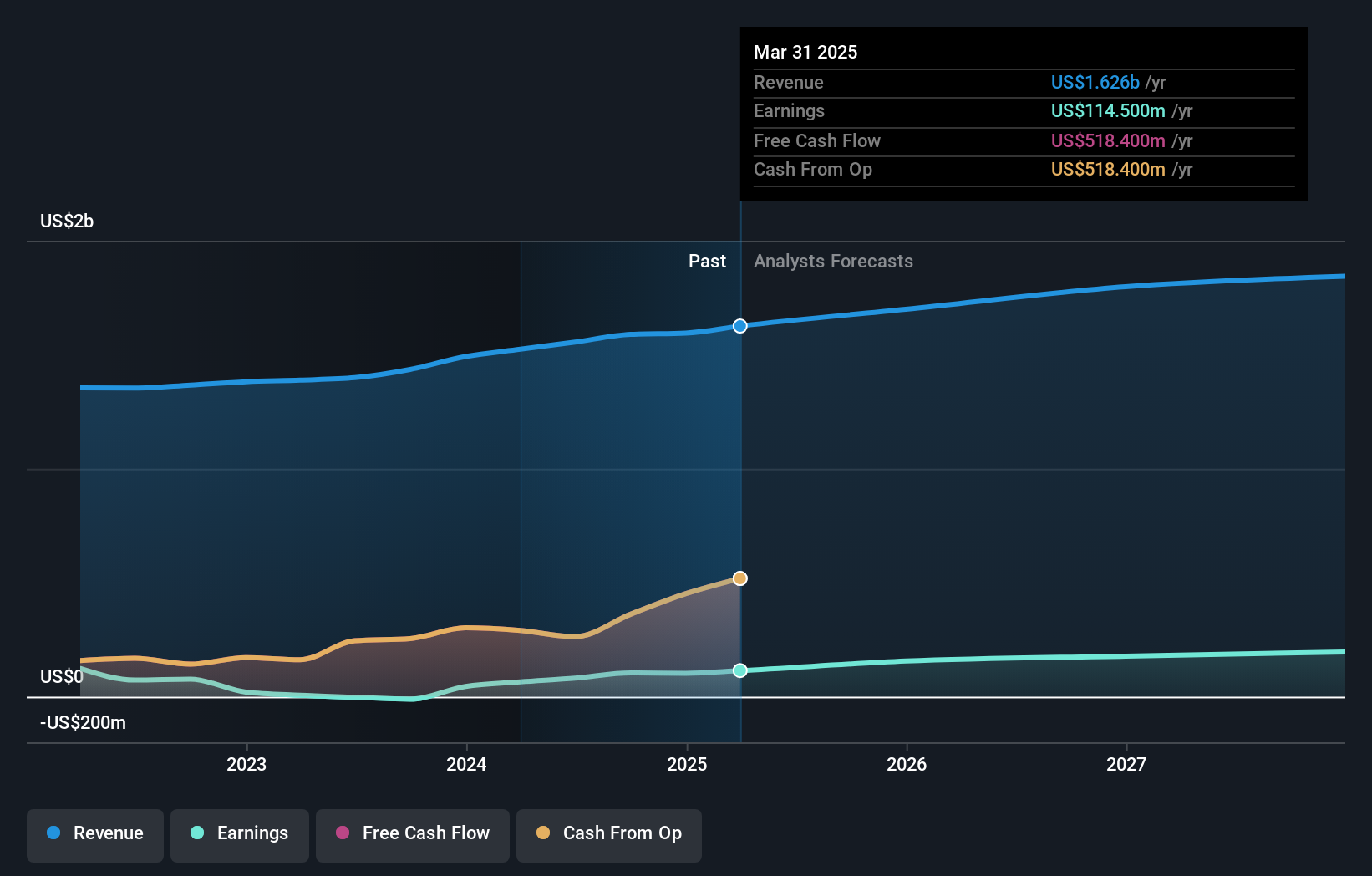

DRDGOLD, a player in the metals and mining sector, has shown robust financial performance with earnings growing by 28% over the past year. The company is trading at 80.3% below its estimated fair value, indicating potential undervaluation. While DRDGOLD is debt-free, its free cash flow remains negative. Recent results highlight significant growth; sales reached ZAR 7.88 billion from ZAR 6.24 billion last year, and net income rose to ZAR 2.24 billion from ZAR 1.33 billion previously. The appointment of Ms Henriette Hooijer as CFO Designate signals strategic leadership changes aimed at supporting Vision 2028 initiatives.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Horace Mann Educators Corporation operates as an insurance holding company in the United States, with a market capitalization of approximately $1.83 billion.

Operations: The company generates revenue primarily from its Property & Casualty segment ($827.90 million) and Life & Retirement segment ($552.50 million), supplemented by Supplemental & Group Benefits ($296.20 million).

Horace Mann Educators, a niche player in the insurance sector, is making waves with its robust earnings growth of 71.9% over the past year, outpacing industry averages. The company’s debt to equity ratio has climbed from 26.7% to 40.2% in five years, yet its interest coverage remains strong at six times EBIT. Trading at a price-to-earnings ratio of 13.2x against the US market’s 18.8x suggests attractive valuation metrics for potential investors. Recent executive changes and increased earnings guidance further highlight strategic shifts aimed at enhancing shareholder value amidst evolving market dynamics and digital transformation efforts within the education-focused segment.

Where To Now?

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if BK Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com