As the U.S. market experiences a surge with the Dow Jones Industrial Average hitting record highs following Federal Reserve Chair Jerome Powell’s indication of potential interest rate cuts, investors are eagerly exploring opportunities in small-cap stocks that may benefit from these favorable conditions. In this environment, identifying undiscovered gems involves looking for companies with solid fundamentals and growth potential that can thrive amid shifting economic policies and market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingOakworth Capital87.50%15.82%9.79%★★★★★★Morris State BancsharesNA3.34%3.70%★★★★★★ASA Gold and Precious MetalsNA12.79%-0.59%★★★★★★Affinity Bancshares43.51%4.54%8.05%★★★★★★First Northern Community BancorpNA8.05%12.27%★★★★★★FineMark Holdings115.14%2.22%-28.34%★★★★★★Pure Cycle5.02%4.35%-2.25%★★★★★☆Gulf Island Fabrication20.48%3.25%43.31%★★★★★☆Rich Sparkle Holdings26.73%-6.13%1.75%★★★★★☆Solesence91.26%23.30%4.70%★★★★☆☆

Click here to see the full list of 287 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

We’ll examine a selection from our screener results.

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market cap of $302.85 million.

Operations: Citizens & Northern generates revenue primarily from its Community Banking segment, which contributed $108.31 million.

Citizens & Northern, with total assets of US$2.6 billion and equity of US$286.4 million, is trading at a notable 43% below its estimated fair value. The bank’s earnings surged by 15.7% last year, outpacing the industry growth rate of 12.7%, and it has high-quality earnings marked by a net interest margin of 3.3%. Despite an insufficient allowance for bad loans at 1.3% of total loans, its funding structure is low risk with customer deposits comprising 91% of liabilities. Recent activities include a dividend affirmation at US$0.28 per share and no share repurchases in the latest tranche update.

Simply Wall St Value Rating: ★★★★★★

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services in the United States, with a market capitalization of $278.99 million.

Operations: John Marshall Bancorp generates revenue primarily from its banking segment, which reported $56.75 million. The company’s financial performance can be analyzed through its net profit margin trends over recent periods.

John Marshall Bancorp, a promising player with total assets of US$2.3 billion and equity of US$253.7 million, showcases strong fundamentals. With deposits and loans each totaling US$1.9 billion, the bank maintains a non-performing loan ratio of just 0.5%, indicating prudent risk management. Its earnings growth over the past year soared by 664%, far outpacing the industry average of 12.7%. The company recently repurchased shares worth US$1.31 million, reflecting confidence in its valuation as it trades below estimated fair value by about 5%. This financial stability is underscored by high-quality earnings and low-risk funding sources at 94%.

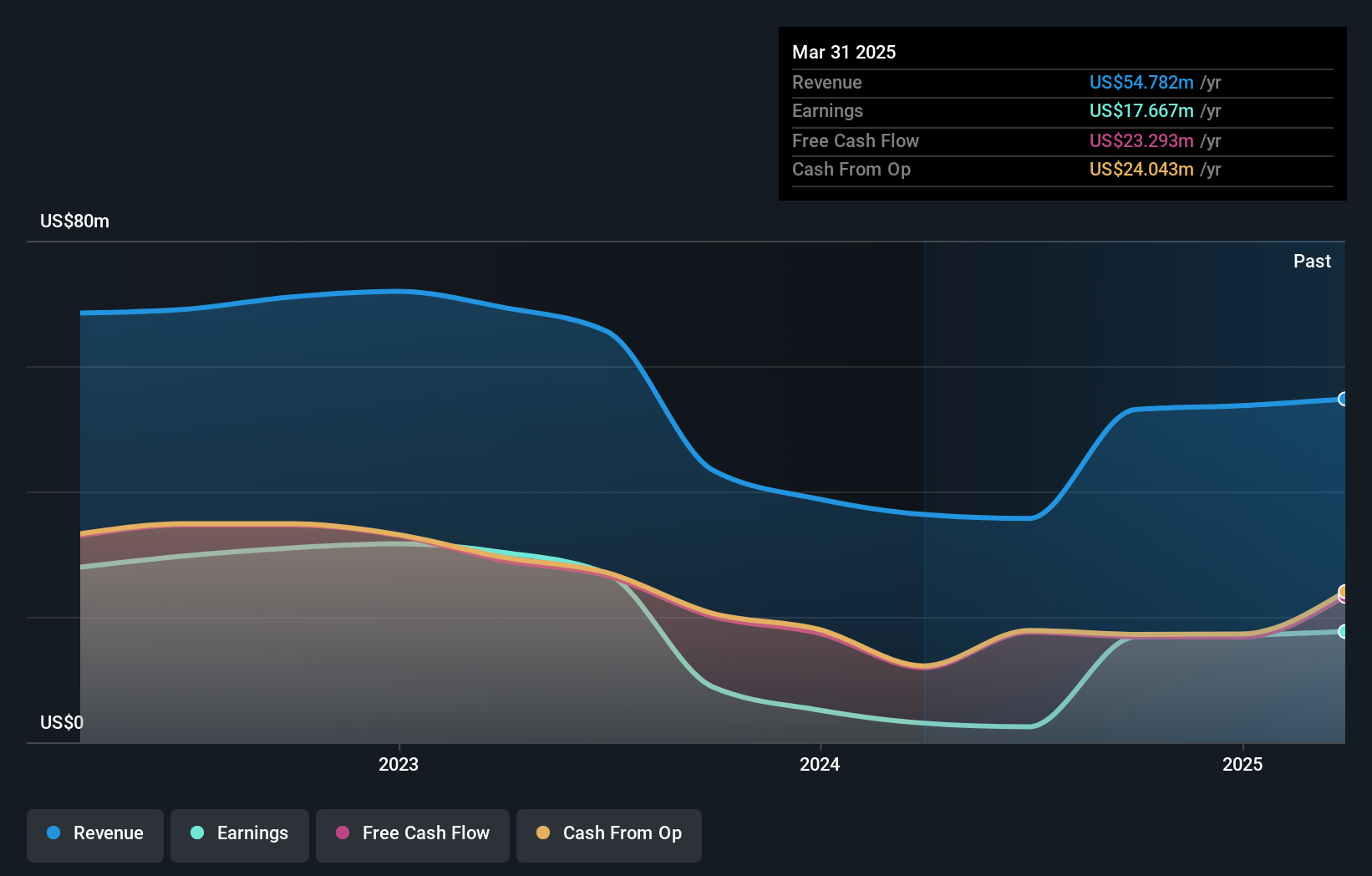

Simply Wall St Value Rating: ★★★★★★

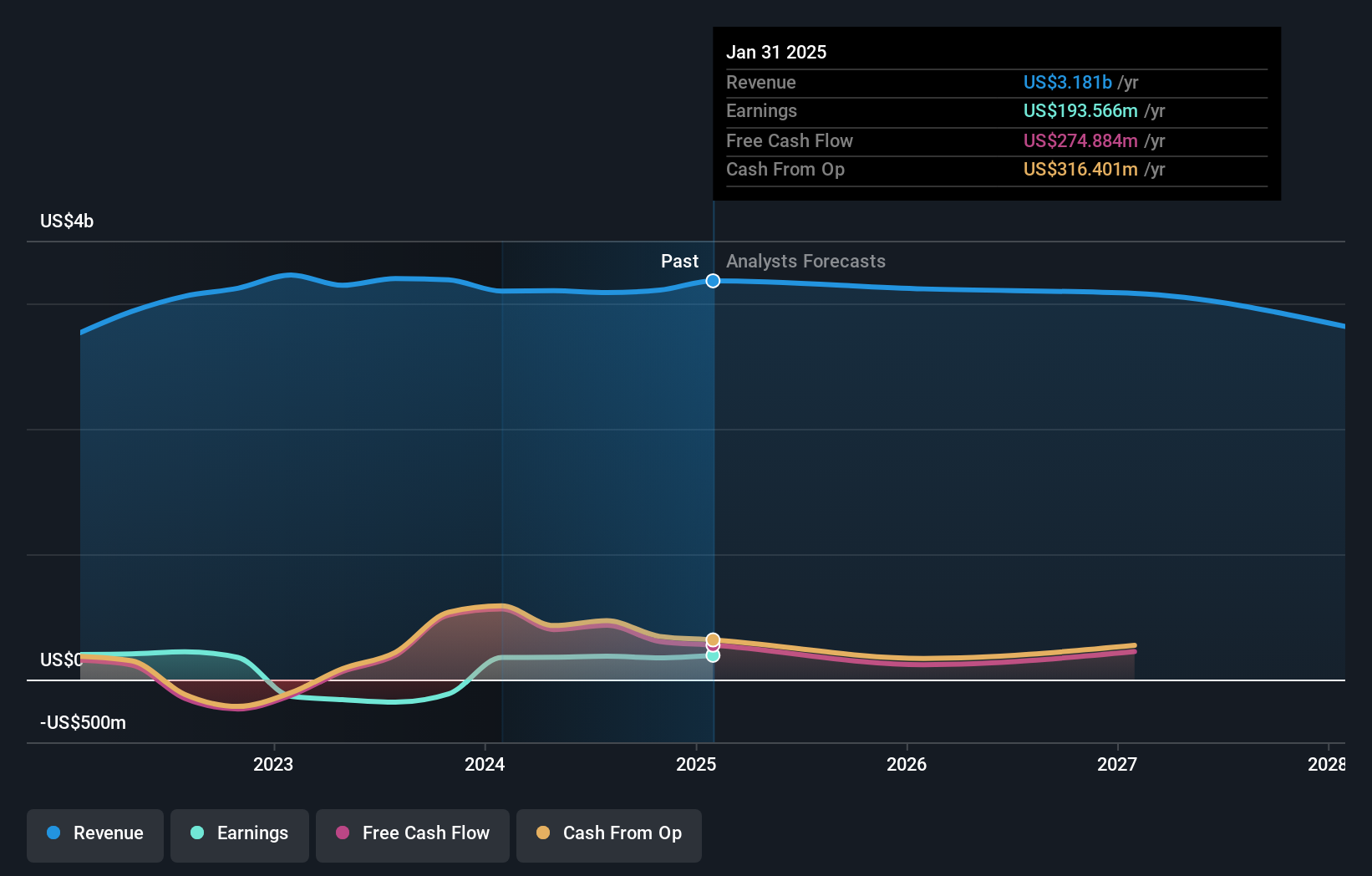

Overview: G-III Apparel Group, Ltd. is involved in the design, sourcing, distribution, and marketing of women’s and men’s apparel both in the United States and internationally, with a market capitalization of approximately $1.12 billion.

Operations: G-III generates revenue primarily through its wholesale segment, which accounts for $3.05 billion, significantly overshadowing its retail segment at $172.31 million.

G-III Apparel Group stands out with its solid financials and strategic maneuvers. The company reported a net income of US$7.76 million for the recent quarter, up from US$5.8 million last year, showcasing resilience in a challenging market. Its debt to equity ratio has impressively shrunk from 72.3% to 1.1% over five years, reflecting effective debt management strategies. With earnings growth of 9.4%, it surpasses the luxury industry’s -1.2% trend, highlighting its competitive edge. Additionally, G-III’s price-to-earnings ratio of 5.8x suggests good value compared to the broader US market at 18.7x.

Where To Now?

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com