Market snapshot

Market snapshot

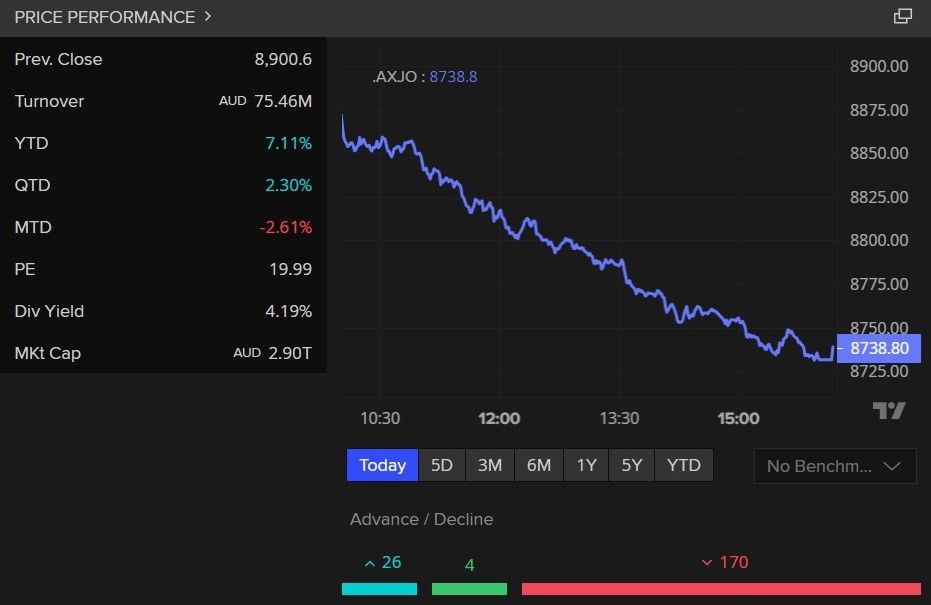

ASX 200: -1.8% to 8,739 points

Australian dollar: -0.1% at 65.14 US cents

Asia: Nikkei (-0.8%), Hang Seng (0.72%), Shanghai (-1.1%)

Wall Street: Dow Jones (-0.6%), S&P 500 (-0.7%), Nasdaq (-0.8%)Europe: FTSE (+0.1%), DAX (+0.5%), Stoxx 600 (+0.5%)

Spot gold: +0.3% to $US3,601/ounce

Oil (Brent crude): -0.3% to $US68.88/barrelIron ore: +0.4% to $US102.95/tonneBitcoin: -0.1% to $US110,585

Prices current around 5:15pm AEST

Live updates on the major ASX indices:

Yesterday, 7:29amWed 3 Sep 2025 at 7:29am

And that’s a wrap for this blog today

We’ll be back in the morning from 7:30am AEST and will be here to see if trade is better or worse on the ASX on Thursday.

Verrender: The September market ‘hoodoo’ on the ASX

The September stock market hoodoo hasn’t taken long to assert itself this year.

If you’re wondering why the violent reaction on the stock market today, it’s all down to the prospect of interest rate cuts.

Those better-than-expected GDP numbers today – the economy grew by 0,6 per cent in the June quarter – are welcome news for all of us and no doubt would have put a collective smile on the faces of those in Treasury, the Reserve Bank and government.

But they decrease the urgency for the RBA to cut rates.

Bond traders reacted by pushing up the yield, or the interest rate, on Australian government bonds that mature in 10 years’ time. These are considered the benchmark for market interest rates.

Bonds don’t get much attention in the media. But they are the financial bedrock that determines the price of everything from commodities to currencies and everything else in between, including stocks.

Why don’t they attract much notice?

Unlike companies like BHP, they don’t dig stuff out of the ground. They don’t have big personalities like Andrew Forrest. And you won’t see their products in the supermarket.

But they are all-powerful. If bond yields rise, as they have today, they raise the cost of capital and suck money out of other corners of the financial world, like stocks, forcing prices lower.

Could this get worse? Absolutely. Because this is not just an Australian story and involves much more serious issues than a recovering Australian economy, which normally would be good news.

Global stocks are over-valued and it won’t take much for jittery investors to take flight.

Not only that, bond traders are worried that governments across the developed world are spending too much and running up ever greater deficits. So, they’re less inclined to hold onto US, UK and EU debt because they see greater risk in getting their money back when those bonds mature.

They’re essentially demanding higher interest rates as compensation to take on that risk. And that is causing a re-pricing of just about everything.

Yesterday, 7:24amWed 3 Sep 2025 at 7:24am

Will tomorrow be as bad on the ASX?

We are starting to get some early indicators from other global markets, with trade in parts of Europe opening up as their clocks tick over to 9am.

European markets are actually all opening in positive territory, after closing down in the last session, as traders there mull over those bond market moves and other factors.

Over on Wall Street, futures are a mixed bag.

It looks like investors are feeling positive about the tech index, after the landmark court ruling in the US on Google, which has relieved fears that the massive company will be split up.

(You can see a post about this in this blog further down!)

Who knows what the ASX will do tomorrow. We’ll be here!

Is this the infamous September sell-off?

The ASX 200 index has fallen every day so far this month (plus it edged lower on Friday, the last trading day of August).

I started work at the ABC in 2008 — and September that year certainly wasn’t good for stocks, it was the month Lehman Brothers collapsed, sparking the worst of the global financial crisis.

September does have a bit of a reputation as a bad month for stocks, at least in the US — and America still generally sets trends for global markets more generally.

This “September effect” is so well known, it has its own entry in Investopedia, which reports it as being the worst month on average for stock returns at -1% over the past century, although it notes this trend hasn’t held over the past decade.

According to CNBC, quoting analysis by Morningstar, September is the only month of the year since 1926 where stocks have averaged a loss, rather than gains.

In fact, as investors like to be ahead of the game, there is serious speculation (reported by Reuters) that some are selling in August to get ahead of an expected September sell-off.

So, is the September effect about to strike again?

Yesterday, 6:45amWed 3 Sep 2025 at 6:45am

Verrender: Why central banks aren’t getting their way

Most of us think Central banks set interest rates but that’s not really the case.

It’s bond markets that determine rates. Central Banks are big, powerful players and they usually get their way. But not always.

And this is one of those times.

US president Donald Trump’s concerted attempt to muscle US rates lower by threatening to take control of The US Fed Reserve has alarm bells ringing across the globe.

Bond traders are responding by pushing short term interest rates down. But they’re in open revolt on long term rates as they fear he may cause a renewed inflation spike. So, they’re pushing longer term loan rates higher.

Traders are also worried about government spending and ongoing deficits in the US, the UK and Europe.

All of that requires more debt funding, and higher interest rates.

Yesterday, 6:36amWed 3 Sep 2025 at 6:36am

$57 billion was wiped off the Australian share market today

That’s according to number crunching by my colleague, David Taylor. We’ll bring you more soon.

ASX almost has its worst day since April 9

Well it wasn’t as bad today as on April 9, when the broader Australian sharemarket lost 1.9% in one day.

But it got close. The ASX 200 dived 1.8% today, while the broader All Ords fared a bit better at 1.7% off.

So what’s driving it? There’s a lot of factors that happened today that could have prompted this stock sell-off.

We’ve had movements on bond markets, Wall Street lost a lot overnight, and then we had local GDP figures out today, which pushed analysts to review how soon the RBA will cut rates again. (They think less quickly, in summary.)

Here’s some topline thoughts from Tony Sycamore.

He notes the last day of trade that was worse than today was April 9, when Trump’s tariffs came into effect and there was a “Liberation day sell off”.

Today is now the biggest (drop) since then.

The backdrop certainly isn’t as dire as back then – however valuations are now stretched and positioning is the wrong way around (traders caught long).

Then on top of that and the bond yield (factor mentioned earlier in blogs) there is the weak seasonality which is also making folks a little nervous.

Yesterday, 6:15amWed 3 Sep 2025 at 6:15am

Where the ASX 200 is sitting on close

You could roll a lot of things down that hill.

Yesterday, 5:58amWed 3 Sep 2025 at 5:58am

More bond and ASX analysis

CBA is also noting the effect of today’s GDP data on bond markets, although its fresh notes points towards a potential overstatement in the data.

Thirty-year Australian government bond yields hit their highest since late May at 5.19%, though there is very little of this debt on issue and trading is illiquid. Australia’s government debt to GDP ratio is among the lowest in the developed world at 35% and its bonds carry the top triple A credit rating, offering support against global fiscal worries.

Its note argues the ASX is so off today, more likely because it is following the drops on Wall Street too.

‘Bond markets simply aren’t playing nice’

Confused about bonds ? You’re not alone, my friend.

Put simply, government bonds are debt issued by a government to raise money to fund its deficits — that is when spending is more than revenue (mainly taxes).

They give a fixed annual rate of interest that’s set when they are issued, and investors basically bet on future inflation and interest rates by how much they are willing to pay now for that fixed rate of return.

At the moment, investors are generally selling off bonds, lowering their current price and thus pushing up the yield (or annual percentage rate of return).

In other words, investors want a better rate of return for lending governments money right now, because they’re increasingly worried that inflation and interest rates are going to be higher in the long term.

Martin Whetton is the head of financial markets strategy at Westpac, and it’s a core part of his job to understand what is happening on bond markets.

Here’s some thoughts he just shot through:

“Bond markets simply aren’t playing nice right now.

“Sovereigns are facing large financing requirements at a time that the markets are struggling to see value in yields.

“The UK is ground zero: as fiscal challenges and the future funding requirements and spending needs simply don’t add up to the growth and tax revenues expected.

“Global yields are all moving higher as a result.

“In Australia, the normally innocuous GDP print (released today) saw better than expected consumer spending, and this has seen longer end yield rise sharply on the day.”

The key thing to note is that it’s the ultra-long-term bonds that are seeing the biggest increases in yields (and therefore falls in value).

“5% 30-year yields are (almost) appearing for the UST [US Treasury] 30-year, while in the UK, HM Treasury would beg for a funding rate for long bonds at that level, as their yields hit 5.7% overnight,” Whetton notes.

“Peripheral European yields are drifting wider to a rising core as well. Supply is coming to the market in size — the European market saw a record EUR39.6bn of issuance on Tuesday, while the US market had similar sized supply.”

In other words, governments are falling over each other to raise more cash to fund growing deficits, but there is a lack of willing buyers for their IOUs.

Yesterday, 5:49amWed 3 Sep 2025 at 5:49am

Verrender: The ‘unusual’ reaction to today’s GDP figures

That’s unusual.

Normally, it’s the currency market that’s sensitive to speculation about a rate cut.

While the Aussie dollar has strengthened a touch against the Euro and the Yen, it’s barely changed against the greenback. In fact, it’s a little lower than yesterday.

Australian stocks, however, have borne the brunt of the better than expected GDP performance for the June quarter, plunging 1.7 per cent as the faint hopes for a September rate cut evaporated.

Aussie bond yields, however, have surged as traders ruminated on the prospect of future RBA rate cuts.

As a bit of background, traditionally, Australian interest rates have been higher than America’s because we always had to offer a premium to attract investment capital.

That reversed about six years ago because of our improved trade performance and out market rates traded substantially lower and because the US Fed jacked up its cash rate further than the RBA.

A couple of weeks back, however, American and Australian 10 year bonds yields began level pegging.

And now, with the US on the verge of a September rate cut and Aussie interest rates looking less likely to be trimmed, that old traditional relationship has been reinstalled.

That could lead to a stronger Aussie dollar as global funds look for safe havens with decent returns.

Yesterday, 5:46amWed 3 Sep 2025 at 5:46am

The stocks that dived the most during reporting season

Macquarie has revealed the ASX shares that endured the biggest share price falls after their results were released during earnings season.

The broker limited the list to the top 100 ASX shares.

It found 11 stocks experienced a 10% or more decline within two days of their reports being released.

Here’s the top 5 worst:

CSL Ltd (ASX: CSL)

The CSL share price is trading at a 6-year low of $206.28 at the time of writing, down 1%.

CSL reported a 5% revenue rise to US$15.6 billion and a 17% increase in net profit after tax (NPAT) to US$3 billion for FY25.

The market’s largest healthcare company also surprised investors with the announcement of the demerger of its Seqirus division.

The ASX healthcare share plummeted 18.6% over the next two days.

Woolworths Group Ltd (ASX: WOW)

The Woolworths share price is $27.34, down 1.9% today.

Woolworths reported a 3.6% year-over-year increase in sales to $69.1 billion and a 17.1% decline in NPAT to $1.39 billion for FY25.

The ASX consumer staples share plunged 15.2% within two days of the report.

Sonic Healthcare Ltd (ASX: SHL)

The Sonic Healthcare share price is 4% lower on Wednesday at $22.79.

Sonic Healthcare reported revenue of $9,645 million, up 8% year over year, and an NPAT of $514 million, up 7% for FY25.

The ASX healthcare share fell 14.4% over the next two days.

WiseTech Global Ltd (ASX: WTC)

The WiseTech share price is $95.74 at the time of writing, down 3.7%.

WiseTech reported a 14% year-over-year increase in revenue to $778.7 million, and a statutory NPAT of $200.7 million, up 17% for FY25.

The market’s biggest tech share dropped 13.8% within two days of the report.

James Hardie Industries PLC (ASX: JHX)

The James Hardie share price is currently $29.88, down 0.8%.

James Hardie reported net sales of US$899.9 million, down 9% and adjusted EBITDA of US$225.5 million, down 21% in 1Q FY26.

Investors didn’t like it. The ASX materials share was punished with a 34.6% decline within two days.

Yesterday, 5:41amWed 3 Sep 2025 at 5:41am

ASX 200 plunging just a week after hitting record highs

How much difference a week makes.

Our reporter David Taylor filed a story just last week, noting the ASX hitting a record high of more than 9,000 points. He also noted fears the market was in a bubble.

He had this chat with analyst Roger Montgomery.

What could cause a crash is anyone’s guess, but Mr Montgomery points to the withdrawal of central bank liquidity, or a major company or hedge fund’s inability to pay a debt, as a potential catalyst.

“We don’t know what will cause it, but it will [fall],” he warned.

“And when it does, it will be very painful for those people who have behaved irrationally.”

It could also be painful for the many millions of Australians with superannuation caught in the crossfire of a potential market plunge.

Now the ASX is headed for its worst day in 5 months.

Yesterday, 5:37amWed 3 Sep 2025 at 5:37am

ASX now very close to worst day since April 9

It’s gotten even worse in the last 20 minutes, with the ASX 200 now down 1.8% and the broader market diving 1.7%.

That is now very nearly touching the losses on April 9, when Trump’s tariffs took effect and $50b was wiped off the Aussie sharemarket.

Some notes that just came through from analyst Kyle Rodda.

The IT sector is the worst performer following the multi-session drawdown in US tech stocks. Gold stocks are one of the few shining lights. That in of itself is something of a bearish signal. The price of gold hit another record high overnight as risk aversion sets in.

The fact is, the markets are due for a pull back. Seasonality has entered the narrative: for US equities, September is the worst month of the year for the S&P 500, with an average drawdown of nearly 2% over the past 10 years.

But from an Australian and fundamental standpoint, valuations have been eye-watering and far beyond what could be justified by the earnings that were served up by companies last month.

He also notes the impacts of bonds, noted already in blog posts here by other analysts.

And the GDP data out today, which has led economists to all but rule out the chance of a September rate cut by the RBA.

Shifting rate expectations in Australia probably also contributed to the ASX200’s sell-off (with) the markets are pricing out RBA rate cuts going forward. The next cut isn’t fully baked-in until December now, with futures suggesting the odds of another cut after that in 2026 isn’t much better than a coin toss.

Yesterday, 5:09amWed 3 Sep 2025 at 5:09am

ASX on course for worst trade since April 9

That was the day that US President Donald Trump’s tariffs took effect. The ASX lost 1.9% or $50 billion in one day.

Today’s losses are currently at 1.7% for the ASX 200 and 1.6% for the broader Australian sharemarket, and if that downward trend continues, it could beat April 9.

ASX plunging in arvo trade with losses at 1.6%

Here’s some fresh analysis from Tony Sycamore at IG.

Just a day after dipping below 8,900 for the first time in two weeks, the index plunged below 8,800 today, currently trading 147 points (-1.65%) lower at 8753, on course for its steepest single day drop since April 9.

The decline is primarily driven by surging bond yields and the return of the bond vigilantes, fuelled by concerns over large fiscal deficits, central banks expected to cut rates into persistent inflation, and President Trump’s dovish reshaping of the FOMC.

The Japanese 30-year bond yield hit a record high of 3.275%, the US 30-year bond yield stands at 4.98% eyeing the 5.15% “red alert” high from earlier this year, while Australia’s 30-year bond yield reached 5.19%, approaching the 5.20% high seen earlier in 2025.

We’ll bring you more analysis soon!

Yesterday, 4:55amWed 3 Sep 2025 at 4:55am

Market snapshot

Australian dollar: Flat at 65.18 US centsAsia: Nikkei (-0.9%), Hang Seng (-0.4%), Shanghai (-1%)Wall Street: Dow Jones (-0.6%), S&P 500 (-0.7%), Nasdaq (-0.8%)Europe: FTSE (-0.9%), DAX (-2.3%), Stoxx 600 (-1.5%)

Spot gold: +0.1% to $US3,537/ounce

Oil (Brent crude): -0.3% to $US68.93/barrelIron ore: +0.4% to $US102.95/tonneBitcoin: -0.3% to $US111,074

Prices current around 2:55pm AEST

Live updates on the major ASX indices:

Yesterday, 4:46amWed 3 Sep 2025 at 4:46am

GDP figures: ‘Timing quirks’ deliver boost to figures

Some more on those GDP figures we got a few hours ago, which showed the economy grew a little more than expected in the months from April to June 2025.

As flagged by the ABS in its release, there were a few one-off factors that contributed to the better-than-expected GDP numbers for Australia in the second quarter.

The head of Australia economics at Moody’s Analytics, Sunny Kim Nguyen, warns people not to “mistake this rebound for a breakout”.

“The economy finally found its footing after the weather-disrupted March quarter; consumers opened their wallets, mining exports normalised, and services demand perked up,” she notes.

“That said, much of the improvement owed more to timing quirks, with underlying momentum still well below potential.

“Households did the heavy lifting, breaking free from their spending hibernation. End-of-financial-year sales drove splurges on furniture and cars, while the Easter-ANZAC Day holiday window boosted discretionary services.

“The consumption surge was real but came at the expense of savings rather than stronger incomes as households ran down pandemic-era buffers.

“With cost-of-living pressures lingering and rate-sensitive households still cautious, sustaining momentum without income support will be a key challenge.”

Yesterday, 4:23amWed 3 Sep 2025 at 4:23am

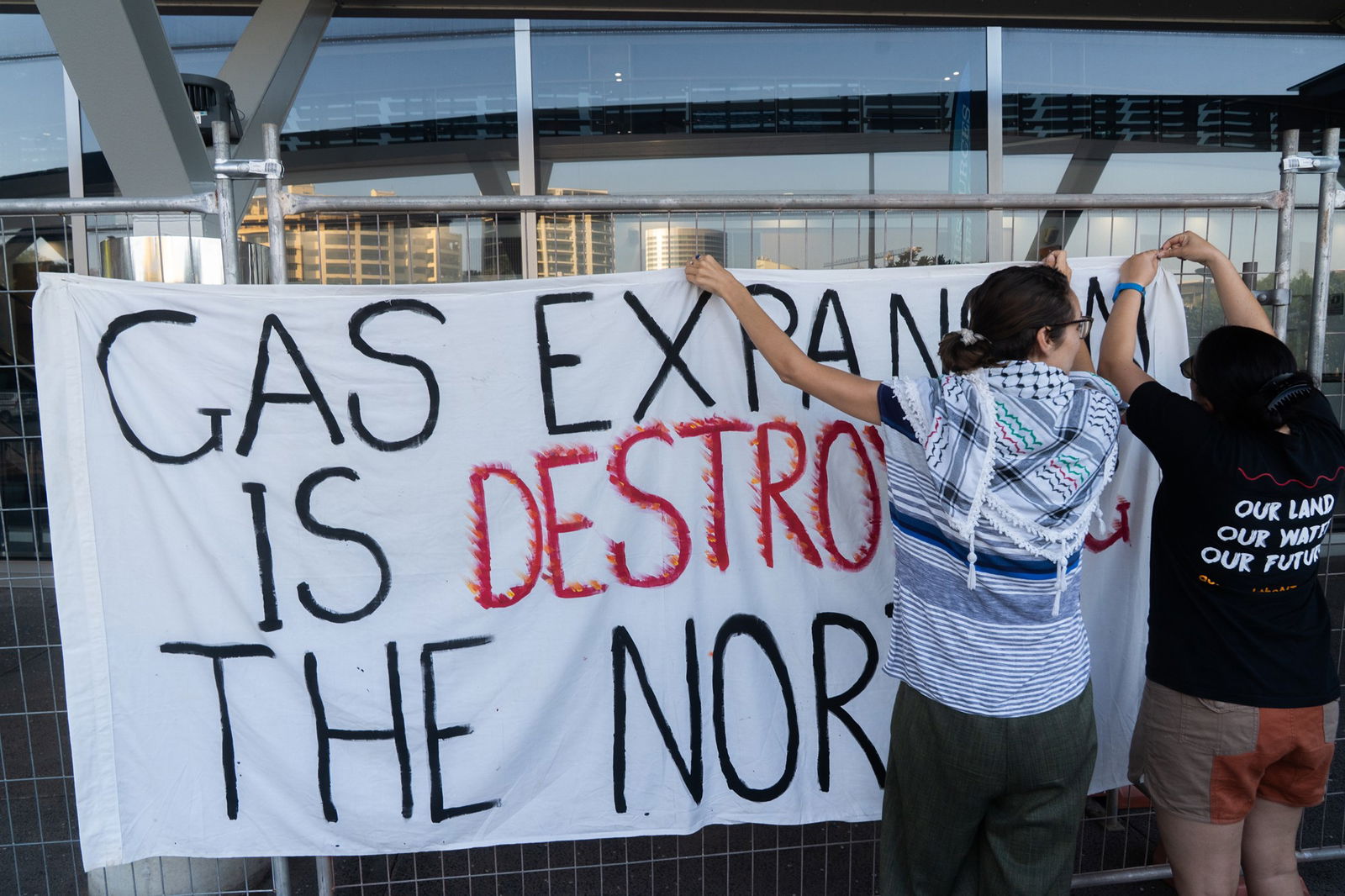

Protests outside Darwin mining convention after ABC investigation

We just got these photos from our Darwin bureau of a protest held outside the tropical city’s convention centre, where a forum about resources and mining is being held this week.

This protest came after an ABC investigation revealed on Monday, that a design flaw in a storage tank at the Darwin Liquefied Natural Gas (DLNG) plant, has led to it leaking thousands of tonnes of climate-polluting methane since its inception in 2006.

Santos has been cleared to use the faulty tank until 2050 for its new Barossa gas project without fixing the leak or measuring emissions, in what environmentalists have branded a “national scandal”.

This followed advice to Santos over the leak from the federal Clean Energy Regulator and CSIRO, which neither agency has been willing to detail publicly.

More on the latest on that ABC investigation here.